21st Austria weekly - AT&S, Erste Group (31/10/2024)

03.11.2024, 2356 Zeichen

AT&S: AT&S expects the market conditions of the first half of the financial year 2024/25 to continue. In comparison with the prior-year period, consolidated revenue was nearly constant at € 800 million in the first half of 2024/25 (PY: € 814 million). AT&S recorded a positive volume development during the reporting period, which was, however, offset by continuing high price pressure for both printed circuit boards and IC substrates. EBITDA declined by 27% from € 217 million to € 157 million. The decline in earnings is primarily attributable to the increased price pressure and higher start-up costs. In order to counter effects such as price pressure and inflation resulting from the currently difficult market environment, AT&S consistently continued to drive its comprehensive cost optimization and efficiency program. In addition to price pressure, start-up costs in Kulim, Malaysia, and Leoben, Austria, as well as costs in connection with the cost optimization and efficiency program had a negative impact on earnings. Adjusted for these costs, EBITDA amounted to € 223 million (PY: € 249 million), which corresponds to a decline by 10%.

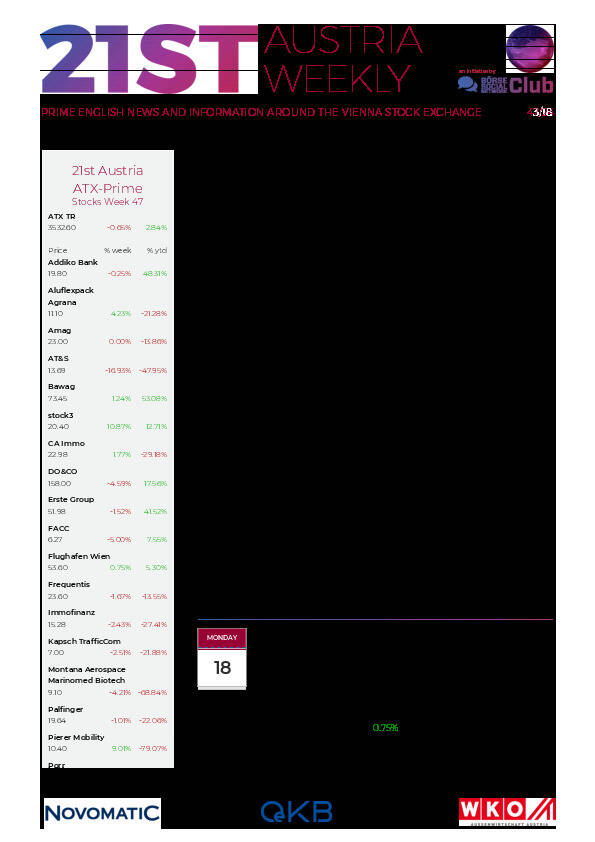

AT&S: weekly performance:

Erste Group: Erste Group Banks net interest income increased to EUR 5,591 million (+3.1%; EUR 5,422 million), in all core markets except Austria, on the back of larger loan volume and lower interest expenses on customer deposits. Net fee and commission income rose to EUR 2,158 million (+11.4%; EUR 1,938 million). Growth was registered across all core markets, most notably in payment services and asset management. Net trading result increased to EUR 428 million (EUR 337 million); the line item gains/losses from financial instruments measured at fair value through profit or loss deteriorated to EUR -70 million (EUR -18 million). The net result attributable to owners of the parent rose to EUR 2,516 million (EUR 2,310 million) on the back of the strong operating result and improved other operating result. Following the good business development in the first nine months of the year, Erste Group again upgrades its financial outlook for 2024, now targeting a return on tangible equity (ROTE) of more than 16%, as opposed to higher than 15% previously.

Erste Group: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (31/10/2024)

Wiener Börse Party #788: Pierer Mobility am Geburtstag des Namensgebers mächtig im Plus, Yvonne de Bark lernt mir was

Bildnachweis

Aktien auf dem Radar:voestalpine, Pierer Mobility, Warimpex, Addiko Bank, CA Immo, Immofinanz, Verbund, ATX, ATX Prime, ATX TR, Bawag, Andritz, Österreichische Post, AT&S, Cleen Energy, Frauenthal, Kostad, Oberbank AG Stamm, Kapsch TrafficCom, DO&CO, Agrana, Amag, Erste Group, EVN, Flughafen Wien, OMV, Palfinger, RHI Magnesita, Semperit, S Immo, Telekom Austria.

Random Partner

Frequentis

Frequentis mit Firmensitz in Wien ist ein internationaler Anbieter von Kommunikations- und Informationssystemen für Kontrollzentralen mit sicherheitskritischen Aufgaben. Solche „Control Center Solutions" entwickelt und vertreibt Frequentis in den Segmenten Air Traffic Management (zivile und militärische Flugsicherung, Luftverteidigung) und Public Safety & Transport (Polizei, Feuerwehr, Rettungsdienste, Schifffahrt, Bahn).

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten