21st Austria weekly - Vienna Stock Exchange, Verbund (02/10/2024)

06.10.2024, 1705 Zeichen

Vienna Stock Exchange: The Vienna Stock Exchange can look back on a positive third quarter. Equity turnover on the Vienna Stock Exchange has risen sharply in the last three months. At EUR 8.1 billion (2023: EUR 4.0 billion), September was exceptionally strong in terms of turnover, concluding a very dynamic quarter. Trading volumes in August (EUR 6.7 billion, 2023: EUR 3.4 billion) – the strongest since 2012 – and July (EUR 5.3 billion, 2023: EUR 3.7 billion) were already at an high level. M&A activities in the real estate sector were the main driver of this development. Overall, share turnover after three quarters totalled EUR 51.0 billion (2023 Q1-Q3: EUR 41.1 billion), with an average turnover of EUR 384 million per trading day. The strongest trading days were 20 September (EUR 891.5 million), followed by 6 September (EUR 534.7 million) and 11 September (EUR 474.2 million). The most traded Austrian stocks as of 30 September were Erste Group Bank AG (EUR 7.9 bn), CA Immobilien Anlagen AG (EUR 6.5 bn) and OMV AG (EUR 6.2 bn).

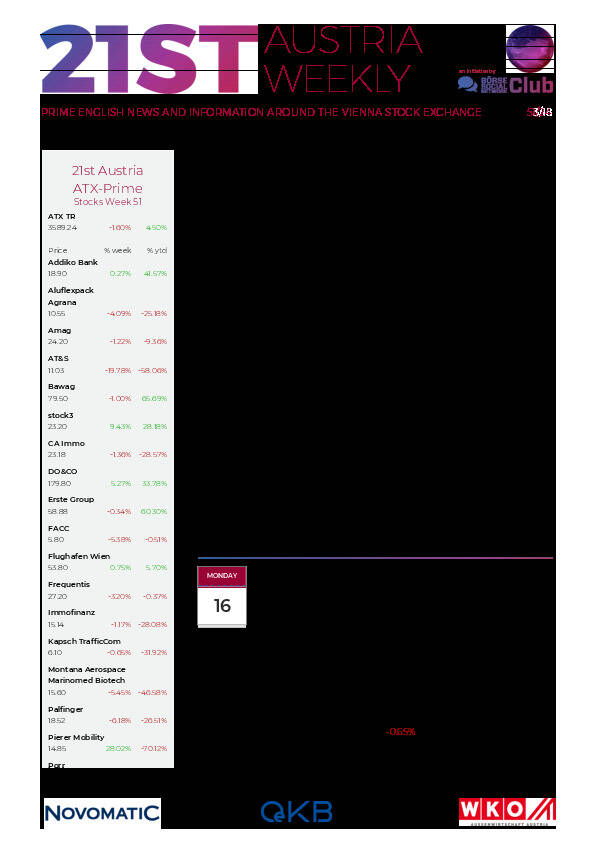

ATX: weekly performance:

Verbund: Since the end of September, the Verbund subsidiary Smatrics has been one of the first companies to be authorized as a calibration center for e-charging stations. The company can now take over the calibration of charging stations throughout Austria and regardless of the manufacturer. The need to calibrate charging points is great. There are currently more than 24,000 public charging points in Austria. All non-public charging points, i.e. those at home or in companies, must still be counted here.

Verbund: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (02/10/2024)

kapitalmarkt-stimme.at daily voice 5/365: Wie kann man Karl Nehammer zu einem Aktionär machen? (Reprise)

Bildnachweis

Aktien auf dem Radar:Warimpex, Kapsch TrafficCom, Amag, Frequentis, Austriacard Holdings AG, Rosenbauer, EVN, FACC, OMV, SBO, AT&S, Telekom Austria, Athos Immobilien, Cleen Energy, Gurktaler AG VZ, Josef Manner & Comp. AG, Marinomed Biotech, Wolford, Polytec Group, Semperit, Porr, Zumtobel, RHI Magnesita, EuroTeleSites AG, Flughafen Wien, Kostad, Oberbank AG Stamm, BKS Bank Stamm, Pierer Mobility, UBM, Strabag.

Random Partner

Rosenbauer

Rosenbauer ist weltweit der führende Hersteller für Feuerwehrtechnik im abwehrenden Brand- und Katastrophenschutz. Als Vollsortimenter bietet Rosenbauer der Feuerwehr kommunale Löschfahrzeuge, Drehleitern, Hubrettungsbühnen, Flughafenfahrzeuge, Industriefahrzeuge, Sonderfahrzeuge, Löschsysteme, Feuerwehrausrüstung, stationäre Löschanlagen und im Bereich Telematik Lösungen für Fahrzeugmanagement und Einsatzmanagement.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten