21st Austria weekly - Uniqa, Porr (22/08/2024)

25.08.2024, 2499 Zeichen

Uniqa: Premiums written at UNIQA Insurance Group AG, including savings portions from unit-linked and index-linked life insurance, rose by 8.8 per cent to €4,071.3 million in the first six months of 2024 compared with the same period of the previous year (1 – 6/2023: €3,741.9 million). Above all, property and casualty insurance (+10.7 per cent) and health insurance (+10.2 per cent) contributed to this very pleasing growth. The insurance revenue in accordance with IFRS 17 at the UNIQA Group rose in the first two quarters of 2024 by 10.4 per cent to €3,211.6 million (1 – 6/2023: €2,909.2 million). All business lines and segments contributed towards this, with property and casualty insurance growing by 11.0 per cent, health insurance by 10.7 per cent and life insurance by 6.6 per cent. Insurance revenue in Austria rose by 6.6 per cent and gained 14.0 per cent in the international companies. The UNIQA Group’s earnings before taxes improved by 19.0 per cent to €277.5 million (1 – 6/2023: €233.2 million). The consolidated profit (share of the profit/(loss) for the period attributable to the shareholders of UNIQA Insurance Group AG) increased by 24.6 per cent to €220.9 million (1 – 6/2023: €177.3 million). The solvency capital requirement (SCR) ratio according to Solvency II – considered to be an indicator for capitalisation – was at a very high level of 266 per cent as at 30 June 2024, an increase of 11 percentage points compared to the end of 2023.

Uniqa: weekly performance:

Porr: In the first half of 2024, construction group PORR continued to build on its solid performance. EBIT rose by 23.7% to EUR 42.2m. Higher output, full order books and the expected turnaround in the European construction industry ensure a positive outlook for the second half of the year. In terms of production output, PORR achieved a 3.3% increase against the same period last year to total EUR 3,116m. The main growth driver here is infrastructure, for example tunnelling and large-scale projects in Romania. Austria remains the most important market with a share of 44.8%, followed by Germany and Poland. At EUR 8,564m, PORR currently has the third-highest order backlog in its history, although the order intake of EUR 3,228m in the first six months did not quite match the previous year’s level. The reason: In 2023, the Brenner Base Tunnel set a record that is hard to beat.

Porr: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (22/08/2024)

kapitalmarkt-stimme.at daily voice 6/365: Österreichische Aktien, Indizes, Sparpläne und unsere Idee dazu

Bildnachweis

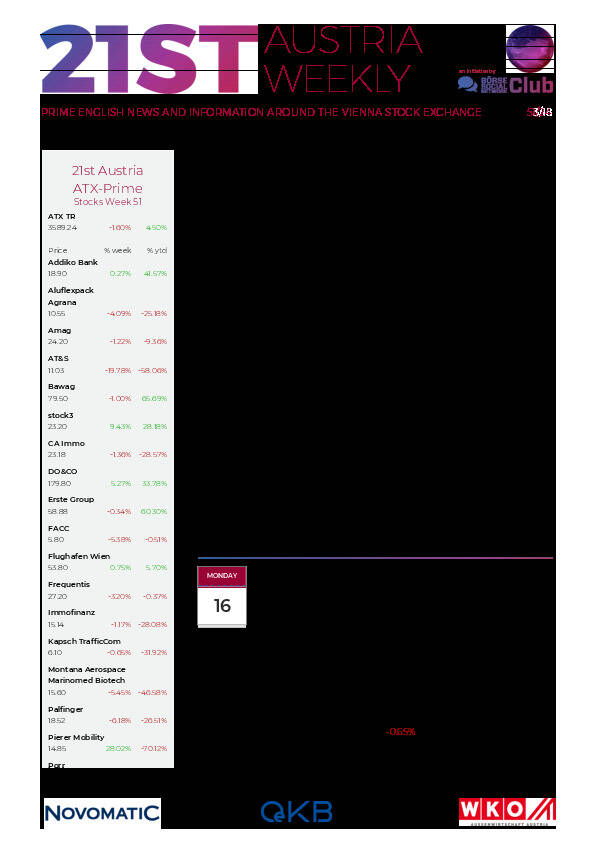

Aktien auf dem Radar:Austriacard Holdings AG, Addiko Bank, Agrana, OMV, SBO, AT&S, Telekom Austria, Porr, Semperit, Cleen Energy, DO&CO, Kapsch TrafficCom, Mayr-Melnhof, Wolford, Warimpex, Polytec Group, Strabag, EuroTeleSites AG, RHI Magnesita, Zumtobel, Rosenbauer, Flughafen Wien, Oberbank AG Stamm, Pierer Mobility, UBM, FACC, Amag, Frequentis, EVN, Palfinger, Österreichische Post.

Random Partner

Marinomed

Erforscht und entwickelt völlig neuartige Technologieplattformen, die innovative Therapien gegen Atemwegs- und Augenerkrankungen ermöglichen. Aus wissenschaftlichen Ideen werden so neue Patente, Marken und Produkte geschaffen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten