21st Austria weekly - Kapsch TrafficCom, Marinomed (21/08/2024)

25.08.2024, 2592 Zeichen

Kapsch TrafficCom: Kapsch TrafficCom, provider of transportation solutions for sustainable mobility, presented result for the first quarter of 2024/25. Revenues increased by 5% from EUR 132 million in the first quarter of the previous year to EUR 139 million in the first quarter of 2024/25. At EUR -3 million, EBIT remained negative and at the previous year's level, although no one-off operating effects had an impact in the reporting period. The negative EBIT is primarily attributable to deconsolidation in Africa, which had a negative impact of EUR -7 million on the other operating result. Kapsch TrafficCom was therefore able to significantly improve its operational performance, which would have been clearly positive without the non-operating effects. This shows the success of the restructuring and the cost savings.

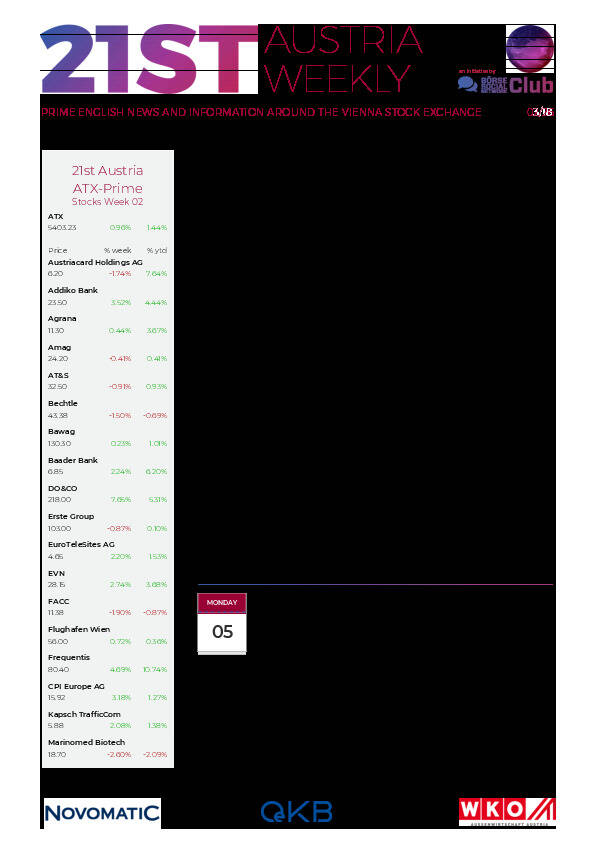

Kapsch TrafficCom: weekly performance:

Marinomed: Marinomed Biotech AG reports revenues of EUR 2.5 million for the first half of 2024. This corresponds to a decline of around 53% compared to the first half of 2023 (EUR 5.2 million). As already reported, this is mainly due to high inventory levels at Marinomed's marketing partners and therefore fewer orders. Compared to the first quarter of 2024, however, significantly more Carragelose products were delivered and revenues more than doubled in Q2 (from EUR 0.7 million to EUR 1.7 million). The operating result (EBIT) amounted to EUR -3.2 million (H1 2023: EUR -2.9 million). Cash and cash equivalents fell to EUR 0.9 million compared to end of 2023 (EUR 2.6 million). After it was not possible to raise the funds needed to secure liquidity in the short term, court restructuring proceedings without self-administration were initiated on August 14, 2024, at the Company's request. Andreas Grassauer, CEO of Marinomed, says: “Despite intensive efforts, we have unfortunately not succeeded in raising the funds required in the short term to secure the Company's liquidity. It was therefore necessary to apply for restructuring proceedings. Our top priority is now the sustainable stabilization of Marinomed in the course of the restructuring proceedings, which were opened on August 14, 2024. The second priority is to generate funds from revenues, partnerships and the implementation of strategic options for the Carragelose business. We are aiming to make a decision here by the end of the year. We are also in negotiations with investors to secure the Company's liquidity.”

Marinomed Biotech: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (21/08/2024)

BörseGeschichte Podcast: Gerald Grohmann vor 10 Jahren zum ATX-25er

Bildnachweis

Aktien auf dem Radar:Polytec Group, Addiko Bank, UBM, RHI Magnesita, Zumtobel, Agrana, Rosgix, CA Immo, DO&CO, SBO, Gurktaler AG Stamm, Heid AG, OMV, Wolford, Palfinger, Rosenbauer, Oberbank AG Stamm, BTV AG, Flughafen Wien, BKS Bank Stamm, Josef Manner & Comp. AG, Mayr-Melnhof, Athos Immobilien, Marinomed Biotech, Amag, Österreichische Post, Verbund, Wienerberger, Merck KGaA, Continental, Fresenius Medical Care.

Random Partner

REPLOID Group AG

Die 2020 gegründete REPLOID Group AG stellt hochwertige Proteine und Fette sowie biologischen Dünger aus der Aufzucht von Larven der Schwarzen Soldatenfliege her. In den für ihre Kunden errichteten Mastanlagen – den REPLOID ReFarmUnits – erhalten vom Unternehmen gelieferte Junglarven eine auf den jeweiligen Standort abgestimmte Futtermischung aus Reststoffen der regionalen Lebensmittel-Wertschöpfungskette. Nach erfolgter Mast übernimmt REPLOID die Larven zur zentralen Vermarktung.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten