21st Austria weekly - Kontron, OMV (15/01/2024)

21.01.2024, 1687 Zeichen

Kontron: IoT company Kontron expects an increase in net profit to over EUR 87 million in 2024. Revenue is expected to grow to over EUR 1,400 million in 2024. The company’s provisional figures for the financial year 2023 indicate a strong fourth quarter and that all targets have been met – both for the planned revenues of EUR 1,200 million and for the most recent net profit guidance of EUR 72 million. CEO Hannes Niederhauser: “The transformation of Kontron AG into a pure IoT provider is a complete success. In 2023, we were able to increase our net profit guidance twice and we have almost doubled it in the last 3 years since 2021. Our order books are at record levels and we have groundbreaking product innovations in the pipeline. So, we are convinced that the 2024 financial year will be another very good year for Kontron.”

Kontron: weekly performance:

OMV: OMV, the integrated energy, fuels & feedstock, and chemicals & materials company headquartered in Vienna, is undergoing a transformation as part of its target to become carbon neutral by no later than 2050. Some 40 per cent of the planned annual Group investments to support organic growth has been designated for sustainable projects. As part of this journey, OMV is investing in and collaborating with startups and technology frontrunners in the energy sector to drive progress in its low carbon business unit. Some EUR 5 bn in investments have been earmarked until 2030 in projects such as low carbon geothermal energy, Carbon Capture and Storage (CCS), and further renewable power solutions.

OMV: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (15/01/2024)

BörseGeschichte Podcast: Peter Brezinschek vor 10 Jahren zum ATX-25er

Bildnachweis

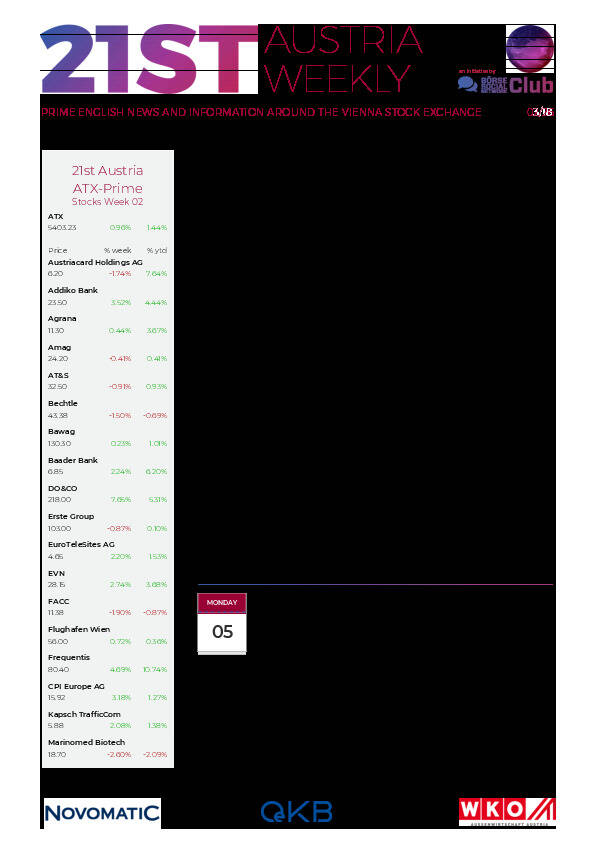

Aktien auf dem Radar:voestalpine, CA Immo, Andritz, Austriacard Holdings AG, RHI Magnesita, Addiko Bank, Rosgix, SBO, Wienerberger, Rosenbauer, Marinomed Biotech, EVN, Mayr-Melnhof, AT&S, DO&CO, Kapsch TrafficCom, Polytec Group, Frequentis, Palfinger, Agrana, Amag, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, SW Umwelttechnik, Zumtobel, Wolford, Österreichische Post, Verbund, GEA Group, Merck KGaA.

Random Partner

Erste Asset Management

Die Erste Asset Management versteht sich als internationaler Vermögensverwalter und Asset Manager mit einer starken Position in Zentral- und Osteuropa. Hinter der Erste Asset Management steht die Finanzkraft der Erste Group Bank AG. Den Kunden wird ein breit gefächertes Spektrum an Investmentfonds und Vermögensverwaltungslösungen geboten.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten