21st Austria weekly - ams Osram (07/12/2023)

10.12.2023, 2207 Zeichen

Zumtobel: Lightning group Zumtobel presented results for the first half of the 2023/24 financial year. The figures show a decline of 8.5% in revenues to EUR 574.4 million. After an adjustment for foreign exchange effects, the decline equalled 6.8%. The main underlying reason is the ongoing difficult order situation in the components business: Revenues fell by 22.8% year-on-year to EUR 152.1 million in the Components Segment, but declined only marginally by 1.5% to EUR 454.4 million in the Lighting Segment. EBIT recorded by the Zumtobel Group consequently dropped from EUR 50.8 million the first half of the previous year to EUR 30.9 million as a result of the decline in revenues and represents an EBIT margin of 5.4% for the reporting period (8.1% in the previous year). Net profit amounted to EUR 21.2 million compared with EUR 33.7 million in the first half of 2022/23. "Orders in the components business are recovering very slowly, and customers' warehouses remain well-stocked. The pressure on prices is high, and the construction branch is confronted with widespread weakness", explained Alfred Felder, CEO of the Zumtobel Group. "In this market environment, the second half of the financial year will be more than challenging for us – and we have taken the necessary steps to strengthen our company's competitive position".

Zumtobel: weekly performance:

ams Osram: ams Osram announced that upon closing of the rights issue, scheduled on 11 December 2023, ams Osram will receive gross proceeds of approximately CHF 781 million (approximately EUR 808 million). Following the announcement of the rights issue’s preliminary results, ams Osram (SIX: AMS) confirms that subscription rights for 716,777,622 offered shares under the rights issue have been validly exercised by the end of the subscription period on 6 December 2023. The remaining 7,377,040 offered shares for which the subscription rights were not exercised during the subscription period have been successfully placed with institutional investors in a private placement at a price of CHF 1.88 per share.

ams-Osram: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (07/12/2023)

SportWoche ÖTV-Spitzentennis Podcast: Sebastian Ofner, Joel Schwärzler und Sebastian Sorger liefern den erwünschten Aufschwung

Bildnachweis

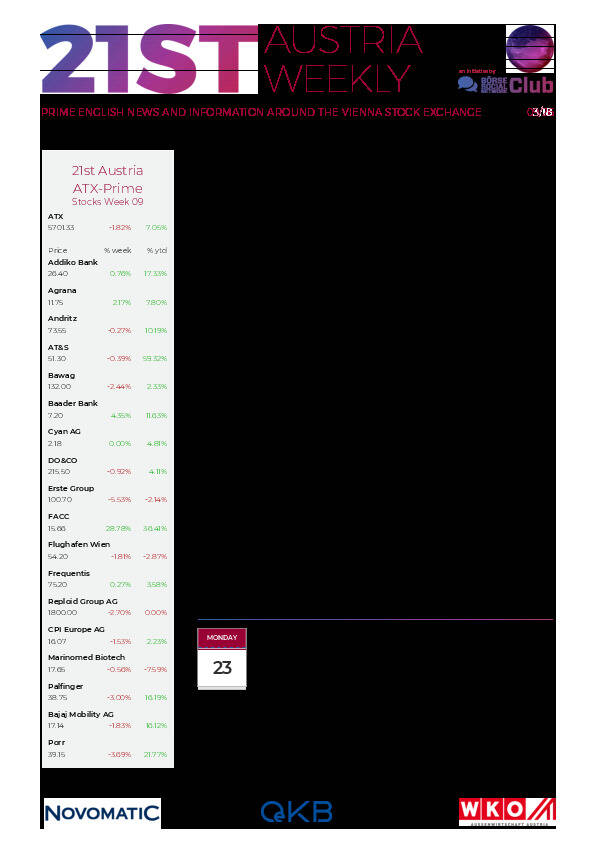

Aktien auf dem Radar:Bawag, FACC, RHI Magnesita, Kapsch TrafficCom, Austriacard Holdings AG, Polytec Group, Rosgix, AT&S, ATX, ATX TR, voestalpine, Porr, ATX NTR, Erste Group, Amag, DO&CO, EuroTeleSites AG, Hutter & Schrantz Stahlbau, Lenzing, OMV, Bajaj Mobility AG, RBI, Rosenbauer, Verbund, Wienerberger, Wolford, BKS Bank Stamm, Oberbank AG Stamm, UBM, Marinomed Biotech, CA Immo.

Random Partner

Wiener Börse

Als zentrale Infrastrukturanbieterin der Region öffnet die Wiener Börse AG Tore zu den globalen Finanzmärkten. Sie vereint die Börsenplätze Wien und Prag. Mit modernster Technik und kundenorientierten Services leistet die Wiener Börse als privatwirtschaftliches, gewinnorientiertes Unternehmen einen bedeutenden Beitrag für einen international wettbewerbsfähigen Kapitalmarkt.

>> Besuchen Sie 53 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten