21st Austria weekly - Frequentis (08/04/2025)

13.04.2025, 1086 Zeichen

Frequentis: Frequentis, the world’s leading provider of safety-critical applications for control centres, has once again posted double-digit growth in 2024. Order intake rose by 15.7% to EUR 583.8 million, an increase of EUR 79.0 million. Demand remains high, as shown by order intake and the well-stocked pipeline of tenders and requests for proposals. Orders on hand exceeded EUR 700 million for the first time, resulting in strong capacity utilisation and a continuous expansion of our teams. At EUR 480.3 million, revenues were close to the EUR 500 million threshold. Despite higher personnel expenses, mainly due to inflation, EBIT was 20.5% higher at EUR 32.1 million. The EBIT margin improved to 6.7% (2023: 6.2%). "Our growth and improved profitability are based on our stable business model, the clear focus on innovation, and ongoing development of our flagship solutions for safety-critical control centres,” says Frequentis CEO Norbert Haslacher.

Frequentis: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (08/04/2025)

Zertifikate Party Österreich: Zufriedenes Update Zertifikate Real Money Depot bei dad.at - Bayer und RBI brachten Plus, Verlierer gibt es auch

Bildnachweis

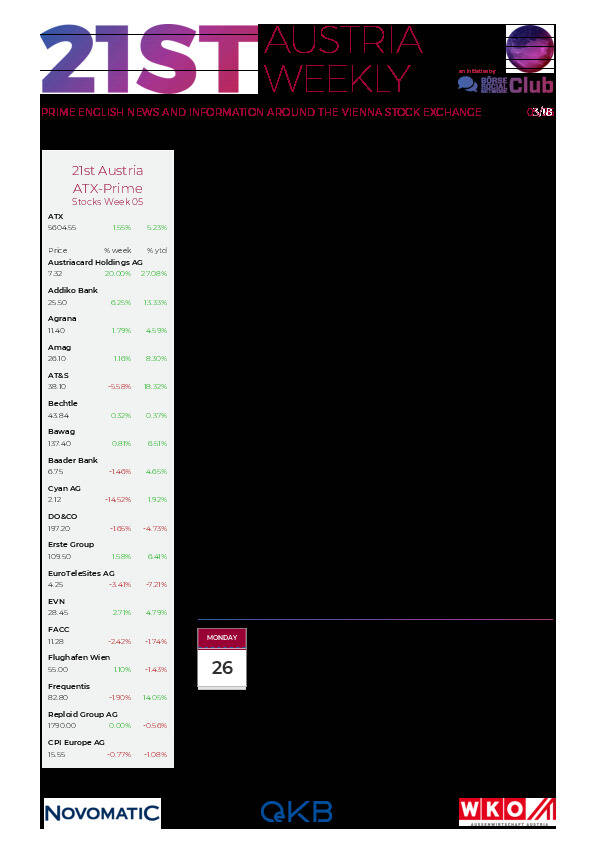

Aktien auf dem Radar:Addiko Bank, Austriacard Holdings AG, Strabag, SBO, Rosenbauer, Flughafen Wien, RBI, DO&CO, Lenzing, AT&S, Wolford, Bajaj Mobility AG, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, Reploid Group AG, Amag, CA Immo, EuroTeleSites AG, EVN, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund, Caterpillar, Walt Disney, Deutsche Telekom, Zalando, Siemens Energy, Allianz.

Random Partner

Do&Co

Als Österreichisches, börsennotiertes Unternehmen mit den drei Geschäftsbereichen Airline Catering, internationales Event Catering und Restaurants, Lounges & Hotel bieten wir Gourmet Entertainment auf der ganzen Welt. Wir betreiben 32 Locations in 12 Ländern auf 3 Kontinenten, um die höchsten Standards im Produkt- sowie Service-Bereich umsetzen zu können.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten