21st Austria weekly - FACC, Frequentis, Vienna Insurance Group (16/08/2023)

20.08.2023, 3082 Zeichen

FACC: Compared to previous year's period, revenue of FACC AG, a worldwide leading aerospace company in design, development and production of aerospace technologies and advanced aircraft lightweight systems, grew from EUR 270.1 million to EUR 354.7 million in the first half of 2023 - this corresponds to an increase of 31.3 %. Despite ongoing challenges along the supply chains, EBIT increased significantly from EUR 6.1 million to EUR 14.9 million. This development is attributable to the sustained recovery of the aviation industry, the rising demand for new aircraft and increasing production of all aircraft types. Revenue from new projects and development orders are also positively contributing to earnings. Group revenue in the financial year 2023 is expected to increase by between 12 % and 16 % compared to the financial year 2022. With regard to earnings, management expects a smaller but positive result for the second half of the year compared to the first half.

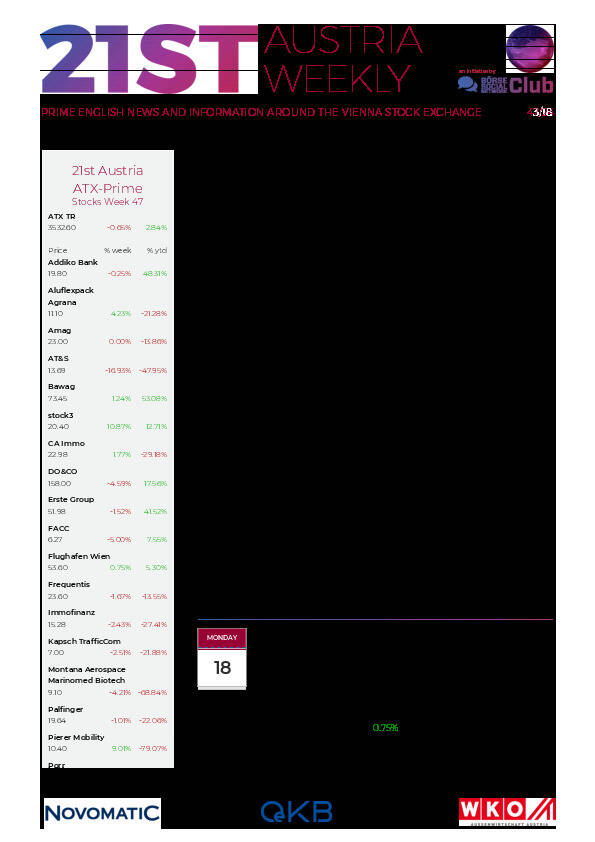

FACC: weekly performance:

Frequentis: Revenues of Frequentis, a global supplier of communication and information systems for control centres with safety-critical tasks. rose 11.7% to EUR 186.8 million in the first half of 2023. Looking at the regional split, Europe accounted for 67%, the Americas for 14%, Asia for 11%, and Australia/Pacific/Africa for 8%. Demand for Frequentis products remains high around the world. Order intake increased by 29.1% to EUR 208.0 million in the first half of 2023. Orders on hand amounted to EUR 546.7 million, a rise of 9.8%. The war in Ukraine, which started in February 2022, indirectly impacted the Frequentis Group through higher inflation, which then filtered through stepwise to the cost of goods sourced from suppliers, salary rises, and other cost items. EBITDA was EUR 8.2 million. Depreciation and amortisation were almost unchanged. In all, EBIT was EUR -0.3 million. As a result of seasonal fluctuations, as usual, the second half of the year is more relevant for Frequentis’ profitability than the first half.

Frequentis: weekly performance:

Vienne Insurance Group: Subject to substantial interest rate and market volatilities and in view of the current ongoing weather extremes, Vienna Insurance Group expects a profit before taxes for the Group in a range of EUR 700 - 750 million for the full-year 2023 under IFRS 17/9. In the course of the first-time preparation of the 2023 half-year result as of 30 June 2023 in accordance with the accounting standards IFRS 9 and IFRS 17, which have to be applied since 1 January 2023, a profit before taxes of around EUR 460 million is shown for the first half of 2023. The profit before taxes of EUR 212 million in the first half of 2022 in accordance with IFRS 17/9 was significantly influenced by the interest rate development in the reporting period. In the second half of 2023, dampening effects on earnings are to be expected also due to the severe weather events, the company stated.

VIG: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (16/08/2023)

Wiener Börse Party #792: ATX zum Ultimo etwas fester, Immofinanz liefert gut und dank Thomas Rybnicek heisst es Handle with Care

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

Zumtobel

Die Zumtobel Gruppe ist ein international führender Anbieter ganzheitlicher Lichtlösungen. Seit über 50 Jahren entwickelt Zumtobel innovative und individuelle Lichtlösungen und bietet ein umfassendes Spektrum an hochwertigen Leuchten und Lichtsteuerungssystemen für unterschiedliche Anwendungsbereiche der Gebäudebeleuchtung

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten