21st Austria weekly - RHI Magnesita, RBI (05/05/2023)

07.05.2023, 1551 Zeichen

RHI Magnesita: Refractory company RHI Magnesita provided an update on trading for the three months to 31 March 2023 ('Q1'). The momentum of improving EBITA and EBITA margins established in 2022 continued through the first quarter as lower cost inflation offset an expected reduction in sales volumes. Refractory sales volumes in the first quarter were 8% lower than Q1 2022, in line with management expectations and overall market demand. As anticipated, steel and cement demand outside of India and China softened due to a slowdown in construction activity, whilst demand in the Industrial Projects segment remained strong. EBITA margins in Q1 were ahead of guidance of approximately 10% for 2023 but pricing pressure is anticipated in the remainder of the year as input costs reduce for refractory producers globally.

RHI Magnesita: weekly performance:

RBI: Raiffeisen Bank International (RBI) reported earnings for the firt quarter. Overall, consolidated profit increased 49 per cent year-on-year to € 657 million. Consolidated return on equity improved from 13.2 per cent to 15.8 per cent. Overall, core revenues increased 41 per cent, to € 2,350 million, which made for a further improvement in the cost/income ratio to 38.6 per cent (previous year’s period: 42.1 per cent). Net interest income increased € 399 million to € 1,385 million, mainly due to higher interest rates and strong loan growth in numerous Group countries.

RBI: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (05/05/2023)

BörseGeschichte Podcast: Ernst Vejdovszky vor 10 Jahren zum ATX-25er

Bildnachweis

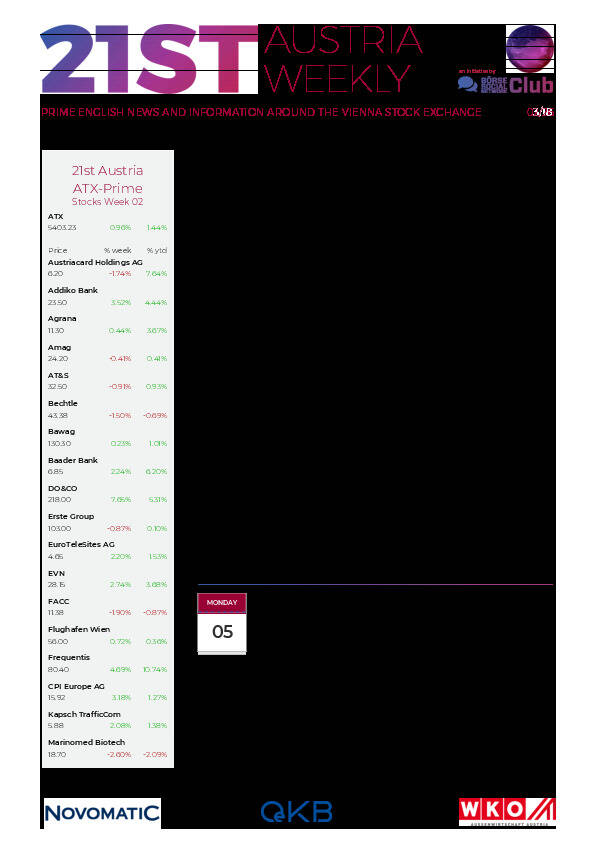

Aktien auf dem Radar:Polytec Group, Addiko Bank, UBM, RHI Magnesita, Zumtobel, Agrana, Rosgix, CA Immo, DO&CO, SBO, Gurktaler AG Stamm, Heid AG, OMV, Wolford, Palfinger, Rosenbauer, Oberbank AG Stamm, BTV AG, Flughafen Wien, BKS Bank Stamm, Josef Manner & Comp. AG, Mayr-Melnhof, Athos Immobilien, Marinomed Biotech, Amag, Österreichische Post, Verbund, Wienerberger, Merck KGaA, Continental, Fresenius Medical Care.

Random Partner

Vontobel

Als internationales Investmenthaus mit Schweizer Wurzeln ist Vontobel auf die Bereiche Private Clients und Institutional Clients spezialisiert. Der Erfolg in diesen Bereichen gründet auf einer Kultur der Eigenverantwortung und dem Bestreben, die Erwartungen der Kundinnen und Kunden zu übertreffen.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten