21st Austria weekly - Lenzing, voestalpine (09/03/2023)

12.03.2023, 1642 Zeichen

Lenzing: Lenzing: In the year under review, revenue of fiber group Lenzing increased by 16.9 percent year-on-year to reach EUR 2.57 bn, primarily as a result of higher fiber prices. The quantity of fiber sold decreased, while the quantity of pulp sold rose. In addition to lower demand, the earnings trend particularly reflects the increase in energy and raw material costs. Earnings before interest, tax, depreciation and amortization (EBITDA) decreased by 33.3 percent year-on-year to EUR 241.9 mn in 2022. The net result for the year was minus EUR 37.2 mn (compared with EUR 127.7 mn in the 2021 financial year). In the current financial year, the Lenzing Group expects EBITDA in 2023 to be in a range of EUR 320 mn to EUR 420 mn.

Lenzing: weekly performance:

voestalpine: voestalpine Railway Systems are the global leading supplier of complete railway systems, offering everything from the “hardware” (rails, turnouts, mountings, and sleepers) through to the digital monitoring of rail tracks and trains from a single source. Now the voestalpine Group subsidiary has secured its largest ever order worth around EUR 237 million (approx. GBP 210 million) for the design, supply, and servicing of turnouts, drives, and rail expansion joints including diagnostic systems for Great Britain’s new High Speed 2 rail network. voestalpine is also supplying other major projects worldwide with premium rails, high-speed turnouts, and signaling technology. In total, the order volumes amount to around EUR 600 million.

voestalpine: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (09/03/2023)

BörseGeschichte Podcast: Christian-Hendrik Knappe vor 10 Jahren zum ATX-25er

Bildnachweis

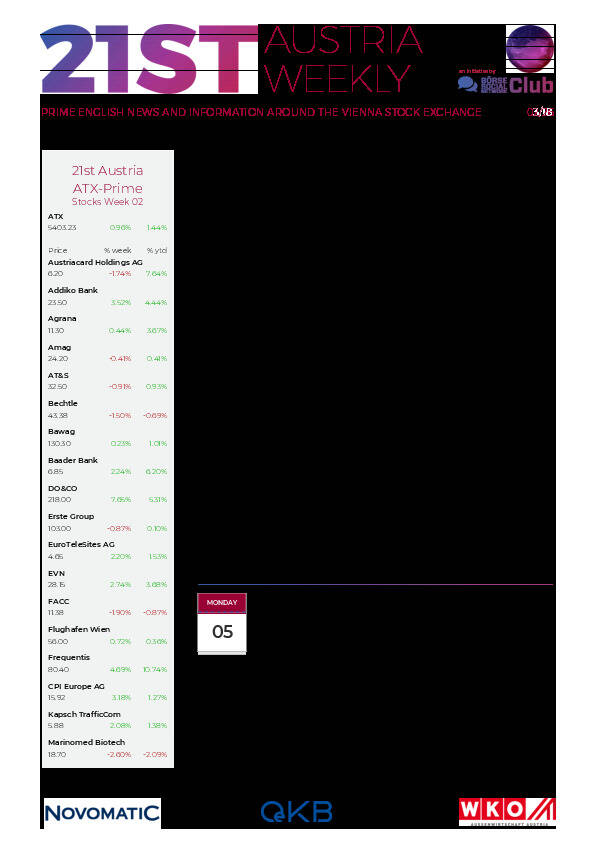

Aktien auf dem Radar:DO&CO, Amag, AT&S, Austriacard Holdings AG, RHI Magnesita, SBO, Rosgix, Rosenbauer, FACC, Lenzing, OMV, Polytec Group, Zumtobel, Porr, Frequentis, Gurktaler AG Stamm, Wienerberger, Wolford, Wolftank-Adisa, Palfinger, Pierer Mobility, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Marinomed Biotech, Österreichische Post, Verbund, GEA Group, Bayer, Fresenius Medical Care, Symrise.

Random Partner

Societe Generale

Société Générale ist einer der weltweit größten Derivate-Emittenten und auch in Deutschland bereits seit 1989 konstant als Anbieter für Optionsscheine, Zertifikate und Aktienanleihen aktiv. Mit einer umfangreichen Auswahl an Basiswerten aller Anlageklassen (Aktien, Indizes, Rohstoffe, Währungen und Zinsen) überzeugt Société Générale und nimmt in Deutschland einen führenden Platz im Bereich der Hebelprodukte ein.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten