21st Austria weekly - Wolftank, Zumtobel (07/12/2022)

11.12.2022, 2239 Zeichen

Wolftank: The Executive Board of Wolftank-Adisa Holding AG has decided to increase the share capital of the company by issuing up to 438.093 new no-par value bearer shares at the issue price of Euro 14.01 per share. The shareholders' subscription rights to the new shares to be issued are excluded. According to the company, the capital increase serves to strengthen the equity base and to finance current or planned projects. The current increased number of inquiries in the field of refueling systems for renewable energies and environmental remediation of the existing European refueling infrastructure requires an accelerated positioning in key markets such as Germany. This is to be supported by strategic partnerships or participations.

Wolftank-Adisa: weekly performance:

Zumtobel: The lightning group Zumtobel is following the announcement of preliminary numbers for the first half-year on 10 November with final results for the first half of the 2022/23 financial year. In the first six months of the current financial year, this lighting group generated revenue growth of 10.6% to EUR 627.8 million (H1 2021/22: EUR 567.4 million). EBIT rose by 45.2% to EUR 50.8 million, net profit increased by 46.8% to EUR 33.7 million. According to the company, commercial construction is only expected to generate marginal growth due to the increase in interest rates and the rising cost of construction materials and energy. As an alternative, commercial customers are shifting their investments to so-called refurbishment, meaning the energetic renovation of existing buildings, which also includes more sustainable and energy-efficient lighting solutions. The Zumtobel Group also has the right solutions here: The complete replacement of a lighting concept or an upgrade with a special refurbishment kit are only two of the many offers. CEO Alfred Felder: "Together with our customers and partners, we develop energy-saving concepts by using highly efficient lighting solutions. In this way, we positively contribute to the protection of our environment. We also see further growth opportunities in this area."

Zumtobel: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (07/12/2022)

Private Investor Relations Podcast #23: Joachim Brunner zu IR quer über Kontinente, Sprachen, Aufsichten; als Bonus-Content 1x ATXPrime

Bildnachweis

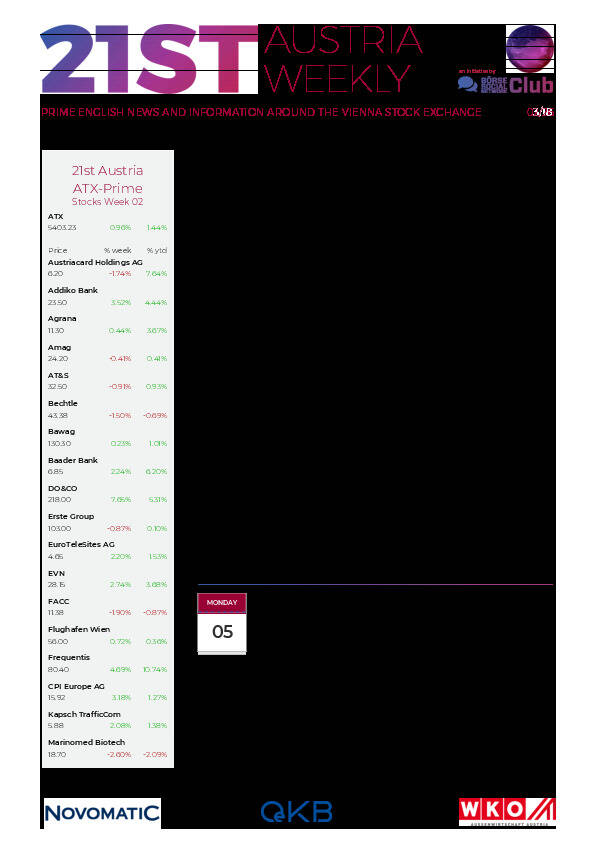

Aktien auf dem Radar:DO&CO, Amag, AT&S, Austriacard Holdings AG, RHI Magnesita, SBO, Rosgix, Rosenbauer, FACC, Lenzing, OMV, Polytec Group, Zumtobel, Porr, Frequentis, Gurktaler AG Stamm, Wienerberger, Wolford, Wolftank-Adisa, Palfinger, Pierer Mobility, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Marinomed Biotech, Österreichische Post, Verbund, GEA Group, Bayer, Fresenius Medical Care, Symrise.

Random Partner

Verbund

Verbund ist Österreichs führendes Stromunternehmen und einer der größten Stromerzeuger aus Wasserkraft in Europa. Mit Tochterunternehmen und Partnern ist Verbund von der Stromerzeugung über den Transport bis zum internationalen Handel und Vertrieb aktiv. Seit 1988 ist Verbund an der Börse.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten