21st Austria weekly - DO & CO, Mayr-Melnhof, Valneva, Austrian Post (11/08/2022)

14.08.2022, 6547 Zeichen

DO & CO: The recovery from the impacts of the Covid-19 pandemic has continued in the first quarter of the business year 2022/2023 and catering company DO & CO has benefited from an increase in demand across all divisions. At Euro 288.31 mn rthe company eported the strongest quarter in terms of revenue in its history despite the continuing depreciation of the Turkish lira. Exchange rate fluctuations against the euro compared to the first quarter of the business year 2021/2022 resulted in a negative effect on Group revenue in the amount of Euro 51.30 mn. The result of the first quarter of the business year 2022/2023 was strongly affected by application of the provisions of IAS 29 "Financial reporting in hyperinflationary economies" to the financial statements of the Turkish subsidiaries. The net result amounts to Euro 3.35 mn, at Euro 7.78 mn, the net result would have been Euro 4.43 mn higher without applying IAS 29. Despite the strain resulting from the depreciation of the Turkish lira, at Euro 195.26 mn the Company again reports a high amount of cash and cash equivalents in the first quarter of the business year 2022/2023. Particularly in the International Event Catering division, a number of large tenders are in progress which are quite promising but where no final decision has been made yet, the company stated in its outlook, also that the demand in the restaurants and in gourmet retail and utilisation in the field of Airline Catering are also quite gratifying.

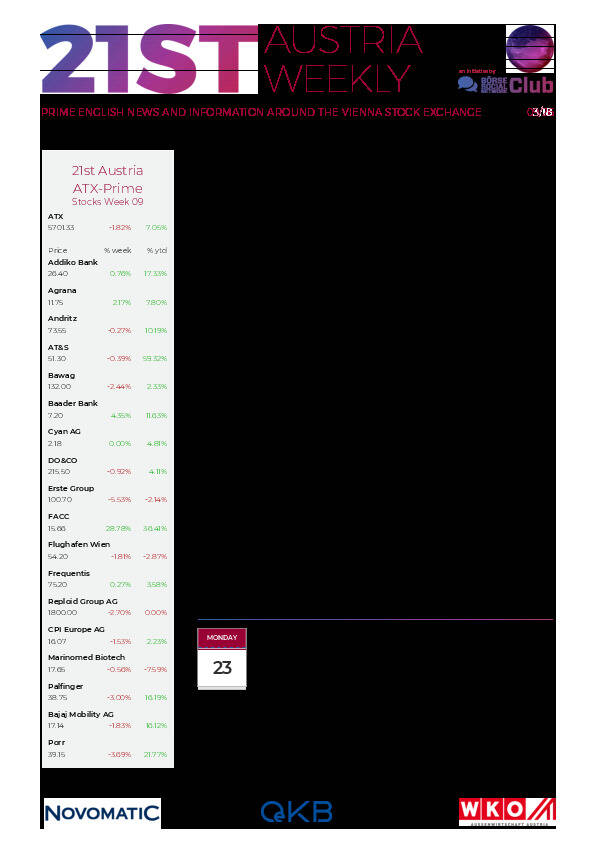

DO&CO: weekly performance:

Mayr-Melnhof: The carton board group Mayr-Melnhof reported an increase in consolidated sales by Euro 928.9 mn to Euro 2,218.5 mn. This growth results mainly from the previous year’s acquisitions as well as the passing on of cost increases through higher prices. At Euro 285.0 mn, operating profit was Euro 192.9 mn above the previous year’s value. The significant rise primarily results from the division MM Board & Paper. Profit for the period rose by Euro 143.6 mn to Euro 205.8 mn. Peter Oswald, MM CEO, comments: „Demand for our products is strong, as consumers prefer natural, recyclable packaging made from renewable, fiber-based raw materials. Our strategy of focused organic growth and value enhancing acquisitions combined with a strong grip on improvement of productivity is starting to pay off. As the continuous supply of our customers has top priority, we have undertaken several measures to mitigate a possible gas rationing, which would affect all cartonboard and paper mills except MM Kwidzyn: We have started to build up safety stocks for recycled fiber-based cartonboard, rented gas storage facilities in Austria, and are investing in alternative oil firing in Finland. The second half-year will be impacted by planned capex-related downtime, necessary adjustment measures and supply chain disruptions, at an extent which seems quite unpredictable at this point in time.”

Mayr-Melnhof: weekly performance:

Valneva: Vaccine developer Valneva’s total revenues were Euro 93.2 mn in the first half of 2022 compared to Euro 47.5 mn in the first half of 2021, an increase of 96.3%. Product sales, including COVID-19 vaccine sales, increased by 5.0% to Euro 33.3 mn in the first half of 2022 compared to Euro 31.8 mn in the first half of 2021. Product sales related to Covid-19 amounted to Euro 3.8 mn. Valneva recorded an operating loss of Euro 150.4 mn in the first half of 2022 compared to Euro 86.2 mn in the first half of 2021, of which the COVID-19 operating loss represented Euro 110.7 mn and Euro 55.5 mn as of June 30, 2022 and 2021 respectively and the other segments represented Euro 39.7 mn in the first half of 2022 compared to Euro 30.7 mn in the first half of 2021. Adjusted EBITDA (as defined below) loss in the first half of 2022 was Euro 136.0 mn compared to an adjusted EBITDA loss of Euro 80.1 mn in the first half of 2021. In the first half of 2022, Valneva generated a net loss of Euro 171.5 mn compared to a net loss of Euro 86.4 mn in the first half of 2021. Thomas Lingelbach, Valneva’s Chief Executive Officer, commented, “Valneva continued to achieve significant R&D milestones in the first half of the year. Our updated Lyme disease collaboration agreement with Pfizer included a substantial equity investment which we see as a strong sign of confidence and recognition of our vaccine expertise, and the recent Phase 3 initiation brings us a step closer to a potential vaccine solution against Lyme disease. Our chikungunya vaccine program successfully met all Phase 3 clinical endpoints, readying us for BLA submission. Our COVID-19 vaccine became the first to receive full marketing authorization in Europe, and we look forward to delivering the first doses in Europe in the coming weeks. However, given the revised volume of orders from the EU Member States, we are evaluating how to re-shape our operations. Looking at our other commercial products, we are seeing a faster recovery than expected in the travel vaccine market and demand may even exceed our current supply capacity in the later part of the year. I would like to take this opportunity to thank our shareholders, partners and employees for their ongoing support and contribution.”

Valneva: weekly performance:

Austrian Post: The first half of 2022 for Austrian Post was shaped by very challenging conditions. Interruptions in international value chains have put an upward pressure on costs intensified by the war in Ukraine. This backdrop and the extraordinarily high parcel volumes in the prior-year quarters make it for a challenging start into 2022. “Our focus on delivery quality and many customer acquisition initiatives are proving successful. This gives us cause for optimism in the second half of the year,” says CEO Georg Pölzl. Group revenue in the first half-year 2022 totalled Euro 1,211.8m (–4.0 %), whereas second-quarter revenue showed an improved trend, with revenue down by only 0.8 %. In particular, the parcel business in Turkey was strongly impacted due to inflation and currency effects compared with an extraordinarily successful year in 2021. EBITDA of the first half-year fell by 2.7 % to Euro 179.4 mn, whereas earnings before interest and tax (EBIT) declined by 12.0 % year-on-year to Euro 91.0 mn. From today’s perspective, Group earnings (EBIT) in 2022 should be in the range of the results reported in the last two years (2021 EBIT: Euro 205 mn; 2020 EBIT: Euro 161 mn).

Österreichische Post: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (11/08/2022)

Wiener Börse Party #1109: ATX weiter leicht erholt, Verbund, FACC und Andritz gesucht, Wiener Börse grosser Profiteur dieser Marktphase

Bildnachweis

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

Erste Asset Management

Die Erste Asset Management versteht sich als internationaler Vermögensverwalter und Asset Manager mit einer starken Position in Zentral- und Osteuropa. Hinter der Erste Asset Management steht die Finanzkraft der Erste Group Bank AG. Den Kunden wird ein breit gefächertes Spektrum an Investmentfonds und Vermögensverwaltungslösungen geboten.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten