21st Austria weekly - Agrana, UBM, Andritz, Warimpex (07/07/2022)

10.07.2022, 3257 Zeichen

Agrana: In the first quarter of the 2022|23 financial year (the three months ended 31 May 2022), Agrana, the fruit, starch and sugar company, as expected achieved very significant growth in operating profit (EBIT), from € 20.9 million to € 51.6 million. The Group’s revenue rose to € 886.3 million (Q1 prior year: € 705.8 million). “Despite a difficult market environment, we are on track in the 2022|23 financial year. We have so far coped well with the challenges of increased market volatility created by the war in Ukraine,” notes Agrana Chief Executive Officer Markus Mühleisen. While the hikes in energy prices weighed on production operations in all business segments, the bottom line was buoyed by a very positive performance in the ethanol business, which contributed to a strong increase in EBIT in the Starch segment. Significantly, the Sugar segment too, after a prolonged period below break-even, was able to generate positive quarterly EBIT again. In the Fruit segment, EBIT expanded thanks particularly to a better performance in the fruit juice concentrate business. “Our aim at Agrana is to be a reliable buyer of raw materials from farmers and a stable supplier to our customers. Inflation poses a challenge for every participant in the value chain, and so we first try to exhaust all available efficiencies in our own activities. We only raise sales prices when we are left with no other choice,” explains Mühleisen.

UBM: UBM Development sold one commercial property and building rights to three properties in Vienna for a total of €39.07m before the end of June. UBM CEO Thomas G. Winkler: “These transactions demonstrate that UBM can still find successful investors, even in difficult times. “Following the sale of all 165 condominiums in Siebenbrunnengasse 21, UBM has now successfully sold the adjoining commercial property at Stolberggasse 26 in Vienna’s fifth district. The building has 6,121 m² of rentable space and an underground garage with space for 130 cars. The sale proceeds totalled €24.5m, and the buyer is an Austrian family office. UBM CEO Thomas G. Winkler: “We have adjusted to these changing times and can now manage them even better.“

Andritz: International technology group Andritz has received an order from Shanying Paper (Jilin) Co. Ltd. to supply a complete OCC line, including fiber recovery and reject handling system, for its mill near Fuyu City, Songyuan, Jilin Province, China. Start-up is scheduled for the second quarter of 2023.

Warimpex: Real estate developer Warimpex has acquired the Red Tower office building with a total area of more than 12,000 square metres in the Polish city of Łódź. This is Warimpex’s third investment in Łódź, following the andel’s hotel and Ogrodowa Office. Franz Jurkowitsch, CEO of Warimpex: “For many years we have been watching Łódź develop and attract more and more Polish and foreign companies. With a solid business environment, a highly qualified workforce, and well-developed infrastructure, we see great potential in the local office market. We will actively seek new tenants for the Red Tower, but we also plan to expand the existing co-working space offerings at this location.”

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (07/07/2022)

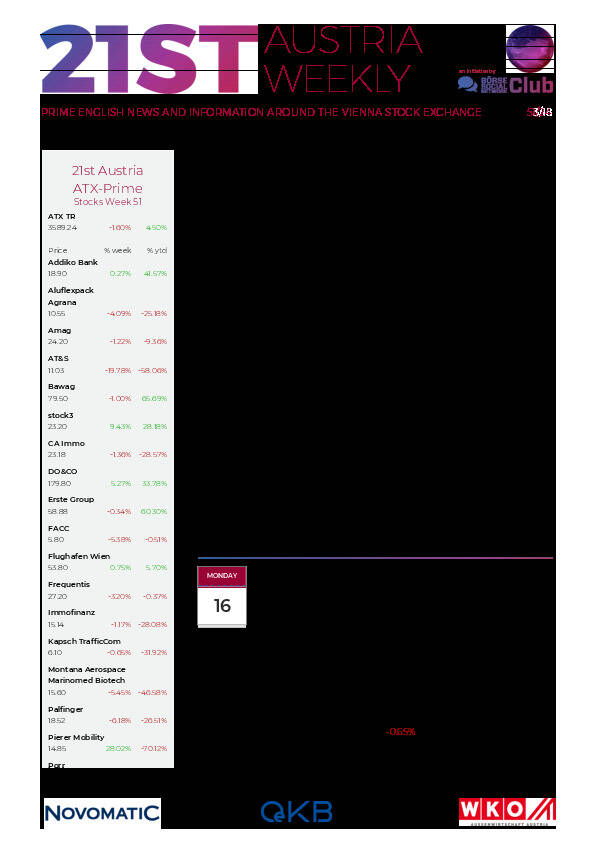

Wiener Börse Party #809: Post-Xmas-Boom bei Aktien von Pierer Mobilty, AT&S, Porr, UBM und Palfinger; Infos zum Jahresendhandel

Bildnachweis

Aktien auf dem Radar:Pierer Mobility, Warimpex, RHI Magnesita, Immofinanz, Addiko Bank, CA Immo, Mayr-Melnhof, Verbund, ATX, ATX Prime, ATX TR, Wienerberger, Kostad, EVN, Lenzing, Österreichische Post, Strabag, Athos Immobilien, AT&S, Cleen Energy, Marinomed Biotech, RWT AG, SBO, UBM, Agrana, Amag, Flughafen Wien, OMV, Palfinger, Telekom Austria, Uniqa.

Random Partner

VAS AG

Die VAS AG ist ein Komplettanbieter für feststoffbefeuerte Anlagen zur Erzeugung von Wärme und Strom mit über 30-jähriger Erfahrung. Wir planen, bauen und warten Anlagen im Bereich von 2 bis 30 MW für private, industrielle und öffentliche Kunden in ganz Europa. Wir entwickeln maßgefertigte Projekte ganz nach den Bedürfnissen unserer Kunden durch innovative Lösungen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten