21st Austria weekly - Palfinger, Verbund, Wienerberger, RHI Magnesita (12/05/2022)

15.05.2022, 4010 Zeichen

Verbund: Austrian utility Verbund saw a significant improvement in the results posted for quarter 1/2022. EBITDA climbed by 169.3% to Euro 814.9 mn. The Group result soared by 255.6% to Euro 514.4 mn compared with the same period of the previous year. The sharp increase in wholesale electricity prices on the futures and spot markets gave a significant boost to earnings. The average sales prices obtained for VERBUND’s own generation from hydropower rose by €66.3/MWh to €113.8/MWh. The consolidation of Gas Connect Austria GmbH, the regulated gas transmission and distribution system operator in Austria acquired with effect from 31 May 2021, likewise had a positive effect. The contribution from flexibility products also rose significantly as a result of greater volatility in the electricity market. In the Thermal generation segment, increased use of the Mellach combined cycle gas turbine power plant made a positive contribution to earnings. The Group result in quarter 1/2022 was also bolstered by a positive non-recurring effect in taxes on income in the amount of Euro 56.6 mn. This effect results from the revaluation of deferred tax as a consequence of the decision to lower Austria’s corporate income tax rate in connection with the Eco-social Tax Reform Act.

Verbund: weekly performance:

Wienerberger: In the first quarter of 2022, the construction material group Wienerberger increased revenues significantly by 45% to Euro 1,157 mn (Q1 2021: Euro 797 mn). Despite a volatile environment, EBITDA more than doubled to Euro 228 mn in the first quarter of 2022, as compared to Euro 106 mn in Q1 2021. “During the first three months of 2022, we succeeded in seamlessly continuing the very good performance of the previous year and generated the best first-quarter result in the history of our company. This confirms that Wienerberger has taken the right decisions and that our business model, focused on new build, renovation, and infrastructure in 28 markets, has become much more diversified and resilient. Developments in the first quarter were characterized by consistently high demand, especially in the renovation segment, across almost all our markets and product groups. Our plants were therefore working at a high level of capacity in order to meet our customers’ strong demand. We saw particularly high demand for our innovative product and system solutions, which have been continuously added to our product portfolio in recent years”, says Heimo Scheuch, Chairman of the Managing Board of Wienerberger AG.

Wienerberger: weekly performance:

Palfinger: Lifting solutions provider Palfinger acquires 35% minority interest in Guima Palfinger S.A.S. (Guima) from Compagnie Générale Vincent S.A.S., so that Palfinger holds 100% of shares in future. Guima is headquartered in Caussade, France, and is the central production plant for Hooklifts and Skiploaders within Palfinger, having a significant market share in the EMEA region and a high export share to the NAM region.

Palfinger: weekly performance:

RHI Magnesita: Demand of RHI Magnesita refractory products remained robust in the first quarter with strong deliveries for both steel and industrial products. Revenues and profitability were materially higher year on year, reflecting both the continued strong demand and the significant price increase programme implemented during 2021, with Q1 EBITA up c.50% year on year (c.40% in constant currency terms), in line with expectations and at similar levels to that achieved in Q4 2021. Margins were supported by price increases, including additional energy and freight surcharges which were successfully passed on to customers in Q1. Further price increases are currently being implemented to offset ongoing cost increases. Customers continue to value security of supply over price during a period of renewed disruption in global supply chains.

RHI Magnesita: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (12/05/2022)

D&D Research Rendezvous #20: Gunter Deuber sieht Europas Sonderkonjunktur nun at risk - intensiver Blick auf die Aktienmärkte

Bildnachweis

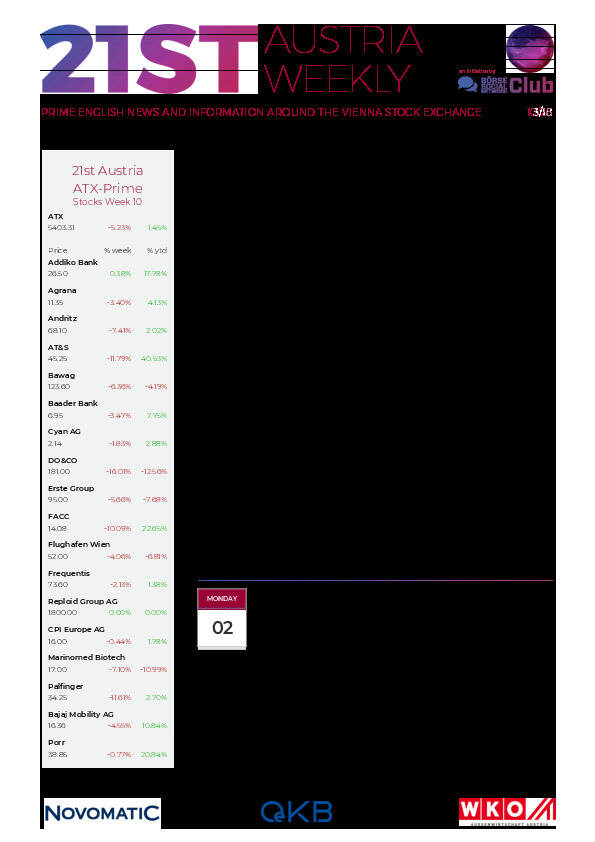

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

Strabag

Strabag SE ist ein europäischer Technologiekonzern für Baudienstleistungen. Das Angebot umfasst sämtliche Bereiche der Bauindustrie und deckt die gesamte Bauwertschöpfungskette ab. Durch das Engagement der knapp 72.000 MitarbeiterInnen erwirtschaftet das Unternehmen jährlich eine Leistung von rund 14 Mrd. Euro (Stand 06/17).

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten