21st Austria weekly - Porr, OMV, S&T, UBM (26/04/2021)

02.05.2021, 4920 Zeichen

Porr: Austria’s second-largest construction company, Porr, with around 20,000 employees, generated production output of Euro 5.2 bn (-6.9%) in its nine countries in 2020. The decrease was mainly caused by the temporary shutdown of construction sites in Austria necessitated by the pandemic and the numerous restrictive measures in relation to COVID-19. In addition to output disruptions and interruptions to operations, every market also saw delays to projects caused by travel restrictions, local lockdowns, and non-performing subcontractors. Overall, Austria and Germany remained the most important Porr markets, together accounting for 71%. Porr ended the year with negative EBT of EUR 51.0m, which reflect the costs incurred as a result of COVID-19 as well as the revaluation of projects. “The past year was a challenge for all of us and from every perspective. Porr’s reaction has been fast and decisive”, says Karl-Heinz Strauss, CEO of Porr. “We established impeccable health and safety infrastructure in order to safeguard construction operations. With the future programme Porr 2025, concrete progress in terms of organisation, costs and efficiency is already visible. We have thereby had a positive start to 2021”. For 2021 the Executive Board assumes production output of approximately Euro 5.3 bn to Euro 5.5 bn and a positive EBT margin of +1.3% to +1.5%. The Executive Board is optimistic that the measures implemented will improve earning power and sustainably return it to pre-pandemic levels.

Porr: weekly performance:

OMV: the Chairman of the Executive Board and CEO of Austrian based oil and gas company OMV, Rainer Seele, has notified the Chairman of the Supervisory Board Mark Garrett that he will not make use of the extension option for one additional year. The current term of office will end automatically on June 30, 2022.

OMV: weekly performance:

S&T: IT company S&T aims to focus on communication and further increase of transperancy. Richard Neuwirth, CFO of S&T AG: "Improving our investor communication, among other things by providing additional information, is an important concern for us. We also want to openly counter any doubts about the accuracy of S&T AG's figures. Therefore, following the question raised in the last earnings call, we mandated KPMG as independent auditor to review S&T's cashflow presentation and the reconciliation of net debt. KPMG has clearly confirmed the correctness and we assume that we have eliminated any last doubts. For 2021, in addition to the further optimization of the associated company structure - another 7 intra-group mergers of subsidiaries are planned in the coming months - the focus is on our ESG step-by-step plan 2023, with which we will also significantly improve our external ESG rating." S&T will be virtually present at the Equityforum Spring Conference and will participate in roadshows organized by Hauck & Aufhäuser and Warburg in May 2021. The earnings call for the Q1 2021 announcement will take place on May 6, 2021. Hannes Niederhauser, CEO of S&T AG: "Every investor should have the same information about S&T as I do. Of course, this is not possible in every area and at every point in time, but through transparent reporting, regular external communication and direct investor contact, we have already achieved a very high level, which we want to improve even further. A lot has happened at S&T in recent years and the transformation of our company continues to progress with the growth in the IoT area. The feedback from our customers and investors is an important guide for us on this path and accompanies us in achieving our medium-term goals within the framework of "Agenda 2023" as well as in implementing our long-term "Vision 2030"."

S&T: weekly performance:

UBM: Real estate developer UBM Development decided to issue a new sustainability-linked bond with a maturity of five years, an interest rate of 3.125% p.a. and a denomination of Euro 500.00. Sustainability-linked bond means that in case both ESG Ratings defined in the terms and conditions are below the ESG Rating threshold set forth in the terms and conditions during the term of the Sustainability-Linked Bond at the determined observation dates, investors will receive an increased redemption amount at the end of the term. The redemption amount to be adapted will increase by 10 basis points on each observation date on which an Adjustment Event exists. The issue volume of the UBM Bond 2021 is to be up to Euro 75 mn, with the possibility of an increase to up to Euro 125 mn, and will depend in particular on the acceptance rate of the exchange offer. Interested investors will be able to subscribe for the Sustainability-Linked Bond during the period which is expected to be from 11 May to 17 May 2021, subject to early closing.

UBM: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (26/04/2021)

kapitalmarkt-stimme.at daily voice: Im Jahr 2007 (bei den letzten ATX-Rekorden) hatte sich noch Politik noch gezeigt. Und 2025?

Bildnachweis

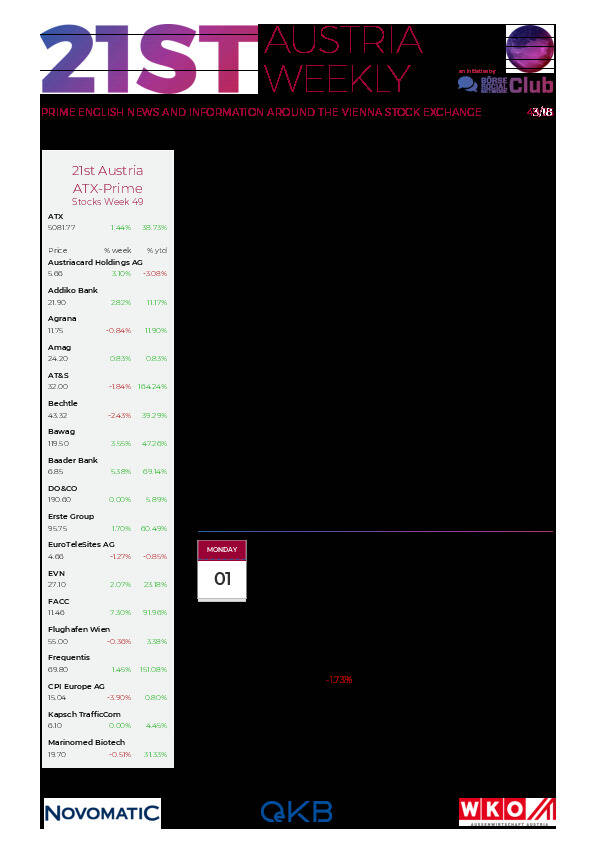

Aktien auf dem Radar:VIG, UBM, FACC, Pierer Mobility, EuroTeleSites AG, RHI Magnesita, Frequentis, AT&S, Porr, Amag, Uniqa, DO&CO, Erste Group, VAS AG, Wolftank-Adisa, BKS Bank Stamm, Oberbank AG Stamm, EVN, Flughafen Wien, CPI Europe AG, Kapsch TrafficCom, Lenzing, Österreichische Post, Rosenbauer, Strabag, Telekom Austria, Continental, Münchener Rück.

Random Partner

Do&Co

Als Österreichisches, börsennotiertes Unternehmen mit den drei Geschäftsbereichen Airline Catering, internationales Event Catering und Restaurants, Lounges & Hotel bieten wir Gourmet Entertainment auf der ganzen Welt. Wir betreiben 32 Locations in 12 Ländern auf 3 Kontinenten, um die höchsten Standards im Produkt- sowie Service-Bereich umsetzen zu können.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten