21st Austria weekly - Vienna Airport, Rosenbauer, Addiko, Andritz (19/05/2020)

24.05.2020, 5083 Zeichen

Vienna Airport (Flughafen Wien): Global travel restrictions and flight cancellations related to COVID-19 strongly affect the traffic and earnings development of the Flughafen Wien Group since March 2020. Passenger volumes increased in the months of January and February 2020. In contrast, traffic development showed a downward development in March 2020 as a result of the global spread of the COVID-19 virus and the related travel and contact restrictions. In the period January to March 2020, the Flughafen Wien Group including the foreign strategic investments in Malta Airport and Kosice Airport reported a drop in the number of passengers handled by 18.6% to a total of 6.0 million. Revenue of the Flughafen Wien Group in Q1/2020 fell by 9.0% from the prior-year period to Euro 161.4 mn. EBITDA declined by 17.7% to Euro 59.0 mn, and EBIT was down 31.2% to Euro 26.4 mn. The net profit for the period after non-controlling interests equalled Euro 16.1 mn in Q1/2020, a drop of 36.6% from the previous year. "The COVID-19 crisis has shaken the global economy and has massively impacted the country's economic landscape and tourism industry as well as Vienna as an aviation hub. This unprecedented crisis without parallel in the history of aviation poses major challenges to Flughafen Wien AG. The company is well equipped, and in any case Vienna Airport will succeed in surviving this crisis, thanks to the initiated cost-saving and liquidity safeguard measures such as short-time work for all employees, cost reductions and postponement of large-scale investments. At present it is hardly possible to predict how long this phase will continue and how the year 2020 as a whole will develop. However, the regular cargo flights with medical supplies, the repatriation and scheduled flights for passengers returning home and last but not least the high demand for our COVID-19 PCR tests at the airport clearly show that air transport is absolutely essential", explains Günther Ofner, Member of the Management Board of Flughafen Wien AG.

Flughafen Wien: weekly performance:

Rosenbauer Group: With revenues of Euro 232.9 mn for the first three months of 2020 (1–3/2019: Euro 175.8 mn), the Rosenbauer Group, world’s leading manufacturer of systems for firefighting and disaster protection, recorded the strongest first quarter in its corporate history. The increase in revenues can be attributed to all sales areas, but particularly to the NISA area, which doubled its business volume. Only sales in the Stationary Fire Protection segment declined due to the temporary cessation of assembly activities caused by the coronavirus. At Euro 282.3 mn, incoming orders were below the enormously high level of the previous year (1–3/2019: Euro 338.1 mn), but still well above the long-term average. EBIT increased to Euro 4.3 mn (1–3/2019: Euro 2.1 mn). Against this background, the Rosenbauer Executive Board expects revenues for the year as a whole to be on a par with 2019, thanks to the full order books. A serious outlook on the annual result is not yet possible due to the continuing uncertainties. As shown from past experience, the firefighting industry follows general economic developments at a delay of several months. Demand for firefighting technology and equipment remains stable, and the sector should be able to hold its own in the current economic downturn.

Rosenbauer: weekly performance:

Addiko: Addiko Group, a listed consumer and small and medium-sized enterprises (SME) specialist banking group in Central and South Eastern Europe (CSEE), reported figures: Pre-provision operating result increased by 31.4% to Euro 13.2 mn compared with 1Q19. Net banking income slightly increased by Euro 0.2 mn, or 0.3%, to Euro 60.6 mn. Net interest income rose by 1.0% to Euro 45.3 mn reflecting growth in the focus segments. Net fee and commission income remained stable at Euro 15.3 mn. Operating expenses decreased by 9.9%, or Euro 4.8 mn, as result of ongoing efficiency measures and the decision of the Management Board to waive potential bonus payments for 2020, in the light of the current environment and the hardship faced by many. The economic impact of the Covid-19 pandemic determined the recognition of incre- mental credit reserve of approximately Euro 13.6 mn leading to total risk costs of Euro -14.4 mn and a reversal of recognition of deferred tax assets in amount of Euro -4.8 mn. These aspects contributed to a material fall in reported result after tax compared with the same period last year, with the Group recording a loss of Euro -8.4 mn.

Addiko Bank: weekly performance:

Andritz: International technology Group Andritz has received an order from Kookil Paper (Zhangjiagang) Limited Corporation to supply a complete 305 bdmt/d stock preparation line including approach flow system, broke handling and fiber recovery to the mill in Zhangjiagang, Jiangsu Province, China. Start-up is scheduled for the first quarter of 2021.

Andritz: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (19/05/2020)

Wiener Börse Party #809: Post-Xmas-Boom bei Aktien von Pierer Mobilty, AT&S, Porr, UBM und Palfinger; Infos zum Jahresendhandel

Bildnachweis

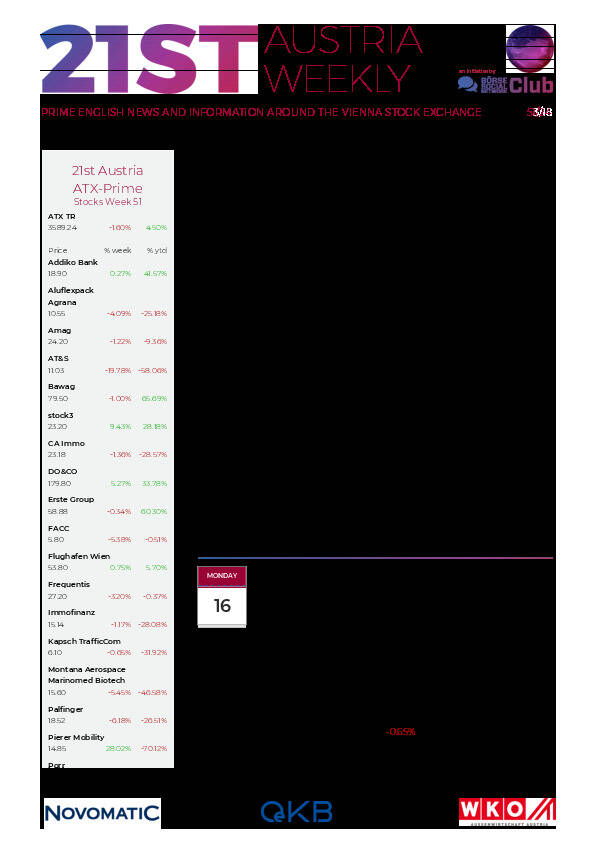

Aktien auf dem Radar:Pierer Mobility, Warimpex, RHI Magnesita, Immofinanz, Addiko Bank, CA Immo, Mayr-Melnhof, Verbund, ATX, ATX Prime, ATX TR, Wienerberger, Kostad, EVN, Lenzing, Österreichische Post, Strabag, Athos Immobilien, AT&S, Cleen Energy, Marinomed Biotech, RWT AG, SBO, UBM, Agrana, Amag, Flughafen Wien, OMV, Palfinger, Telekom Austria, Uniqa.

Random Partner

OeKB

Seit 1946 stärkt die OeKB Gruppe den Standort Österreich mit zahlreichen Services für kleine, mittlere und große Unternehmen sowie die Republik Österreich und hält dabei eine besondere Stellung als zentrale Finanzdienstleisterin.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten