21st Austria weekly - FACC, S Immo (16/01/2020)

19.01.2020, 2483 Zeichen

FACC: The Civil Aviation Administration of China (CAAC) has granted FACC approval as a maintenance organization according to Part-145. This CAAC certification represents a further milestone for the Austrian aerospace group in its latest "Aftermarket Services" business segment. It joins the long list of certifications the company already holds, which include the European EASA, the FAA of the United States and the Canadian TCCA. FACC is thus taking an important step in the expansion of its global customer base and is offering airlines in the growing Chinese market a comprehensive range of maintenance, repair and modification services. FACC is now authorized to perform maintenance work on components and systems operating under Chinese registration. In Austria, there is only one other company besides FACC that has been awarded CAAC Part-145 approval. Futher, FACC adjustes its forecast for the short fiscal year 2019 For the 2019 financial year (short financial year), management currently assumes sales of Euro 668 mn (previously Euro 600 min) and a profit margin (EBIT) in a range from 5.2 % to 5.7 % (previously approximately 6%). The medium-term growth and earnings targets remain unchanged, albeit depending on the market development - significant rate increases on growth projects have been completed. In the coming periods, FACC will focus on a sustainable increase in profitability through an efficiency improvement program of up to Euro 50 mn. There are plans to streamline the supply chain through increased vertical integration - such as the insourcing of the production of strategic component groups - as well as a group-wide optimization of business processes.

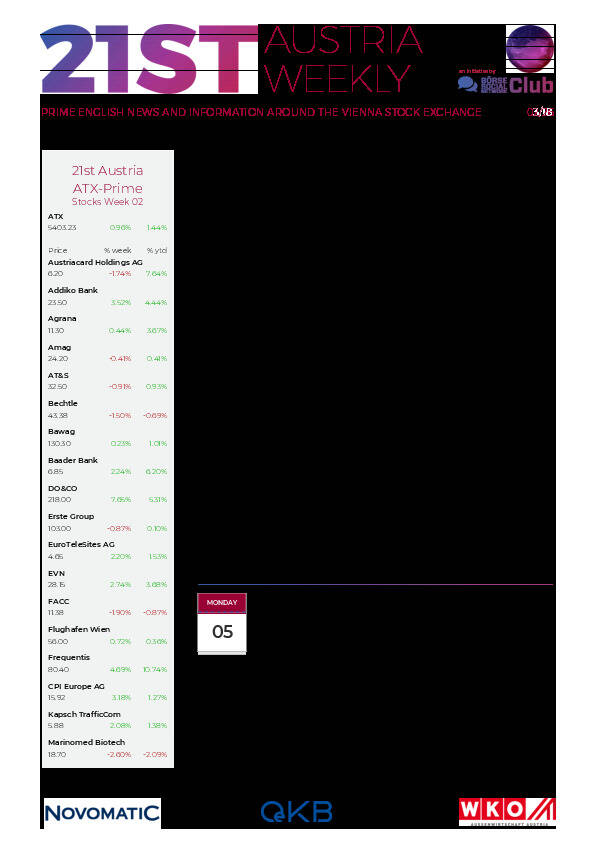

FACC: weekly performance:

S Immo: Austrian based real estate company S Immo AG was able to increase its capital successfully. A total of 6,691,717 new shares will be issued. The issue was multiple times oversubscribed and were placed at Euro 22.25 – thanks to the strong demand – without a discount to closing price as of 15 January 2020. CEO Ernst Vejdovszky commented: “With this capital increase we were able to secure the funding for further profitable growth – through attractive acquisitions and exciting projects. The extraordinary demand shows, that investors appreciate our profitable business model, and confirms once more our strong standing on the capital market.”

S Immo: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (16/01/2020)

BörseGeschichte Podcast: Gerald Grohmann vor 10 Jahren zum ATX-25er

Bildnachweis

Aktien auf dem Radar:Polytec Group, Addiko Bank, UBM, RHI Magnesita, Zumtobel, Agrana, Rosgix, CA Immo, DO&CO, SBO, Gurktaler AG Stamm, Heid AG, OMV, Wolford, Palfinger, Rosenbauer, Oberbank AG Stamm, BTV AG, Flughafen Wien, BKS Bank Stamm, Josef Manner & Comp. AG, Mayr-Melnhof, Athos Immobilien, Marinomed Biotech, Amag, Österreichische Post, Verbund, Wienerberger, Merck KGaA, Continental, Fresenius Medical Care.

Random Partner

Frequentis

Frequentis mit Firmensitz in Wien ist ein internationaler Anbieter von Kommunikations- und Informationssystemen für Kontrollzentralen mit sicherheitskritischen Aufgaben. Solche „Control Center Solutions" entwickelt und vertreibt Frequentis in den Segmenten Air Traffic Management (zivile und militärische Flugsicherung, Luftverteidigung) und Public Safety & Transport (Polizei, Feuerwehr, Rettungsdienste, Schifffahrt, Bahn).

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten