21st Austria weekly - Frequentis, S&T (09/05/2019)

12.05.2019, 2890 Zeichen

Frequentis: Following completion of the bookbuilding phase, the placement price for shares in Frequentis AG was set at Euro 18.00 per share. A total of 3,000,000 bearer shares were placed with investors, comprising 1,200,000 new shares from a capital increase, 1,500,000 shares from the stake held by majority shareholder Johannes Bardach and 300,000 shares in connection with an over-allotment option, which also come from Mr. Bardach's shareholding. B&C Innovation Investments GmbH acquired and subscribed shares both in this advance placement and in the IPO; upon finalisation of the transaction it will hold appr. 10 percent (value corrected, from appr. 10.2 percent to 10 percent) of the shares in Frequentis AG. Retail orders received by the syndicate banks were allocated approximately 20 percent of the total placement volume (including over-allotments). All orders from retail investors received an allocation of approximately 80 percent of the respective order volume. Shares in Frequentis AG are expected to be traded from May 14, 2019 on the regulated market at Frankfurt Stock Exchange (General Standard) and at the Vienna Stock Exchange (prime market) with the ticker symbol FQT and international securities identification number (ISIN) ATFREQUENT09.

S&T: The S&T AG group reported figures for the first quarter of 2019. Revenues increased by almost 11% to Euro 225.1 mn (PY: 203.6 mn), with gross profit rising by some 15% to Euro 85.3 mn (PY: Euro 74.1 mn). That translated into an increase in gross margin to 37.9% (PY: 36.4%). The positive development of business – with this primarily ensuing from the "IoT Solutions Europe” segment. The result after minority interests rose by some 27% to Euro 9.4 mn (PY: Euro 7.4 mn). Earnings per share increased in the first quarter of 2019 to 14 cents – as opposed to the 12 cents earned in the previous year. "S&T’s story of success is now in its ninth year,” states Hannes Niederhauser, S&T AG’s CEO. "The latest chapter in this story was written in the first quarter of 2019, in which we were once more able to record double-digit rises in revenues and earnings, and in which we were able to secure many new clients. The driver of these successes is our unwavering focus on making sustainable investments in cutting edge technologies. We will especially profit from this in the years to come. We are confirming the objectives that we set for 2019: revenues of Euro 1.1 bn and a profitability of more than Euro 100 mn (EBITDA). We are also planning to make further acquisitions, and they will come on top of revenues. We are proceeding upon the implementation of our "Agenda 2023” program. With it, we have firmly set our sights of realizing in 2023 revenues of Euro 2 bn and an EBITDA of at least Euro 200 mn!”.

S&T: weekly performance: -7.04%

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (09/05/2019)

kapitalmarkt-stimme.at daily voice 15/365: zertifikateforum.at als Fundus für Wissensinhalte, heute zb neu "EU & Kapitalmarkt"

Bildnachweis

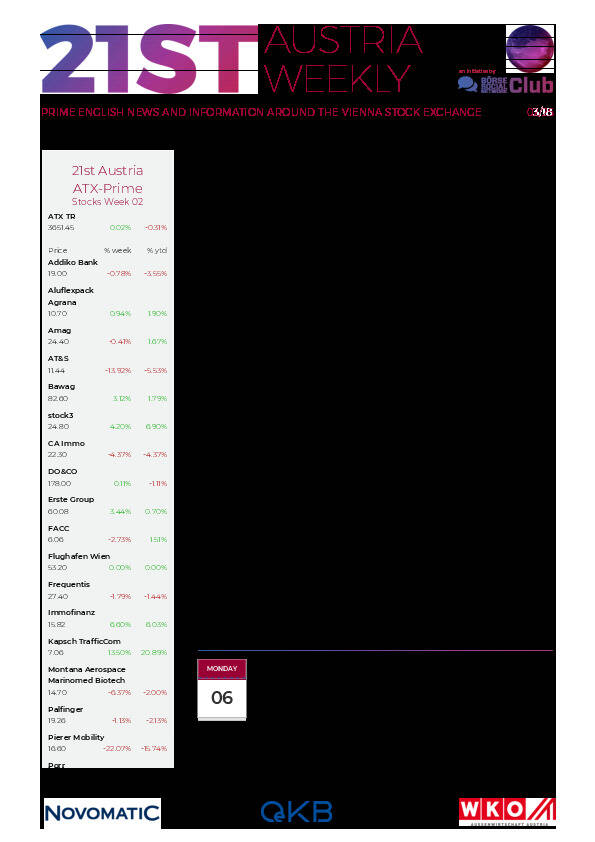

Aktien auf dem Radar:Lenzing, Austriacard Holdings AG, Kapsch TrafficCom, Pierer Mobility, AT&S, Agrana, Erste Group, ATX, ATX Prime, ATX TR, Bawag, voestalpine, Frequentis, Andritz, EVN, Semperit, Polytec Group, Gurktaler AG Stamm, Stadlauer Malzfabrik AG, Wienerberger, Warimpex, UBM, Oberbank AG Stamm, Palfinger, Flughafen Wien, Amag, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG.

Random Partner

stock3

Der Münchner FinTech-Vorreiter wurde im Jahr 2000 gegründet und bietet Privat- und Geschäftskunden IT-Lösungen und redaktionelle Inhalte. Bekannt ist die BörseGo AG für GodmodeTrader und Guidants. Das Portal GodmodeTrader bietet Web-Lösungen für Trading, Technische Analyse und Anlagestrategien. Guidants ist eine Finanzmarktanalyse- und Multi-Brokerage-Plattform.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten