21st Austria weekly - Andritz, Raiffeisen (06/03/2019)

10.03.2019, 2004 Zeichen

Andritz: International technology group Andritz saw solid business development overall in the 2018 business year. At over Euro 6.6 bn, the order intake reached a historic high, thus creating a good order backlog for 2019. Sales amounted to Euro 6.03 bn and were thus 2.4% higher than the level of the previous year. The Group’s service business saw very favorable development and accounted for 36% of total sales (2017: 34%). The development of earnings and profitability adjusted for extraordinary effects remained practically stable compared to the previous year. The EBITA, adjusted for provisions related to capacity restructuring measures in the Hydro and Metals Forming areas, amounted to Euro 415.0 mn and was thus only slightly below the figure for the previous year’s reference period after adjustment for a positive extraordinary effect in the amount of around Euros 25 mn (2017: 420.4 mn); the adjusted EBITA margin was 6.9% compared to 7.1% in 2017. The Executive Board will propose an unchanged dividend – compared to last year – of 1.55 euros per share to the Annual General Meeting. This is equal to an attractive dividend yield of approximately 3.5% based on the current Andritz share price.

Andritz: weekly performance:

Raiffeisen Group: Changes in the Managing Boards of Raiffeisen Centrobank and Kathrein Privatbank: As of 1 May, the Managing Board members of Raiffeisen Centrobank (RCB) Wilhelm Celeda and Valerie Brunner will assume new management positions: Wilhelm Celeda will become CEO of Kathrein Bank, while Valerie Brunner will head the Institutional Clients division in the Markets board area of Raiffeisen Bank International (RBI). RCB's Management Board will in future consist of Heike Arbter, currently Head of Structured Products at RCB, and CEO Harald Kröger, currently Head of Financial Institutions, Country and Portfolio Risk Management at RBI.

RBI: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (06/03/2019)

BörseGeschichte Podcast: Ernst Vejdovszky vor 10 Jahren zum ATX-25er

Bildnachweis

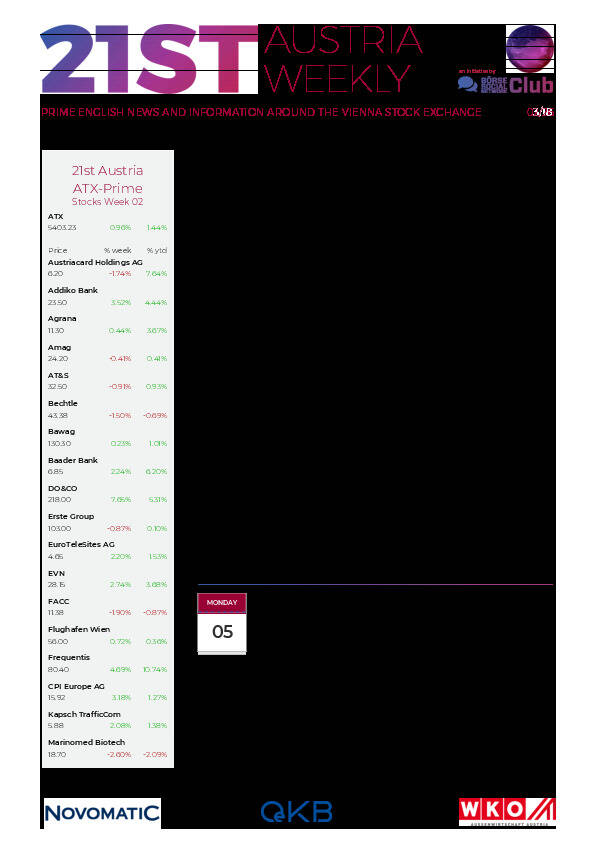

Aktien auf dem Radar:Polytec Group, Addiko Bank, UBM, RHI Magnesita, Zumtobel, Agrana, Rosgix, CA Immo, DO&CO, SBO, Gurktaler AG Stamm, Heid AG, OMV, Wolford, Palfinger, Rosenbauer, Oberbank AG Stamm, BTV AG, Flughafen Wien, BKS Bank Stamm, Josef Manner & Comp. AG, Mayr-Melnhof, Athos Immobilien, Marinomed Biotech, Amag, Österreichische Post, Verbund, Wienerberger, Merck KGaA, Continental, Fresenius Medical Care.

Random Partner

Pierer Mobility AG

Die Pierer Mobility-Gruppe ist Europas führender „Powered Two-Wheeler“-Hersteller (PTW). Mit ihren Motorrad-Marken KTM, Husqvarna Motorcycles und Gasgas zählt sie insbesondere bei den Premium-Motorrädern jeweils zu den europäischen Technologie- und Marktführern.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten