04.03.2019, 8545 Zeichen

- Economic growth slowed to 4.1 % in 2018 and is now more consistent with Romania’s longer-term growth potential.

- Increasing reliance on household consumption makes Romania’s growth structure rather unbalanced.

- Household consumption is fueled by a tight labor market and substantial gains in real wages. Yet, productivity growth cannot keep up with rising labor costs deteriorating Romania’s international cost competitiveness.

- The current account deficit has widened lately and the stock of foreign currency reserves, though remaining stable above 30 bn Euro, is declining relative to imports and short-term external debt.

Romania is among the poorest countries within the European Union. The purchasing power of Romanian households is only 48 % of the Austrian level and 58 % of the EU28 average. Only Bulgaria shows a lower level of household gross disposable income (purchasing power standard, per inhabitant) at 41 % compared to Austria and 49 % compared to the EU28 average (Figure 1). In spite of the comparatively low income level in Romania, it has to be emphasized that relative living standards have more than doubled during the past two decades. In 2000 Romanian gross disposable income was only 20 % of Austrian purchasing power income levels. A similar pattern emerges when looking at relative GDP per capita instead of relative disposable income. Romanian GDP per capita has reached 49 % of Austrian GDP per capita by 2017, starting at 20 % in 2000, and in spite of the Austrian level increasing at an annual average rate of 2.4 %.

To ensure economic convergence to continue, the Romanian economy must grow at faster rates than those EU member countries at higher income levels. With average annual GDP growth at 4.5 % between 2013 and 2018, the Romanian economy seems to prolong the pre-crisis momentum, even though pre-crisis economic growth was somewhat higher (6.0 %, 2000-2008). In 2018 the Romanian economy has stabilized at more sustainable growth rates. After extraordinary growth in 2017, when GDP expanded by 7 %, economic growth has slowed to 4.1 % in 2018 (not seasonally adjusted, nsa). Year-on-year growth was remarkably stable throughout the year ranging between 4.0 % in Q1 and 4.2 % in Q3. Two weeks ago, the National Institute of Statistics (INS) reported its flash estimate for Q4 GDP growth at 4.1 % (nsa, 4.0 % if seasonally adjusted). Growth rates around 4 % are estimated to match Romania’s rate of potential growth by the European Commission (AMECO, 2019 European Semester).

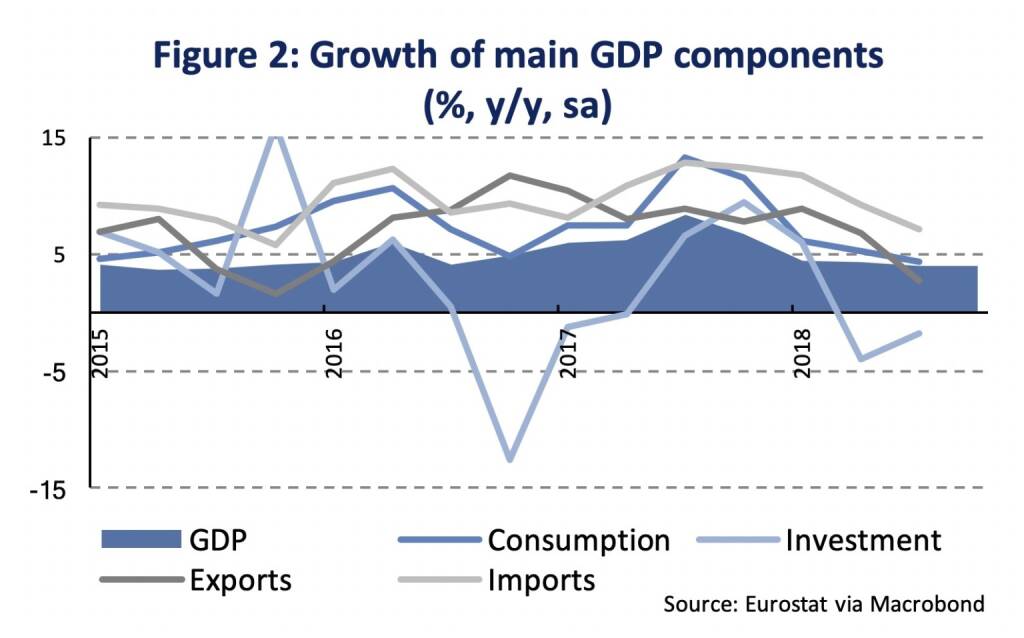

The current expansion in Romania has, so far, mainly been driven by domestic demand. Even though a detailed composition of Q4 GDP growth is not yet available, it is likely that the growth pattern of the first three quarters prolonged into Q4. Figure 2 shows year-on-year growth rates of the main GDP components since Q1 2015. During this period, consumption was the single most important driver of GDP growth, not only fueling the boom in 2017 but also supporting growth in 2018. Final consumption expenditures expanded by 4.6 % (y/y, Q1-Q3, sa) during the first three quarters of the year. Households are the backbone of the Romanian economy, particularly as investment, the second component of domestic demand, has weakened lately. Gross fixed capital formation has stagnated during Q1-Q3 2018 with negative growth rates in Q2/Q3. Moreover, the external sector has subtracted from growth, rather than contributed to it. Growth of imports of goods and services has exceeded export growth during the last six quarters. With external demand weakening and continued growth of household consumption fueling imports, it is unlikely that this pattern will change soon.

The dominance of domestic demand makes Romania’s economic growth rather unbalanced. Household consumption is fueled by a tight labor market with the unemployment rate at a historic low (3.9 %) and a high degree of job vacancies relative to total demand for labor (job vacancy rate at 1.3). Net wages have been growing rapidly in 2018, both in nominal (13 %) and real (8.4 %) terms, further supporting consumption. Compensation of employees increased by 20 % (y/y) in Q3. Yet, as productivity cannot keep up with rising wages unit labor costs per hour worked picked up, averaging 15.4 % (y/y) during the first three quarters of the year. Looking at real effective exchange rates (REER), a measure of international cost competitiveness, shows rising wage costs contributing to a deteriorating competitive position within the European Union (Figure 3). As wage costs have not yet fully transmitted into rising prices, non-ULC denominated REER indices show less pressure on Romania’s competitive position.

Rising wages, outpacing labor productivity growth, deteriorate Romania’s competitiveness. Additionally, with wages rising, also in real terms, the demand for imports grows, thus, putting pressure on Romania’s external position. The current account has, thus, deteriorated reaching a deficit of 5.8 % of GDP (sa) in Q3 2018. Figure 4 shows the structure of Romania’s current account. The negative balance of exported and imported goods (Q3: -7 %) has been the main factor contributing to the current account deficit. Also, the primary income balance (-3.4 %) has a negative effect, while services and the secondary income balance contribute positively.

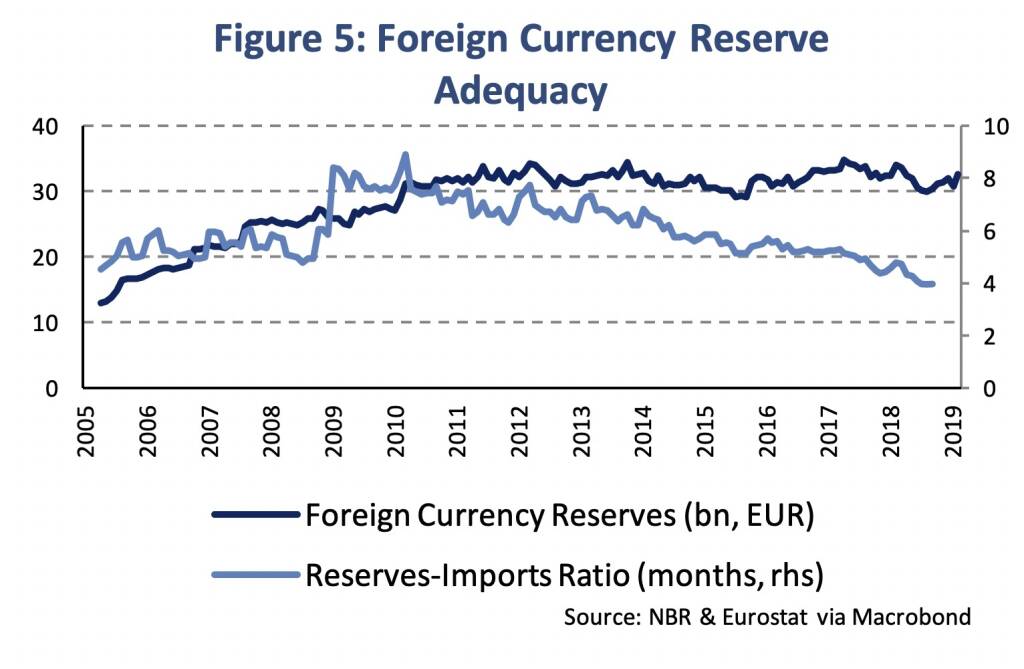

Current account deficits are not necessarily worrisome and may even be necessary in the case of low domestic savings relative to investment. Yet in the case of persistent current account deficits, the economy is vulnerable with respect to foreign financing. An adequate level of foreign exchange reserve is thus required to ensure the sustainability of the current account and prevent an abrupt stop of inflows of foreign funds. The most common metric is the reserve to imports ratio, also known as the import cover, which gives the months of imports foreign exchange reserves can finance. Figure 5 shows the level of foreign currency reserves at the National Bank of Romania (NBR) and the respective reserves-to-imports ratio (right-hand axis). Foreign currency reserves increased continuously from ca. 13 bn Euro in early 2005 to 31 bn Euro in 2010, since when reserves remained broadly stable. In December 2018, the NBR held foreign currency reserves worth 31.9 bn Euro. However, when measured in months of imports, the reserve adequacy has declined since 2010. The reserves to imports ratio has declined from 7.6 months in 2010 to 4 months in Q3 2018. Foreign currency reserves are usually assessed as inadequate if the reserves to import ratio falls below 3 months.

Looking at other metrics, like the foreign exchange reserves as a share of short-term external debt shows a similar picture (Figure 6). Reserve adequacy has decreased during the past years though remains close to or slightly above commonly referred thresholds. In December 2018 foreign exchange reserves relative to short-term external debt was 101.9 %, the IMF’s threshold is at 100 %. Figure 6, further, shows that external debt as a share of GDP has decreased since 2013, yet, the dependence on short-time financing has increased. While the share of short-term external debt in total external debt was 19 % in 2014, it increased to 31 % by 2018. During the same period short-term debt increased to 15 % of GDP, starting from 12 %.

The Romanian economy is reaching a crossroads. So far, economic growth remains solid and is close to its long-term potential. Yet, the structure of economic growth has become increasingly unbalanced depending, to a large extent, on consumption. Household consumption benefits from historically low unemployment and strong wage gains. However, labor productivity is not catching up which deteriorates Romania’s international cost competitiveness and contributes to a widening current account deficit. As long as capital inflows keep up, the current account deficit is not necessarily an immediate problem. The willingness of foreign investors to finance a widening current account deficit might, however, be limited also in light of increasing political uncertainty and concerns about the medium-term institutional quality (fight against corruption). Refocusing on a more balanced growth structure with supporting investment activity to regain strength and wage growth to become more in-line with productivity gains would be necessary to strengthen Romania’s medium-term resilience against adverse shocks.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

BörseGeschichte Podcast: Heiko Thieme vor 10 Jahren zum ATX-25er

Bildnachweis

1.

Relative gross disposable income of households per capita

2.

Growth of main GDP components

3.

Real Effective Exchange Rate

4.

Current Account

5.

Foreign Currency Reserve Adequacy

6.

External debt

7.

Interest Rates

Aktien auf dem Radar:Amag, Polytec Group, DO&CO, Semperit, Rosenbauer, UBM, Rosgix, AT&S, Bawag, Verbund, Uniqa, RBI, voestalpine, Austriacard Holdings AG, Rath AG, SBO, Addiko Bank, Frequentis, BKS Bank Stamm, Oberbank AG Stamm, RHI Magnesita, Mayr-Melnhof, Telekom Austria, Österreichische Post, Siemens Energy, Fresenius Medical Care, E.ON , RWE, SAP, Scout24, BASF.

Random Partner

Palfinger

Palfinger zählt zu den international führenden Herstellern innovativer Hebe-Lösungen, die auf Nutzfahrzeugen und im maritimen Bereich zum Einsatz kommen. Der Konzern verfügt über 5.000 Vertriebs- und Servicestützpunkte in über 130 Ländern in Europa, Nord- und Südamerika sowie Asien.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Börse-Inputs auf Spotify zu u.a. Heiko Thieme, Cyan, Klöckner & Co.

» Wiener Börse Party #1074: ATX etwas schwächer, Cyan wird am Börsentag Wi...

» Österreich-Depots: High zum Wochenende (Depot Kommentar)

» Börsegeschichte 16.1.: Extremes zu Agrana und Austriacard (Börse Geschic...

» Nachlese: Markus Cserna cyan, Barbara Riedl-Wiesinger Bell (audio cd.at)

» In den News: Flughafen Wien, Reploid, Novomatic (Christine Petzwinkler)

» Wiener Börse zu Mittag etwas fester: AustriaCard, Amag, Bawag gesucht

» Börsepeople im Podcast S23/02: Markus Cserna

» ATX-Trends: Polytec, VIG, Uniqa, Bawag, Erste Group, RBI ...

» Wiener Börse Party #1073: ATX wieder auf High, Versicherer top, auch die...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Polytec Group und Andritz vs. Wienerberger und RH...

- Uniqa und Generali Assicuraz. vs. AXA und Talanx ...

- Telecom Italia und Tele Columbus vs. Deutsche Tel...

- ArcelorMittal und Salzgitter vs. voestalpine und ...

- Callaway Golf und Manchester United vs. World Wre...

- Silver Standard Resources und Royal Dutch Shell v...

Featured Partner Video

Börsepeople im Podcast S22/23: Christian Drastil MD

Mein 23. Gast in Season 22 bin zum 6. Mal in der Börsepeople-Serie ich selbst, diesmal mit dem Zusatz MD für Martina Draper, die mich für ihren "Martina und Menschen"-Podcast interviewt hat.

<...

Books josefchladek.com

Fishworm

2025

Void

City Lux

2025

Ludion Publishers

zooreal

2003

Kontrast Verlag

Stahlrohrmöbel (Catalogue 1934)

1934

Selbstverlag

So lebt man heute in Rußland

1957

Blüchert

Elizabeth Alderliesten

Elizabeth Alderliesten Krass Clement

Krass Clement Wassili und Hans Luckhardt

Wassili und Hans Luckhardt Man Ray

Man Ray Jan Holkup

Jan Holkup