21st Austria weekly - Amag, OMV, RBI (31/10/2018)

31.10.2018, 2617 Zeichen

Amag: Aluminium producer Amag reported figures for the first nine month of the financial year. Due to the higher aluminium price, revenue increased from Euro 790.2 mn to Euro 825.0 mn, representing 4.4 percent growth. During the first three quarters of 2018, the company achieved EBITDA of Euro 120.1 mn, compared with Euro 129.0 mn in the equivalent period of the previous year. This reduction chiefly reflected higher raw material costs, as well higher start-up costs in the Rolling Division. Prices for the raw material alumina have appreciated considerably, burdening the results of the Amag Group in 2018. The higher aluminium price, good performance by the Casting Division and the expected volume growth in the Rolling Division will compensate a part of this earnings effect. EBITDA at the lower end of the Euro 150 mn to Euro 170 mn range published in August thereby remains realistic.

Amag: weekly performance:

OMV: Austrian oil and gas company OMV AG said that its third-quarter adjusted net profit fell, as sales were boosted by the downstream business. Reported net profit halved to Euro 221 mn from Euro 439 mn a year earlier, while in adjusted terms it fell 4% to Euro 455 million. Sales rose 21% to Euro 5.61 bn due mainly to higher prices in its downstream business, OMV said. The company also said its adjusted operating result rose 31% to Euro 1.05 bn, driven by the upstream business. OMV said it expects organic capital expenditure of 2018 of about Euro 1.9 bn in 2018. For the year 2018, OMV expects the average Brent oil price to be at USD 74/bbl (previous forecast: USD 70/bbl). In 2018, average European gas spot prices are anticipated to be considerably higher compared to 2017 (previous forecast: higher compared to 2017).

OMV: weekly performance:

RBI: Austrian banking group RBI announced, that the sale of the core banking operations of Raiffeisen Bank Polska S.A., agreed upon in April this year, by way of demerger to Bank BGZ BNP Paribas S.A., a subsidiary of BNP Paribas S.A., was successfully closed upon receipt of regulatory approval. The direct impact of the sale on RBI Group’s consolidated profit is expected to amount to minus Euro 121 million, already recognized in the income statement in the second quarter. The amount may change following the audited closing statement of financial position. Additional equity neutral effects from the disposal after closing amount to around minus Euro 38 million and are primarily due to already realized currency effects.

RBI: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (31/10/2018)

Wiener Börse Party #1072: ATX unverändert, Polytec erweitert Investmentstory, Austriacard zieht weiter, Cyber Security für die Ohren

Bildnachweis

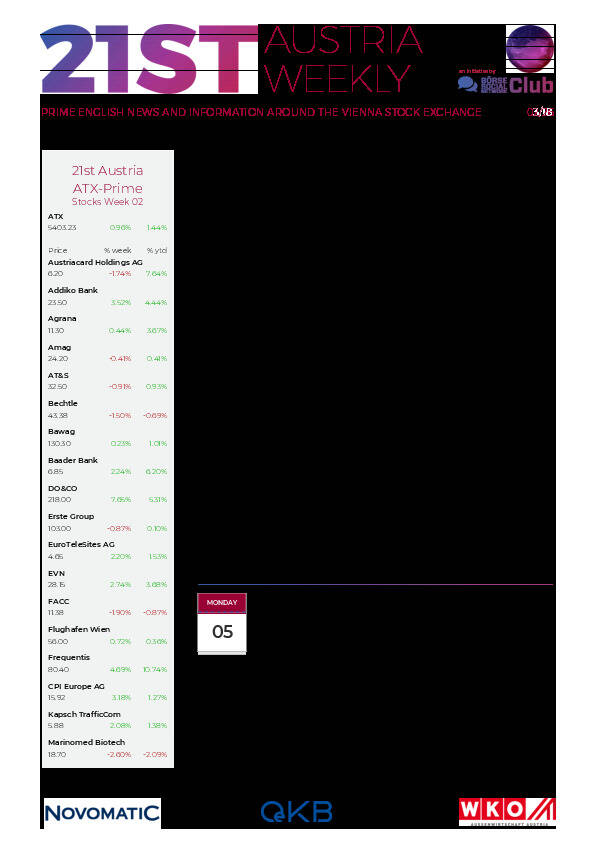

Aktien auf dem Radar:voestalpine, AT&S, Andritz, RHI Magnesita, Austriacard Holdings AG, Pierer Mobility, Rosgix, Addiko Bank, CA Immo, Rosenbauer, FACC, Lenzing, OMV, EVN, Mayr-Melnhof, Wolford, Zumtobel, Gurktaler AG Stamm, Gurktaler AG VZ, Polytec Group, RBI, VIG, Wienerberger, Amag, UBM, Palfinger, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, SW Umwelttechnik.

Random Partner

Semperit

Die börsennotierte Semperit AG Holding ist eine international ausgerichtete Unternehmensgruppe, die mit ihren beiden Divisionen Semperit Industrial Applications und Semperit Engineered Applications Produkte aus Kautschuk entwickelt, produziert und in über 100 Ländern weltweit vertreibt.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten