21st Austria weekly - Erste Group, Telekom Austria, AT&S (05/05/2025)

11.05.2025, 2157 Zeichen

Erste Group: Erste Group enlarges CEE growth footprint by becoming No. 3 bank in Poland, following an agreement with Banco Santander SA to acquire a controlling stake (full consolidation) of 49% in Santander Bank Polska with full cash consideration for PLN 584 per share (approx. EUR 6.8bn). Erste Group also acquires 50% in asset management firm Santander TFI for an approx. EUR 0.2bn cash consideration. Banco Santander SA acquires 60% in Santander Consumer Bank from Santander Bank Polska prior to completion of the acquisition by Erste Group. The agreement includes an indemnity for the majority of Erste Group’s share of potential CHF provisions beyond levels expected in the business plan. Erste Group will fund the acquisition exclusively from internal resources, supported by cancellation of planned EUR 700m share buyback announced on 28 February 2025, application of a temporarily reduced dividend payout ratio of max. 10% to 2025e net profit and various balance sheet optimisation measures.

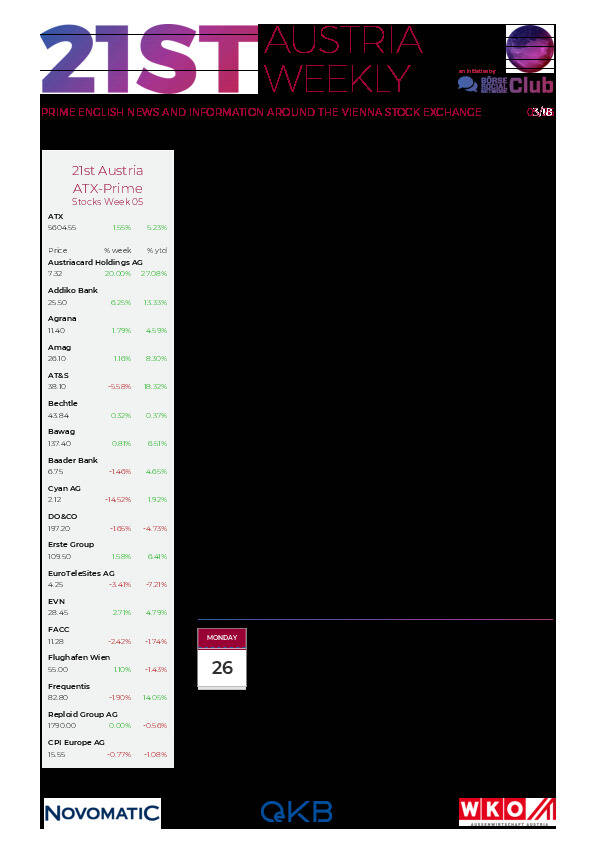

Erste Group: weekly performance:

AT&S: AT&S Austria Technologie & Systemtechnik (Malaysia) Sdn Bhd is ready to start high volume manufacturing at the new campus at Kulim Hi-Tech Park (KHTP) in the state of Kedah. AT&S Malaysia delivers high-end Integrated Circuit (IC) Substrates for AMD’s data center processors and other customers. About RM 5 Billion (1 Billion EUR) have been invested in the plant and administrative building to date for the overall Kulim Campus. In plant 1, AT&S produces cutting-edge substrates for the renowned semiconductor company AMD. The gross floor area is about 255.000 sqm, with about 500 high-tech machines.

AT&S: weekly performance:

Telekom Austria: Fitch Ratings has affirmed Telekom Austria AG's Long-Term Issuer Default Rating (IDR) with a Positive Outlook and its senior unsecured rating at 'A-'. This includes the bond issued by Telekom Finanzmanagement GmbH. Fitch also affirmed Telekom Austria's Short-Term IDR at 'F1', reflecting strong financial flexibility and structure.

Telekom Austria: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (05/05/2025)

BörseGeschichte Podcast: Harald Hagenauer vor 10 Jahren zum ATX-25er

Bildnachweis

Aktien auf dem Radar:Addiko Bank, Austriacard Holdings AG, Strabag, SBO, Rosenbauer, Flughafen Wien, RBI, DO&CO, Lenzing, AT&S, Wolford, Bajaj Mobility AG, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, Reploid Group AG, Amag, CA Immo, EuroTeleSites AG, EVN, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund, Caterpillar, Walt Disney, Deutsche Telekom, Zalando, Siemens Energy, Allianz.

Random Partner

WEB Windenergie AG

Die WEB Windenergie AG projektiert und betreibt Kraftwerke auf Basis Erneuerbarer Energien mit besonderem Schwerpunkt auf Windkraft. Die derzeit 339 Kraftwerke haben eine Gesamtleistung von 781 MW (Stand: 12.08.2025). Neben Österreich ist das Unternehmen in Deutschland, Frankreich, Italien, der Slowakei, Tschechien, Kanada und den USA tätig.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten