21st Austria weekly - Bawag, Frequentis, Kontron (08/12/2023)

10.12.2023, 2516 Zeichen

Bawag: Dexia and Bawag announced that they have signed a sale and purchase agreement allowing Bawag Group to buy Dexia Crédit Local's five non-regulated leasing entities. This transaction will enable BAWAG Group to refinance a roughly EUR 750 million leasing portfolio from Dexia Crédit Local. The leasing assets being refinanced are comprised of approximately 80 contracts to mainly public sector related counterparties. No employees will be transferred as part of this agreement. The transaction is expected to close during the first quarter of 2024. It will have a non-significant impact on Dexia's solvency. Detailed financial impacts will be disclosed when the transaction closes.

Bawag: weekly performance:

Frequentis: Frequentis has been selected by Verizon for Federal Aviation Administration’s Enterprise Network Services (FENS) contract. Under the contract Frequentis will work together with Verizon to transition the U.S. National Airspace System (NAS) to a modern IP network. Under the terms of the contract with Verizon, Frequentis will provide its mission- and safety-critical network products vitalsphere® VCX-IP and NetBroker for versatile, modern, and network-enabled ATM operations in the NAS. The Frequentis products will enable Verizon and the FAA to support voice communications, radar, automation, and other NAS requirements with legacy interfaces while moving to an IP-based network.

Frequentis: weekly performance:

Kontron: Kontron AG, a global leader in IoT Technology, and Bsquare Corporation, an expert in developing and deploying software technologies for the makers and operators of connected devices, today jointly announced the successful completion of the previously commenced tender offer by Kontron Merger Sub., Inc., a wholly owned, indirect subsidiary of Kontron, to acquire all of the outstanding shares of common stock of Bsquare, for $1.90 per Share, net to the seller in cash, without interest and less any applicable withholding taxes. Approximately 14,093,157 Shares were validly tendered in the Offer, representing approximately 70.9% of the total outstanding Shares as of the Expiration Time and an additional 386,424 Shares were tendered pursuant to guaranteed delivery procedures, representing an additional approximately 1.9% of total outstanding Shares at the Expiration Time. Accordingly, all conditions to the Offer have been satisfied.

Kontron: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (08/12/2023)

Wiener Börse Party #1071: ATX korrigiert, Addiko Bank sehr stark und Bajaj Mobility nun auch börslich offiziell, heute Auftakt zum ZFA-20er

Bildnachweis

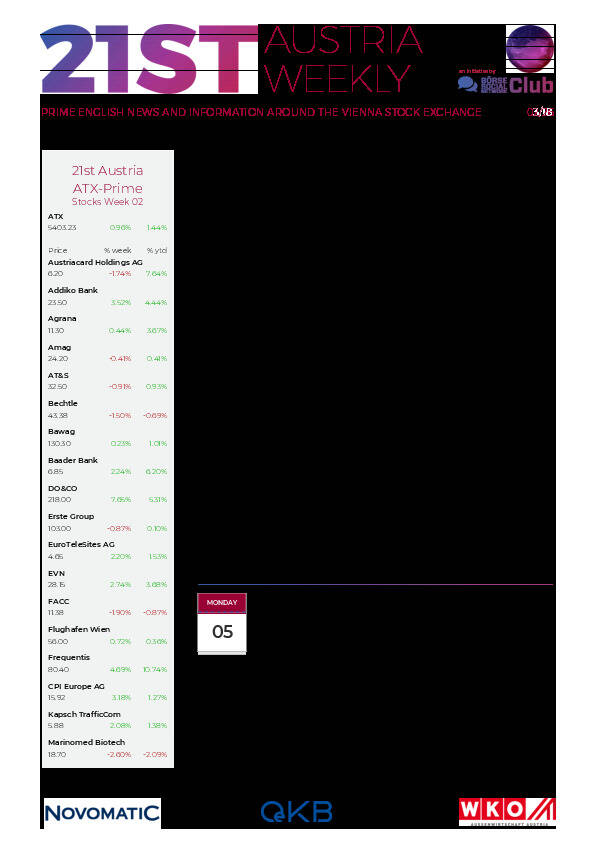

Aktien auf dem Radar:voestalpine, AT&S, Andritz, RHI Magnesita, Austriacard Holdings AG, Pierer Mobility, Rosgix, Addiko Bank, CA Immo, Rosenbauer, FACC, Lenzing, OMV, EVN, Mayr-Melnhof, Wolford, Zumtobel, Gurktaler AG Stamm, Gurktaler AG VZ, Polytec Group, RBI, VIG, Wienerberger, Amag, UBM, Palfinger, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, SW Umwelttechnik.

Random Partner

Bajaj Mobility AG (vormals Pierer Mobility AG)

Die Bajaj Mobility AG (vormals PIERER Mobility AG) ist die Holdinggesellschaft der KTM-Gruppe, einem der führenden Motorradhersteller Europas. Mit ihren Marken KTM, Husqvarna und GASGAS zählt die KTM AG zu den europäischen Premium-Motorradherstellern. Das Produktportfolio umfasst neben Motorrädern mit Verbrennungsmotor auch High-End-Komponenten (WP) sowie Fahrzeuge mit innovativen Elektroantrieben.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten