21st Austria weekly - Warimpex (29/11/2023)

03.12.2023, 3431 Zeichen

Warimpex: Real estate company Warimpex Group succeeded in generating a clearly positive result amidst the still challenging market conditions in the first three quarters of the year. Operating business remained strong, with a 16 per cent increase in revenue and a 5 per cent improvement in EBITDA. After depreciation, amortisation, and property valuations, this resulted in a profit for the period of EUR 3.2 million, down from EUR 13.6 million in the prior-year period. The focus of recent business activities has been on the successful adoption of a new zoning plan for office and commercial property developments in Darmstadt as well as the completion of Mogilska 35 Office in Krakow after the reporting date. “Our long-standing strategy allows us to retain the necessary flexibility and the long-term stability – even amidst challenging market conditions – to excel at getting real estate projects off the ground and successfully implementing them,” commented Warimpex CEO Franz Jurkowitsch. “As a result, we are able to present another clearly positive result for the first three quarters of 2023.”

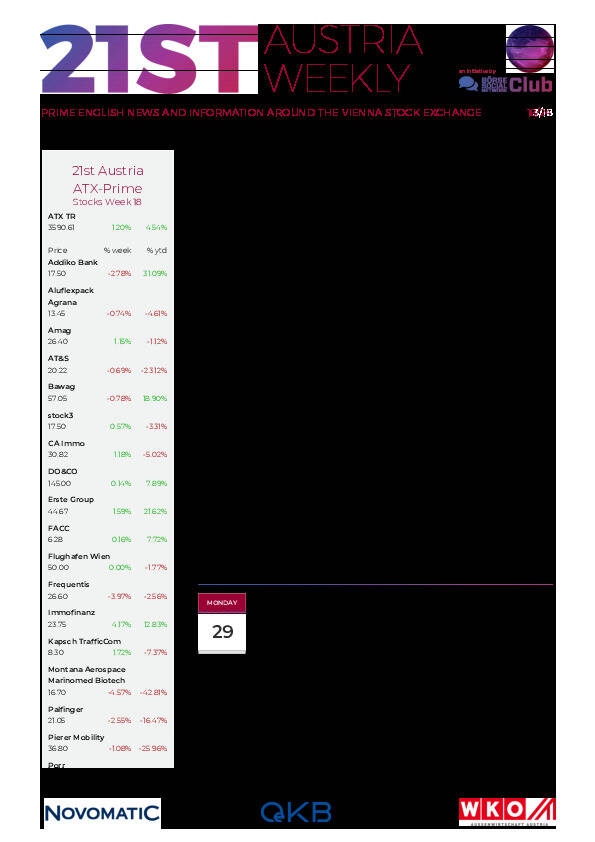

Warimpex: weekly performance:

S Immo: In the first three quarters of 2023, total revenues of real estate company S Immo increased from EUR 185.1m in the same period of the previous year to EUR 242.5m. This increase is mainly due to acquisitions of leased properties in CEE. Rental income amounted to EUR 142.8m (Q3 2022: EUR 112.7m). Revenues from operating costs also increased to EUR 49.9m (Q3 2022: EUR 34.0m) due to acquisitions and current inflation trends. “S IMMO’s operational performance was outstanding, while market-related property revaluations of EUR -88.2m led to a net result for the period of EUR -19.6m,” says Radka Doehring, Member of the Management Board. “We strongly believe in our current strategy with the acquisitions executed in recent quarters already making a decisive contribution to earnings.” As of 30 September 2023, S IMMO Group’s total assets amounted to EUR 3,824.0m (31 December 2022: EUR 3,774.4m).

S Immo: weekly performance:

OMV: Oil, gas and chemical group OMV announced the signing of a long-term sale and purchase agreement (SPA) with US-based company Cheniere Energy, Inc. covering the supply of up to 850,000 tons per annum of liquefied natural gas (LNG) beginning in late 2029. Under the terms of the agreement, Cheniere will provide OMV up to 12 cargoes per year of LNG, which will be received and re-gasified through the Gate LNG Terminal in Rotterdam, the Netherlands, where OMV holds long term regasification capacities. The contractual price for LNG is linked to the TTF index. Berislav Gaso, Executive Vice President for OMV Energy business, said: “OMV has made another significant step in diversifying and safeguarding alternative non-Russian gas supply sources for its customers in the long-term."

OMV: weekly performance:

FACC: As of 1 January 2024, Martina Hamedinger will be responsible for Human Resources at aerospace supplier FACC AG. She will take over from Georg Horacek, who will take his well-deserved retirement at the end of the year, but will continue to support the company as an advisor until March 2024. Born in Upper Austria, she has held various HR positions at FACC since 2011, most recently as Senior HR Business Partner.

FACC: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (29/11/2023)

Wiener Börse Party #651: Addiko mit höflichem neuen Bieter, Polytec stark, dazu Inputs & Ideen von Wolfgang Plasser (Pankl)

Bildnachweis

Aktien auf dem Radar:FACC, Rosenbauer, AT&S, Amag, Flughafen Wien, Frequentis, Addiko Bank, Rosgix, Palfinger, Pierer Mobility, Erste Group, Österreichische Post, Marinomed Biotech, Gurktaler AG Stamm, Polytec Group, S Immo, Agrana, CA Immo, EVN, Immofinanz, Kapsch TrafficCom, OMV, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

VIG

Die Vienna Insurance Group (VIG) ist mit rund 50 Konzerngesellschaften und mehr als 25.000 Mitarbeitern in 30 Ländern aktiv. Bereits seit 1994 notiert die VIG an der Wiener Börse und zählt heute zu den Top-Unternehmen im Segment “prime market“ und weist eine attraktive Dividendenpolitik auf.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten