21st Austria weekly - Mayr-Melnhof, voestalpine, Bawag (25/04/2023)

30.04.2023, 3246 Zeichen

Mayr-Melnhof: Carton board group Mayr-Melnhof (MM) increased consolidated sales by 5.8 % to EUR 1,122.1 million (1Q 2022: EUR 1,060.4 million). This increase results mainly acquisition-related from the division MM Packaging. At EUR 61.6 million, operating profit was EUR 49.5 million below the comparable figure of the previous year (1Q 2022: EUR 111.1 million). This decline is primarily due to market- and rebuild-related downtimes in the MM Board & Paper division and restructuring expenses in the amount of EUR 15.5 million in the Packaging division. Peter Oswald, MM CEO, comments: “As expected, the MM Group recorded a restrained start into the year in the MM Board & Paper division in the 1st quarter of 2023 against the background of a slow destocking of high customer inventory levels as well as inflation-related restrained demand. In addition to the planned capex-related shutdowns in the cartonboard mills Frohnleiten and Neuss, considerable market-related downtimes were necessary. In the division MM Packaging, demand tended to be weaker in the first months, but was overall still resilient. 2023 will be a transition year for MM Board & Paper on the one hand and an integration year for MM Packaging on the other hand. While profitability was above the trend line in 2022, it is expected to be below in 2023.”

Mayr-Melnhof: weekly performance:

voestalpine: voestalpine Tubulars supplies and installs high-strength steel tubes for the Semmering Basis Tunnel in Ausria. In this way, the voestalpine Group – together with the delivery of high-tech rails, high-speed switches and the associated digital signaling technology from voestalpine Railway Systems – is making another significant contribution to the implementation of this important infrastructure project.

voestalpine: weekly performance:

Bawag: Banking group Bawag released its results for the first quarter 2023 and reported a net profit of EUR 140 million for the first quarter of 2023 (+26 percent compared to the previous year). The result before risk costs is EUR 248 million (+21 percent), the cost-income ratio is 32.5 percent (previous year 37 percent). In the first quarter of 2023, core operating income increased by 13.3 percent to EUR 366.3 million. CEO Anas Abuzaakouk, CEO, commented on the financial results: “We generated a significant amount of capital during the quarter, increasing our CET1 ratio by 60 basis points to 14.1% after deducting the first quarter dividend accrual of € 77 million. We are targeting a share buyback of up to 100 basis points CET1% (subject to regulatory approval) and will have more than enough dry powder for both organic and inorganic opportunities if they should materialize. We witnessed heightened market volatility and uncertainty during the quarter stemming from idiosyncratic risks. Time-and-time again we stress the merits of being a prudent and conservative commercial lender focused on risk-adjusted returns across all cycles. We have a resilient business with consistent earnings and capital generation that delivers for our customers, shareholders, employees, and local communities.”

Bawag: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (25/04/2023)

SportWoche-Podcast: Egon Theiner bzw. was lief bei den Olympischen Winterspielen in Livigno, Alter? (Come on, Eileen Gu )

Bildnachweis

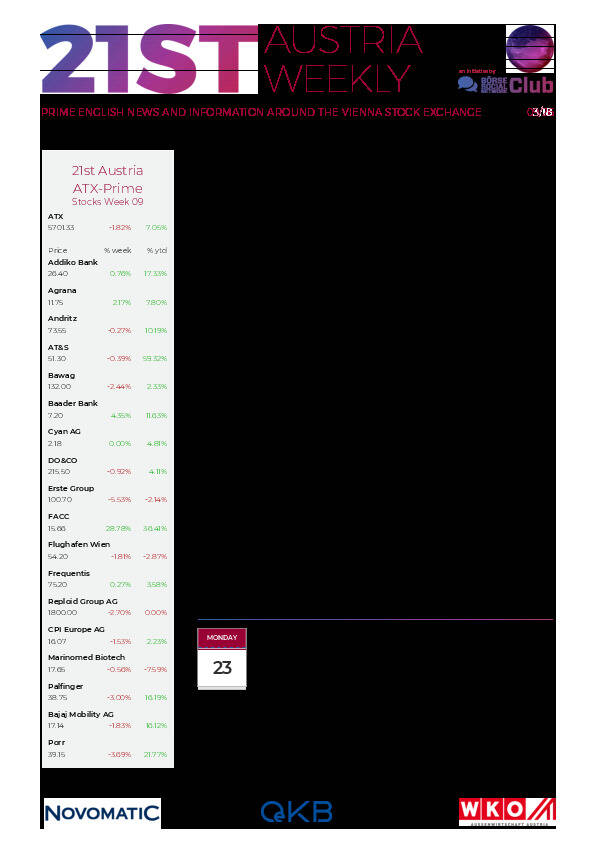

Aktien auf dem Radar:Bawag, FACC, Amag, Austriacard Holdings AG, Polytec Group, Kapsch TrafficCom, Rosgix, Mayr-Melnhof, Strabag, AT&S, Gurktaler AG Stamm, Hutter & Schrantz Stahlbau, Marinomed Biotech, SBO, Wiener Privatbank, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, CA Immo, EuroTeleSites AG, EVN, Flughafen Wien, CPI Europe AG, OMV, Bajaj Mobility AG, Österreichische Post, Telekom Austria, UBM, Verbund, Lenzing, American Express.

Random Partner

gettex

gettex ist ein Börsenplatz der Bayerischen Börse AG für alle Investorentypen – vom Retail-Anleger bis zum Vermögensverwalter und institutionellen Anleger. Auf gettex fallen grundsätzlich weder Maklercourtage noch Börsenentgelt an.

>> Besuchen Sie 53 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten