21st Austria weekly - FACC, Andritz, Palfinger, Uniqa (24/02/2022)

27.02.2022, 3592 Zeichen

FACC: In the 2021 financial year, aerospace supplier FACC AG implemented the operational turnaround as planned while correctly assessing the COVID-19 market environment. With revenue of Euro 497.6 mn and operating EBIT of Euro 4.3 million, the group was able to meet its forecasts for 2021. The positive operating result was negatively impacted by an extraordinary one-time effect related to the ruling of a London arbitration court on past contracts. The strong cash flow generation, as reflected in a high free cash flow of EUR 70.5 million and a substantial reduction of net debt to Eur 177.8 min, deserves special mention in this regard. Key aviation markets continued to stabilize in H2/2021, resulting in an increase in customer call-offs, particularly for short and medium-haul aircraft. The business jet segment also performed well, returning to its pre-pandemic level in Q3/2021. Demand for wide-body and long-haul aircraft remained dampened due to the continued severe restrictions on intercontinental travel. Due to the ongoing constraints on international travel as a result of the COVID-19 pandemic, the market for long-haul aircraft is recovering more slowly than expected.

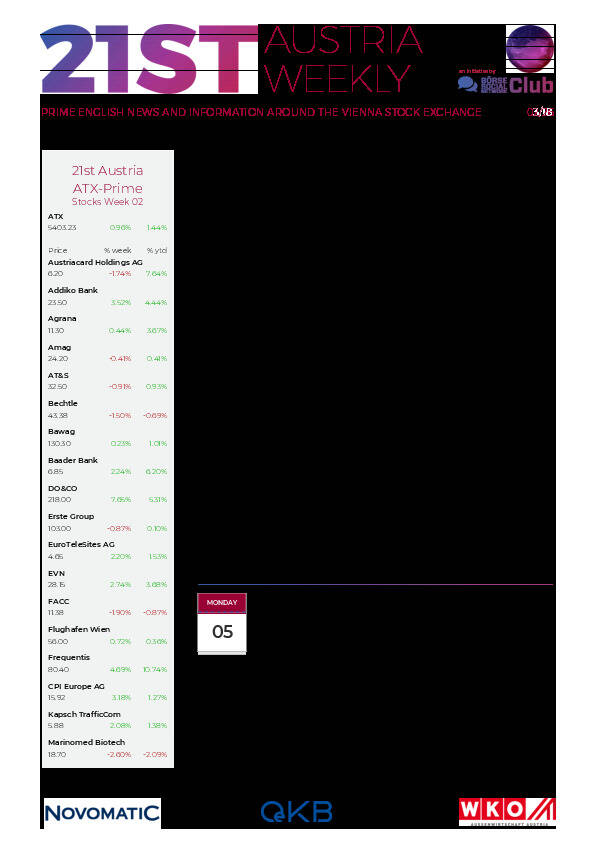

FACC: weekly performance:

Andritz: International technology group Andritz has received another order from the Hitachi Zosen Corporation in Japan to supply a 52.7-MW PowerFluid circulating fluidized bed (CFB) boiler on EPS basis. The boiler will be part of the biomass power plant in Fukuyama, Hiroshima Prefecture, in Japan. Start-up is planned for 2025. The Andritz PowerFluid boiler will be integrated into a biomass-fired power generation facility that will be fueled by wood pellets, wood chips and palm kernel shells.

Andritz: weekly performance:

Palfinger: For the company’s 90th anniversary, lifting solutions provider Palfinger looks back on an outstanding fiscal year 2021. Thanks to strong demand worldwide, the Bergheim/Austria-based group has raised the bar in terms of order intake and order book and achieved a record revenue of Euro 1.84 bn and a record consolidated result of Euro 86.6 mn. With net investments of around Euro 122 mn, Palfinger drives the expansion of forward-looking infrastructure and creates the capacity for further growth.

Palfinger: weekly performance:

Uniqa: Total premiums written by the Uniqa Insurance Group increased by 14.2 per cent to Euro 6,358.0 mn in 2021. Premiums written by Uniqa Austria increased by 2.1 per cent to Euro 3,916.6 mn in the last financial year. At Uniqa International, premiums written rose by 42.1 per cent to Euro 2,423.3 mn following the first-time integration of the AXA companies. The Uniqa Group’s underwriting result was up by 167.2 per cent to Euro 209.2 mn in 2021 on account of an improved cost ratio and the favourable losses figure. Operating earnings increased by 137.4 per cent to Euro 588.0 mn. Accordingly, Uniqa’s earnings before taxes increased sevenfold year-on-year to Euro 382.3 mn. "We had an extremely successful 2021 with outstanding business performance, highly pleasing development in profitability and strong investment results. Despite exceptionally heavy costs of over Euro 300 mn gross caused by major claims and natural disasters, we improved our combined ratio to 93.7% and continued on our growth trajectory, particularly as a result of the successfully completed integration of the former AXA companies in CEE,” said Andreas Brandstetter, CEO Uniqa Insurance Group AG.

Uniqa: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (24/02/2022)

Private Investor Relations Podcast #23: Joachim Brunner zu IR quer über Kontinente, Sprachen, Aufsichten; als Bonus-Content 1x ATXPrime

Bildnachweis

Aktien auf dem Radar:DO&CO, Amag, AT&S, Austriacard Holdings AG, RHI Magnesita, SBO, Rosgix, Rosenbauer, FACC, Lenzing, OMV, Polytec Group, Zumtobel, Porr, Frequentis, Gurktaler AG Stamm, Wienerberger, Wolford, Wolftank-Adisa, Palfinger, Pierer Mobility, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Marinomed Biotech, Österreichische Post, Verbund, GEA Group, Bayer, Fresenius Medical Care, Symrise.

Random Partner

Erste Group

Gegründet 1819 als die „Erste österreichische Spar-Casse“, ging die Erste Group 1997 mit der Strategie, ihr Retailgeschäft in die Wachstumsmärkte Zentral- und Osteuropas (CEE) auszuweiten, an die Wiener Börse. Durch zahlreiche Übernahmen und organisches Wachstum hat sich die Erste Group zu einem der größten Finanzdienstleister im östlichen Teil der EU entwickelt.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten