21st Austria weekly - Vienna Airport, Semperit (17/11/2021)

21.11.2021, 2016 Zeichen

Vienna Airport: Revenue of the Flughafen Wien Group (Vienna Airport) in Q1-3/2021 amounted to Euro 274.5 mn, comprising a minimal decrease of 0.9% and thus essentially corresponding to the prior-year level. EBITDA was up 71.1% year-on-year to Euro 106.6 mn, whereas EBIT rose to Euro 6.9 mn. The net profit for the period before non-controlling interests in Q1-3/2021 was only slightly negative, equalling minus Euro 0.1 mn. The net debt of the company declined to Euro 201.5 mn (31 December 2020: Euro 201.9 mn). The free cash flow in Q1-3/2021 amounted to Euro 21.4 mn (Q1-3/2020: minus Euro 65.3 mn).

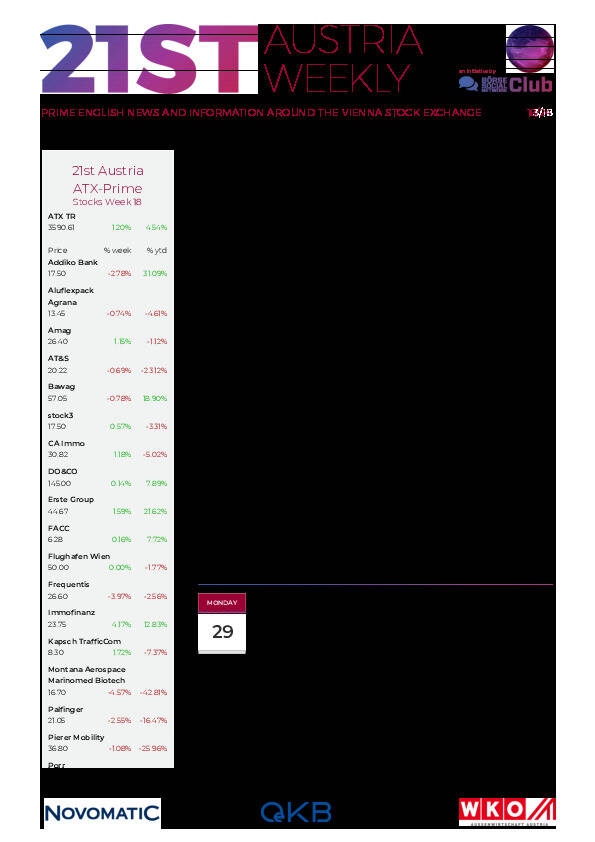

Flughafen Wien: weekly performance:

Semperit: The Semperit Group, producer highly specialised rubber products successfully defied the increasingly challenging market environment with consistently high revenue growth of 40.9% to Euro 962.1 mn compared to the same period of the previous year. The 11.0% increase in revenue to Euro 409.4 mn in the Industrial Sector was fuelled in particular by higher sales volumes in Semperflex and Semperseal, which more than compensated for the decline in sales volumes in the Sempertrans segment. Semperflex posted global market share gains in hydraulic and industrial hoses, while sales volumes at Semperseal increased, due mainly to the economic recovery of the European markets. At Euro 290.0 mn, consolidated EBIT also showed a marked improvement year-on-year (Q1–3 2020: Euro 159.5 mn). Based on current figures, the Executive Board of Semperit AG Holding continues to assume that the Group’s EBITDA for the full year 2021 will be significantly above the EBITDA for 2020. However, in view of the risk factors already communicated in the first quarter, which progressively materialised as the year went on and continue to exist, the Group is expected to fall short of the figure of Euro 395 mn forecast in March by a single-digit percentage.

Semperit: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (17/11/2021)

Börsenradio Live-Blick, Mo. 13.5.24: DAX unchanged, Bayer Charterfolg, Siemens Energy Verdoppler, Bitte an die Börse Frankfurt

Bildnachweis

Aktien auf dem Radar:Österreichische Post, FACC, Austriacard Holdings AG, Flughafen Wien, S Immo, Addiko Bank, Andritz, Rosenbauer, SBO, OMV, ams-Osram, AT&S, Gurktaler AG VZ, Polytec Group, Wiener Privatbank, SW Umwelttechnik, Oberbank AG Stamm, Agrana, Amag, CA Immo, Erste Group, EVN, Immofinanz, Kapsch TrafficCom, Telekom Austria, Uniqa, VIG, Wienerberger, Beiersdorf, Brenntag, Siemens.

Random Partner

Warimpex

Die Warimpex Finanz- und Beteiligungs AG ist eine Immobilienentwicklungs- und Investmentgesellschaft. Im Fokus der Geschäftsaktivitäten stehen der Betrieb und die Errichtung von Hotels in CEE. Darüber hinaus entwickelt Warimpex auch Bürohäuser und andere Immobilien.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten