21st Austria weekly - ams, Bawag, AT&S, Strabag (27/10/2020)

01.11.2020, 4164 Zeichen

ams: ams, a leading worldwide supplier of high performance sensor solutions, announces the successful placement of of Euro 760 mn of guaranteed convertible bonds due 2027. The Bonds will be convertible into new or existing ordinary no par value bearer shares equal to up to 10% of the current issued share capital. Subscription rights of existing shareholders of ams to subscribe to the Bonds have been excluded. The net proceeds of the Bonds will be used for general corporate purposes. Following today's bookbuilding process, the Bonds were determined to bear a coupon of 2.125% per annum and the initial conversion premium of 47.5% above the reference share price of CHF 20.1736, translated into Euro at the prevailing exchange rate, corresponding to an initial conversion price of Euro 27.7209.

AMS: weekly performance:

Bawag: Banking group Bawag released its results for the third quarter 2020, reporting a net profit of Euro 79 mn and a RoTCE of 11.1%. For the first nine months of the year, the group reported net profit of Euro 201 mn and a RoTCE of 9.6%. The underlying operating performance of our business remained solid in the first nine months 2020 with preprovision profits of Euro 495 mn and a cost-income ratio of 43%. The first nine months contain risk costs of Euro 179 mn, of which approximately 50% is related to ECL reserves tied to macroeconomic model assumptions, payment deferrals and general reserves. The macroeconomic assumptions apply the most severe economic scenarios published by the ECB in June for the Euro area of -12.6% GDP decline in 2020, followed by a recovery of +3.3% in 2021. While customer payment deferrals in our Retail & SME business decreased to 1.7% by mid-October (from a high of 6.8% in June) and to 0.6% in our Corporates & Public Sector business (from a high of 1.3% in June), we remain cautious given the uncertain economic development over the coming months. The Bank’s capital position remained strong, with a CET1 ratio of 14.0% post deduction of dividends, up 60 basis points versus end of June. The Bank continues to deduct dividends from its capital base for the full year 2019 (€ 230 million) and first nine months of 2020 (Euro 101 mn) and will wait for further guidance from the regulators regarding capital distributions.

Bawag: weekly performance:

AT&S: The South Korean high-tech company LG Innotek recently of the world’s smallest Bluetooth module for communications and Internet of Things applications. The heart of this module consists of a super thin PCB substrate (250μm), developed and manufactured by the Austria-based market leader for high-end interconnection solutions, AT&S, in its location in Chongqing, China. By applying the sophisticated anylayer technology with stacked micro vias from top to bottom, it was possible to achieve the LG requirements in terms of package density for this Bluetooth module. “One of the main challenges in the project is the handling of such super thin and small substrates during the entire manufacturing process”, Wolfgang Brandl, AT&S Director Sales explains. “It requires the most advanced PCB manufacturing equipment which are installed in our brand new facility in Chongqing, China, Brandl says. Additionally, such modules require new material developments with a super low coefficient of thermal expansion similar to silicon to ensure best in class reliability and manufacturability of the module. “All these shows the excellent technology development of AT&S in terms of miniaturization and modularization and gives us confidence that we are well prepared for future requirements”, Brandl says.

AT&S: weekly performance:

Strabag: The Polish subsidiary of construction group Strabag SE is constructing a new embassy building in the boulevard Unter den Linden in the centre of Berlin. The client for the approximately Euro 60 mn project is the Public Treasury of the Republic of Poland – Embassy of the Republic of Poland in the Federal Republic of Germany. The work is to be completed in the first quarter of 2023.

Strabag: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (27/10/2020)

SportWoche Podcast #137: Tennis-Highlights, Rankings & Rookies 2024 aus österreichischer Sicht feat. Thomas Schweda, ÖTV

Bildnachweis

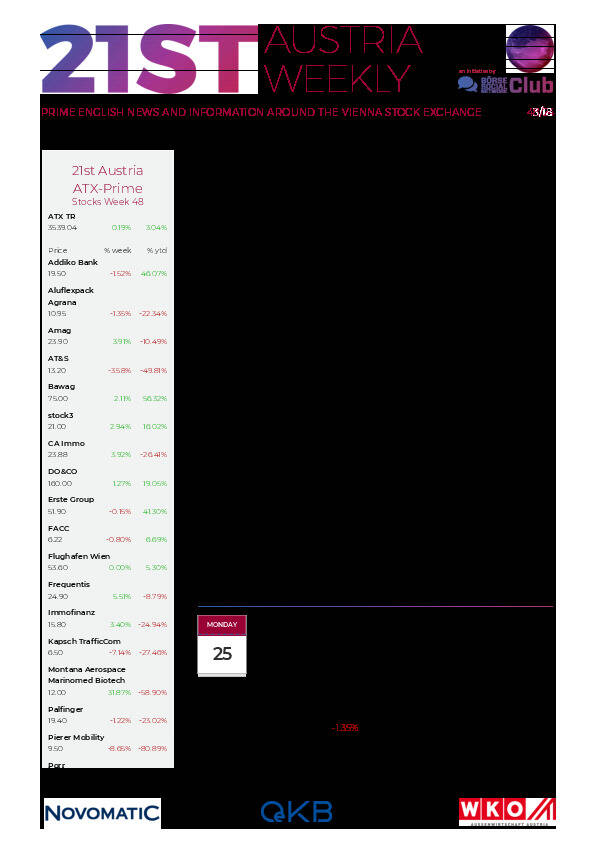

Aktien auf dem Radar:Pierer Mobility, voestalpine, Amag, Immofinanz, CA Immo, EuroTeleSites AG, Frequentis, Rosgix, Warimpex, Wienerberger, Kapsch TrafficCom, AT&S, Frauenthal, Gurktaler AG Stamm, Polytec Group, Wolftank-Adisa, Porr, Oberbank AG Stamm, UBM, Palfinger, Zumtobel, Addiko Bank, Agrana, Erste Group, EVN, Flughafen Wien, OMV, Österreichische Post, S Immo, Telekom Austria, Uniqa.

Random Partner

Erste Group

Gegründet 1819 als die „Erste österreichische Spar-Casse“, ging die Erste Group 1997 mit der Strategie, ihr Retailgeschäft in die Wachstumsmärkte Zentral- und Osteuropas (CEE) auszuweiten, an die Wiener Börse. Durch zahlreiche Übernahmen und organisches Wachstum hat sich die Erste Group zu einem der größten Finanzdienstleister im östlichen Teil der EU entwickelt.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten