21st Austria weekly - Lenzing, Mayr-Melnhof, FACC, Uniqa, Andritz (20/08/2020)

23.08.2020, 6194 Zeichen

Lenzing: Due to the high demand from Chinese brands and retailers for sustainably produced fibers, Lenzing delivers fibers from the two Austrian production sites Lenzing and Heiligenkreuz directly to customers in China by train for the first time. Austria's first complete train with goods exclusively “Made in Austria” will leave the Vienna South Terminal towards China on August 20, 2020 at 11 am. The train, which started at Vienna, brings 41 containers with TencelTM branded Lyocell and Modal fibers with a total value of Euro 1.8 mn directly to customers in China. On its 16-day trip to Shanghai, the train covers a total of 10,460 kilometers and passes seven countries: Austria, the Czech Republic, Poland, Belarus, Russia, Kazakhstan and China. “With this new transport route, we can meet the high demand from our customers for sustainably produced fibers more quickly. Thanks to train transport, the urgently needed fibers arrive at our customers in China twice as quickly as by sea freight,” says Stefan Doboczky, CEO of the Lenzing Group.

Lenzing: weekly performance:

Mayr-Melnhof: The Mayr-Melnhof Group recorded an overall solid operating business performance also in the 2nd quarter of 2020 despite increasingly difficult macroeconomic conditions. The consolidated sales of the Group amounted to Euro 1,266.5 mn and almost reached the previous year's level (1st half of 2019: Euro 1,275.5 mn). The operating profit of Euro 122.5 mn was 1.2 % or Euro 1.5 mn below the previous year's figure (1st half of 2019: Euro 124.0 mn) and includes expenses of Euro -8.6 mn for the termination agreement with the former CEO, which were booked in equal shares in the divisions. Depreciation and amortization increased from Euro 67.6 mn to Euro 89.2 mn, which includes market-related impairments in the non-current assets of both divisions amounting to Euro 20.9 mn. The Group’s operating margin thus remained unchanged at 9.7 % (1st half of 2019: 9.7 %). Profit for the period went down 8.0 % to Euro 84.9 mn (1st half of 2019: Euro 92.3 mn). The company expects the annual result to be below the previous year´s level, as the intensified economic downturn and necessary adjustment measures may have a negative impact on results.

Mayr-Melnhof: weekly performance:

FACC: Aerospace company did not remain untouched by the global impact of the corona crisis. All key financial figures decreased, some of these significantly. The company has drawn up a solid plan for the future in order to meet these challenging times. In the second quarter of 2020, FACC was unable to withstand the global impact of the corona crisis. 80 % of aircraft fleets worldwide were grounded for months, take-overs of new aircraft were postponed, and hardly any new orders were placed. This resulted in necessary adjustments of the production rates of the main customers to the new market conditions and, as a consequence, a reduced sales volume for FACC. Revenue in the first half of 2020 amounted to Euro 292.1 mn (comparative period 2019: Euro 394.9 mn). This decline of 26.0% is mainly attributable to the corona-related slump in the aircraft industry, which had a noticeable impact on business performance, particularly in April, May and June of the reporting period. EBIT before impairment stood at Euro 0.5 million in the first half of the year, with all segments recording lower results. Impairments arising from the COVID-19 pandemic and its impact on the medium-term market environment amounted to Euro - 37.4 mn. As a result, EBIT in the first six months of 2020 decreased to Euro -36.9 mn (comparative period 2019: Euro -5.2 mn). Based on the information currently available on the aircraft programs essential for FACC and the short and medium-term production rates of FACC's key customers, the revenue expectation for the business year 2020 is between Euro 500 and 520 mn. As regards earnings, management is anticipating EBIT in the range of Euro -55 to -65 mn. For the following years, management assumes that the 2021 financial year will remain at the level of 2020. From 2022 onwards, it is expected that renewed growth will occur in line with the market development of the programs essential for FACC and that additionally planned new projects will ensure growth. Robert Machtlinger commented: “We expect to see lower but stable demand up until the end of the financial year. We believe renewed growth is feasible from 2022 onwards. From today's perspective, we will return to our pre-corona levels in four to five years.”

FACC: weekly performance:

Uniqa: Premiums written by insurance group Uniqa, including the savings portion of unit- and index-linked life insurance, rose slightly by 0.5% to Euro 2,827.8 mn in the first half of 2020 (January to June 2019: Euro 2,814.9 mn) in spite of the limited sales opportunities due to Covid-19. Over the first half of the year, earnings before taxes amounted to Euro 55.4 mn in total owing to the negative result in the first quarter (minus Euro 14 mn). The renewed strong contribution by the Group’s international subsidiaries in CEE was very gratifying at Euro 46 mn. Owing to the high level of uncertainty regarding the general economic and financial impact of Covid-19 as the year progresses, and the current development of our Uniqa 3.0 strategy programme, Uniqa anticipates that earnings before taxes for 2020 as a whole may potentially be negative. Uniqa does not intend to distribute a dividend for the 2020 financial year. No Management Board bonuses (STI) will be paid for the 2020 financial year.

Uniqa: weekly performance:

Andritz: International technology group Amdritz has received a contract from the Indian independent power producer JSW Energy (Kutehr) Limited, a 100% subsidiary of JSW Energy Limited, to supply the electro-mechanical equipment for the Kutehr hydroelectric plant (240 MW) located on the River Ravi in the Chamba district of Himachal Pradesh state in India. The plant will generate approximately 955 GWh of electric power, thus supplying clean and renewable energy to around 4.6 million households.

Andritz: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (20/08/2020)

Inside Umbrella powered by wikifolio 03/26: Ritschy setzt mit dem grössten Shift in der Portolio-Zusammensetzung seit der Pandemie auf Öl

Bildnachweis

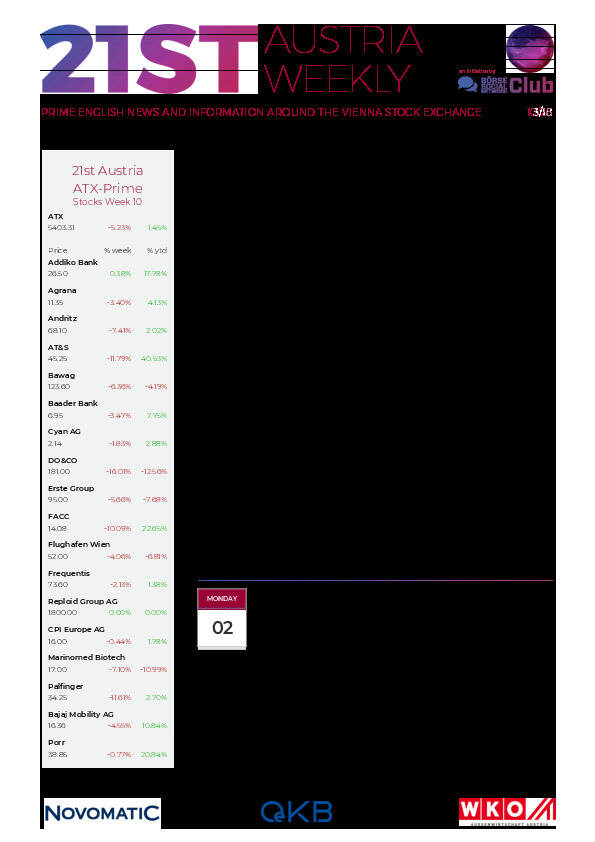

Aktien auf dem Radar:CPI Europe AG, Wienerberger, RHI Magnesita, EuroTeleSites AG, Agrana, Telekom Austria, Austriacard Holdings AG, Gurktaler AG VZ, Hutter & Schrantz Stahlbau, Hutter & Schrantz, Linz Textil Holding, Josef Manner & Comp. AG, Stadlauer Malzfabrik AG, BKS Bank Stamm, Oberbank AG Stamm, Kapsch TrafficCom, DO&CO, FACC, Polytec Group, SBO, Verbund, voestalpine, Amag, CA Immo, Flughafen Wien, Österreichische Post, Rheinmetall, Vonovia SE, Fresenius Medical Care, Bayer, Siemens Healthineers.

Random Partner

Wiener Privatbank

Die Wiener Privatbank ist eine unabhängige, unternehmerisch handelnde Privatbank mit Sitz in Wien.

Als börsennotiertes Unternehmen steht die Bank für Transparenz und verfügt über eine äußerst solide finanzielle Basis. Zu den Kundinnen und Kunden zählen Family Offices, PrivatinvestorInnen, Institutionen sowie Stiftungen im In- und Ausland.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten