21st Austria weekly - Andritz, Erste Group, Uniqa, Do&Co (31/07/2020)

02.08.2020, 4962 Zeichen

Andritz: International technology Group Andritz showed largely solid business development in the second quarter of 2020 in view of the very challenging overall economic environment. In the second quarter of 2020, order intake at Euro 1,183.8 mn was significantly lower than in the previous year’s reference period (-42.2% versus Q2 2019 2,047.1 mn), which included several larger orders in the Pulp & Paper and Metals business areas. The order backlog as of June 30, 2020 amounted to 7,396.6 MEUR and fell by 4.9% compared to the end of 2019 (7,777.6 mn).Sales increased in the second quarter of 2020 by 5.7% compared to the previous year’s reference period (Q2 2019: Euro 1,573.2 mn) to reach 1,662.8 mn. The EBITA amounted to 174.3 mn in the first half of 2020 and was slightly below the level of the previous year’s reference period (-1.8% versus H1 2019 177.5 mn). Net income increased in the second quarter of 2020 to 53.4 mn (Q2 2019: 43.9 mn). In the first half of 2020, the net income (without non-controlling interests) amounted to 84.9 mn (H1 2019: 77.5 mn). CEO Wolfgang Leitner: “All of our business areas have been and still are being affected by the weakness of the global economy – albeit to different extents. We introduced cost-saving measures at the right time and were able to largely cushion the negative effects of the crisis as a result. However, as investment activity will continue to be adversely affected in the markets we serve and the structural weakness in the Hydro and Metals Forming markets will probably persist, we will be taking further steps to adjust our cost structures in the coming months in order to safeguard our ability to compete in the long term.” Based on development of the order intake in the first half of 2020, the existing order backlog of the Group as of the end of June and market expectations for the current, second half of the year, the company expects slightly lower sales from today’s perspective for the 2020 business year compared to 2019 (6,674 mn). Profitability (EBITA margin based on the operating result (EBITA) as reported) including the above mentioned provisions for capacity adjustment measures should remain roughly at the same level as in the previous year (EBITA margin 2019 reported: approx. 5%) in spite of the decline in sales.

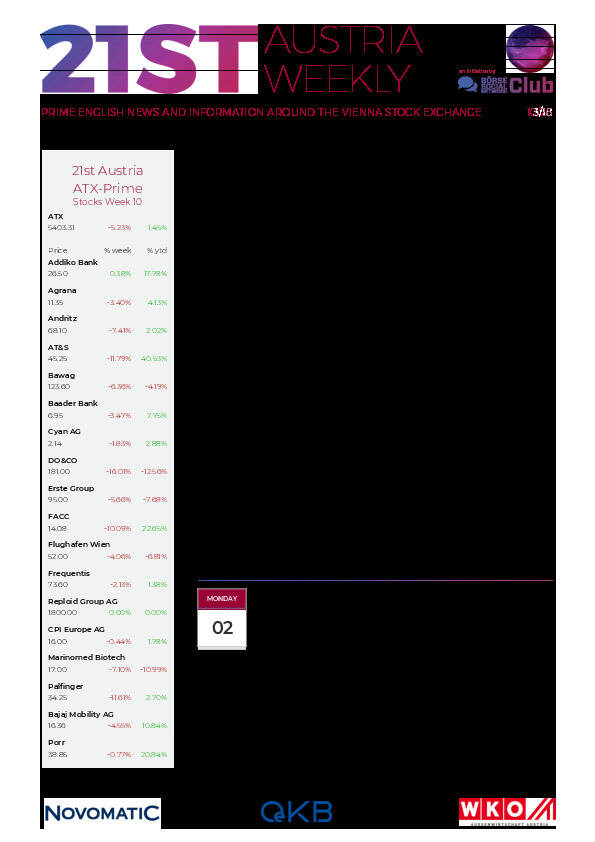

Andritz: weekly performance:

Erste Group Bank: The net result attributable to owners of the parent of Erste Group Bank in first half year amounted to Euro 293.8 mn (-59.9%; Euro 731.9 mn). Net interest income increased – mainly in Austria, but also in Romania – to Euro 2,396.9 mn (+2.9%; Euro 2,329.7 million). Net fee and commission income declined to Euro 956.7 mn (-2.4%; Euro 980.4 mn) as lower income from payment services and lending was offset only partly by higher income from other fee and commission income categories. While net trading resultdeclined significantly to Euro -19.2 mn (Euro 310.1 million). Bernd Spalt, CEO of Erste Group Bank AG: “The development of risk costs was the key driver impacting our profit in the first half of 2020. Although our NPL ratio remained at a historically low level of 2.4 percent, we vigilantly planned ahead to already take into account the expected deterioration in asset quality as far as possible at this point in time. We set aside risk provisions of 675 million euros in the first six months of the year. This led our net profit for the period to decline to 294 million euros. Deposit growth was again strong at more than five percent, reflecting the trust that customers place in us. Loan volumes rose over two percent, boosted by government measures such as loan moratoria and guaranteed loans. The clearest sign of our strong positioning: a record high capitalization, visible in our CET1 ratio of 14.2 percent, far above the regulatory minimum requirement." Erste Groups management expects net profit to decrease significantly in 2020. Erste Group is confident and determined to pay a cash dividend for the financial year 2019 as well as for 2020 once the ban on dividend payments imposed by the supervisory authority is lifted effective 1 January 2021, depending, of course, on the economic and business outlook.

Erste Group: weekly performance:

Uniqa: The EU Commission has not identified any conflicts in relation to competition law and has approved the proposed acquisition of the French AXA Group subsidiaries in Poland, the Czech Republic and Slovakia by insurnace group Uniqa without any conditions. Pending regulatory approvals in the countries concerned, the full completion of the transaction (closing) is currently expected in the fourth quarter of 2020.

Uniqa: weekly performance:

Do&Co: Stock listed Catering company Do&Co announced the renewed appointment of its Management Board Members Attila Dogudan an Gottfried Neumeister for a period of three years.

DO&CO: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (31/07/2020)

Börsepeople im Podcast S23/24: Melanie Steiner

Bildnachweis

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

RWT AG

Die Firma RWT Hornegger & Thor GmbH wurde 1999 von den beiden Geschäftsführern Hannes Hornegger und Reinhard Thor gegründet. Seitdem ist das Unternehmen kontinuierlich, auf einen derzeitigen Stand von ca. 30 Mitarbeitern, gewachsen. Das Unternehmen ist in den Bereichen Werkzeugbau, Formenbau, Prototypenbau und Baugruppenfertigung tätig und stellt des Weiteren moderne Motorkomponenten und Präzisionsteile her.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten