21st Austria weekly - FACC, Eyemaxx, A1 Telekom Austria (15/10/2019)

20.10.2019, 2980 Zeichen

FACC: FACC, a worldwide leading aerospace company in design, development and production of aerospace technologies and advanced aicraft lightweight systems, increased aales revenues in the first six months of 2019 to Euro 373.4 mn (comparable period 2018/19: Euro 367.4 mn). This growth of 1.6% is the result of the increase of product sales to EUR 344.7 million in the first six months of 2019. The revenue drivers in the area of product sales remained unchanged compared to previous periods. All major aircraft programs of our main customers Airbus, Boeing, Bombardier and Embraer along with revenues from their respective engine families continue to support the group's growth. Reported earnings before interest and taxes (EBIT) amounted to Euro 16.0 mn in the first six months of 2019 (comparable period 2018/19: Euro 28.5 mn). The group's earnings situation continued to be adversely affected by start-up costs of projects recently put into series production in the Cabin Interiors segment. For the current fiscal year (short financial year), management expects sales of around EUR 600 million and an EBIT margin of approximately 6%. This expectation corresponds to a continuation of customer requirements for the remainder of the financial year. It should be noted here that the development during the year is not linear due to various seasonal effects.

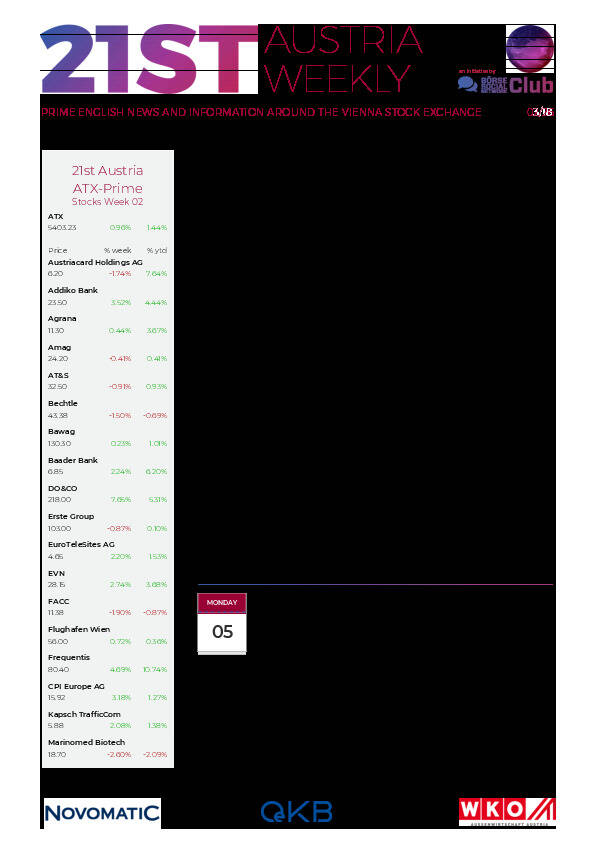

FACC: weekly performance:

Eyemaxx: Eyemaxx Real Estate AG welcomes the increase in the stake of the renowned real estate investor Johann Kowar to now more than 15 percent. The former CEO of the real estate company conwert has already held a shareholding in Eyemaxx for several years and has now increased its stake further. Next to Eyemaxx CEO Michael Müller, who currently holds about 31.50 percent of Eyemaxx, Kowar continues to be the second largest shareholder of the company. Johann Kowar explains the increase in his stake: “Eyemaxx has had a very good development and excellent prospects – with a focus on high-growth real estate segments in Germany and Austria and the combination of project development and the management of portfolio properties. Consequently, I have used the currently favourable level of the share price to further increase my shareholding in the company. My investment in Eyemaxx is a long term one, and I am looking forward towards accompanying the company on its further growth path as a shareholder and benefit from rising share prices.”

A1 Telekom Austria: A1 Telekom Austria AG reported results for the 3rd quarter. Group sales rose by 3.4 % to Euro 1,152.7 mn. Group EBITDA excluding restructuring charges increased by 5.1% to Euro 439.0 mn(reported: +2.2%), driven by higher service revenues. The guidance was confirmed, with approximately 2 % higher revenues and stable CAPEX at Euro 770 mn excl. leases, spectrum investments and acquisitions in 2019.

Telekom Austria: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (15/10/2019)

Wiener Börse Party #1074: ATX etwas schwächer, Cyan wird am Börsentag Wien mit uns präsentieren und Sprachmelodie vs. grosse Trauer

Bildnachweis

Aktien auf dem Radar:Amag, Polytec Group, DO&CO, Semperit, Rosenbauer, UBM, Rosgix, AT&S, Bawag, Verbund, Uniqa, RBI, voestalpine, Austriacard Holdings AG, Rath AG, SBO, Addiko Bank, Frequentis, BKS Bank Stamm, Oberbank AG Stamm, RHI Magnesita, Mayr-Melnhof, Telekom Austria, Österreichische Post.

Random Partner

DADAT Bank

Die DADAT Bank positioniert sich als moderne, zukunftsweisende Direktbank für Giro-Kunden, Sparer, Anleger und Trader. Alle Produkte und Dienstleistungen werden ausschließlich online angeboten. Die Bank mit Sitz in Salzburg beschäftigt rund 30 Mitarbeiter und ist als Marke der Bankhaus Schelhammer & Schattera AG Teil der GRAWE Bankengruppe.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten