ANDRITZ GROUP: Results for the first half of 2016

05.08.2016, 6420 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

6-month report

Graz, August 5, 2016. International technology Group ANDRITZ saw solid business development in the first half of 2016. The key financial figures developed as follows:

Sales in the first half of 2016 amounted to 2,761.2 MEUR, decreasing by 8.1% compared to the previous year's reference period (H1 2015: 3,005.6 MEUR). In the second quarter of 2016, sales decreased by 7.8% compared to the previous year's reference period, reaching 1,475.6 MEUR (Q2 2015: 1,601.3 MEUR).\nIn the first half of 2016, order intake of 2,566.4 MEUR was practically at the same level as during the previous year's reference figure (-0.5% versus H1 2015: 2,580.0 MEUR). In the second quarter of 2016, order intake amounted to 1,319.0 MEUR, thus increasing by 14.8% compared to the previous year's reference period (Q2 2015: 1,149.4 MEUR) and also by 5.7% compared to the previous quarter (Q1 2016: 1,247.4 MEUR). This increase is particularly due to some large orders being booked in the metal forming sector for the automotive and the automotive supplying industry (market segment of Schuler).\nThe order backlog as of June 30, 2016, amounted to 7,076.3 MEUR (-3.4% versus December 31, 2015: 7,324.2 MEUR).\nDespite the decline of sales, the EBITA, at 183.0 MEUR, in the first half of 2016 remained practically at the same level as during the previous year's reference period (-1.0% versus H1 2015: 184.9 MEUR). As a result, profitability (EBITA margin) increased to 6.6% (H1 2015: 6.2%). In the second quarter of 2016, the EBITA amounted to 99.1 MEUR (-11.1% versus Q2 2015: 111.5 MEUR).\nNet income (without non-controlling interests) increased to 120.2 MEUR (H1 2015: 113.9 MEUR) in the first half of 2016.\nWolfgang Leitner, President & CEO of ANDRITZ AG: "In view of the continuing, difficult overall macroeconomic environment, we are satisfied with the results achieved in the first half of the year. From today's perspective, we do not expect any significant changes in the markets we serve for the remaining months of this year."

On the basis of the current financial results, ANDRITZ expects a decline in Group sales for the 2016 business year compared to 2015, but also expects solid development of profitability at the same time.

- End -

Key financial figures of the ANDRITZ GROUP at a glance

(in MEUR) H1 2016 H1 2015 +/- Q2 2016 Q2 2015 +/- 2015 Sales 2,761.2 3,005.6 -8.1% 1,475.6 1,601.3 -7.8% 6,377.2 HYDRO 807.3 866.3 -6.8% 439.4 458.4 -4.1% 1,834.8 PULP & PAPER 980.4 1,043.9 -6.1% 522.8 563.4 -7.2% 2,196.3 METALS 703.6 796.1 -11.6% 370.6 419.0 -11.6% 1,718.1 SEPARATION 269.9 299.3 -9.8% 142.8 160.5 -11.0% 628.0

Order intake 2,566.4 2,580.0 -0.5% 1,319.0 1,149.4 +14.8% 6,017.7 HYDRO 591.4 794.7 -25.6% 339.4 347.7 -2.4% 1,718.7 PULP & PAPER 916.0 908.9 +0.8% 370.4 446.5 -17.0% 2,263.9 METALS 768.7 595.4 +29.1% 469.4 210.5 +123.0% 1,438.6 SEPARATION 290.3 281.0 +3.3% 139.8 144.7 -3.4% 596.5

Order backlog (as of end of period) 7,076.3 7,349.0 -3.7% 7,076.3 7,349.0 -3.7% 7,324.2

EBITDA 229.6 230.9 -0.6% 122.9 134.8 -8.8% 534.7 EBITDA margin (%) 8.3 7.7 - 8.3 8.4 - 8.4

EBITA 183.0 184.9 -1.0% 99.1 111.5 -11.1% 429.0 EBITA margin (%) 6.6 6.2 - 6.7 7.0 - 6.7

Earnings Before Interest and Taxes (EBIT) 163.0 159.6 +2.1% 88.8 98.1 -9.5% 369.1

Financial result 8.9 6.7 +32.8% 8.1 5.6 +44.6% 7.3

Earnings Before Taxes (EBT) 171.8 166.4 +3.2% 96.9 103.8 -6.6% 376.4

Net income (without non- controlling interests) 120.2 113.9 +5.5% 67.7 69.9 -3.1% 267.7

Cash flow from operating activities 200.6 -7.8 +2,671.8% 33.1 -45.0 +173.6% 179.4

Capital expenditure 44.8 36.3 +23.4% 28.3 15.5 +82.6% 101.4

Employees (as of end of period; without apprentices) 25,737 24,992 +3.0% 25,737 24,992 +3.0% 24,508

All figures according to IFRS. Due to the utilization of automatic calculation programs, differences can arise in the addition of rounded totals and percentages. MEUR = million euros. EUR = euros.

Press release for download The press release is available for download at the ANDRITZ web site: www.andritz.com/news.

The ANDRITZ GROUP ANDRITZ is a globally leading supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, the metalworking and steel industries, and for solid/liquid separation in the municipal and industrial sectors. The publicly listed technology Group is headquartered in Graz, Austria, and has a staff of approximately 25,700 employees. ANDRITZ operates over 250 sites worldwide.

Annual and financial reports The annual reports and financial reports of the ANDRITZ GROUP are available as PDF for download at www.andritz.com. Printed copies can be requested by e-mail to investors@andritz.com.

Disclaimer Certain statements contained in this press release constitute "forward-looking statements". These statements, which contain the words "believe", "intend", "expect", and words of a similar meaning, reflect the Executive Board's beliefs and expectations and are subject to risks and uncertainties that may cause actual results to differ materially. As a result, readers are cautioned not to place undue reliance on such forward-looking statements. The company disclaims any obligation to publicly announce the result of any revisions to the forward-looking statements made herein, except where it would be required to do so under applicable law.

end of announcement euro adhoc

company: Andritz AG Stattegger Straße 18 A-8045 Graz phone: +43 (0)316 6902-0 FAX: +43 (0)316 6902-415 mail: welcome@andritz.com WWW: www.andritz.com sector: Machine Manufacturing ISIN: AT0000730007

indexes: WBI, ATX Prime, ATX, ATX five

stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2900/aom

BörseGeschichte Podcast: Gerald Grohmann vor 10 Jahren zum ATX-25er

Andritz

Uhrzeit: 13:02:15

Veränderung zu letztem SK: 0.32%

Letzter SK: 69.40 ( 1.39%)

Bildnachweis

1.

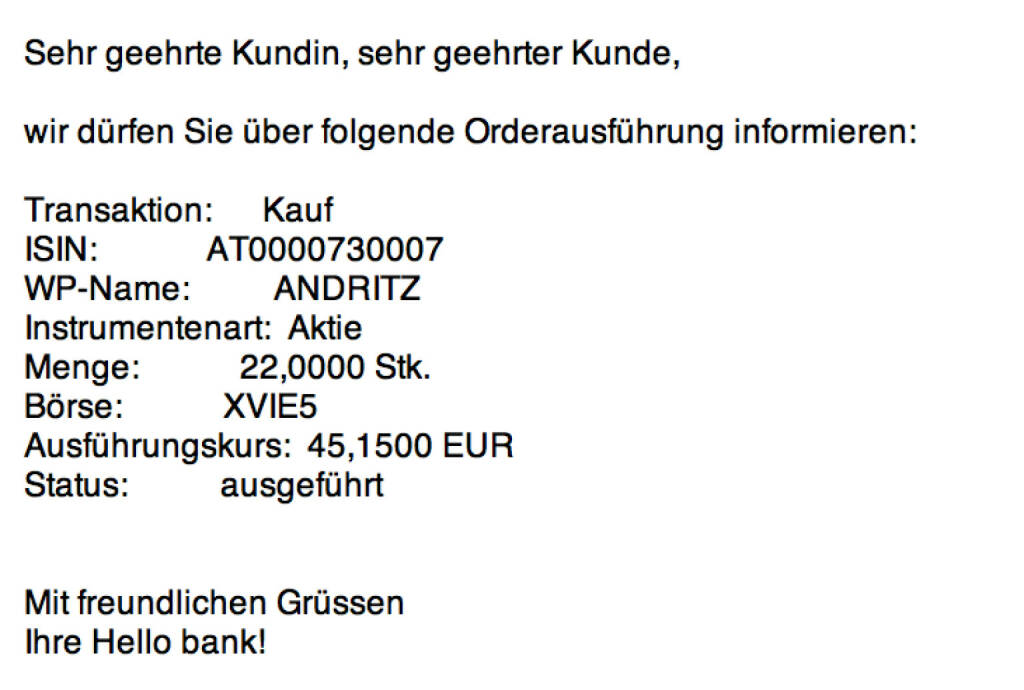

Tag 27: Kauf 22 Andritz zu 45,15

>> Öffnen auf photaq.com

Aktien auf dem Radar:Polytec Group, Addiko Bank, UBM, RHI Magnesita, Zumtobel, Agrana, Rosgix, CA Immo, DO&CO, SBO, Gurktaler AG Stamm, Heid AG, OMV, Wolford, Palfinger, Rosenbauer, Oberbank AG Stamm, BTV AG, Flughafen Wien, BKS Bank Stamm, Josef Manner & Comp. AG, Mayr-Melnhof, Athos Immobilien, Marinomed Biotech, Amag, Österreichische Post, Verbund, Wienerberger, Merck KGaA, Continental, Fresenius Medical Care.

Random Partner

Erste Group

Gegründet 1819 als die „Erste österreichische Spar-Casse“, ging die Erste Group 1997 mit der Strategie, ihr Retailgeschäft in die Wachstumsmärkte Zentral- und Osteuropas (CEE) auszuweiten, an die Wiener Börse. Durch zahlreiche Übernahmen und organisches Wachstum hat sich die Erste Group zu einem der größten Finanzdienstleister im östlichen Teil der EU entwickelt.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Palfinger und Andritz vs. RHI und Wienerberger – ...

- Uniqa und Talanx vs. Swiss Re und Zurich Insuranc...

- Tele Columbus und Telecom Italia vs. AT&T und Ora...

- ArcelorMittal und ThyssenKrupp vs. Salzgitter und...

- Callaway Golf und Puma vs. World Wrestling Entert...

- Silver Standard Resources und Royal Dutch Shell v...

Featured Partner Video

Börsepeople im Podcast S22/18: Christian Mattasits

Christian Mattasits ist CEO der Finanzfuchsgruppe, ausserdem spielt er in seinem eigenen Fussballteam. Einer, der sich der Vermögensberatung, Finanzierung und Finanzplanung für Private und Unterneh...

Books josefchladek.com

Genocídio do Yanomami

2025

Void

Home is where work is

2024

Self published

Fishworm

2025

Void

Remember Who You Once Were

2024

Self published

Adriano Zanni

Adriano Zanni Erich Einhorn

Erich Einhorn Jan Holkup

Jan Holkup Marjolein Martinot

Marjolein Martinot