EANS-Interim Report: Rosenbauer International AG / Zwischenmitteilung

13.05.2015, 5611 Zeichen

- EBIT of EUR 6.0 million (+ 28%) - Intermediate report of the management transmitted by euro adhoc. The issuer is responsible for the content of this announcement.

Rosenbauer starts in 2015 with strong first quarter

- Revenues up 25% to EUR 191.3 million Incoming orders of EUR 133.9 million still at high level without major order

______________________________________________________________________________ |KEY CORPORATE | | | | | |FIGURES_______|_______________|___1-3/2015____|___1-3/2014____|Change %_______| |Revenues______|in_EUR_million_|__________191.3|________152.7*)|___________+25%| |EBIT__________|in EUR million_|____________6.0|____________4.7|___________+28%| |Net profit for| | | | | |the_period____|in_EUR_million_|____________2.2|____________4.1|__________(46%)| |Cash flow from| | | | | |operating | | | | | |activities____|in_EUR_million_|_________(90.9)|_________(75.7)|______________-| |Investments___|in_EUR_million_|____________5.2|____________6.2|__________(16%)| |Earnings per | | | | | |share_________|______EUR______|__________(0.2)|____________0.4|_________(150%)| |Dividend per | | | | | |share_________|______EUR______|_________1.2**)|____________1.2|_____________0%| |Employees as | | | | | |of_March_31___|_______________|__________3,001|__________2,692|___________+11%| |Order_intake__|in_EUR_million_|__________133.9|__________139.1|___________(4%)| |Order backlog | | | | | |as_of_March_31|in_EUR_million_|__________694.6|__________607.5|___________+14%|

*) Due to the change in segment reporting, the previous year's figures were adjusted. **) Proposal to Annual General Meeting

The firefighting industry will face a range of different challenges in 2015 as well. Growth will come predominantly from Asia and the Middle East. A positive trend in demand should get underway on the North American market in 2015, while the industry will recover only slightly - if at all - in Europe.

Revenues The first quarter of 2015 developed positively for the Rosenbauer Group, with consolidated revenues rising by 25% to EUR 191.3 million in the first three months (1-3/2014: EUR 152.7 million). In addition to positive currency effects, this revenue growth was attributable in particular to increased deliveries to Arabic countries in comparison to the same period of the previous year. Sales volumes in North America were also increased by 65%. The previous year's revenues figures were also adjusted due to the review of the criteria for segment reporting.

In the firefighting industry, the first quarter generally tends to be weaker in terms of revenues and earnings. This is because the majority of deliveries are usually made in the second half of the year. However, this seasonality over the course of the year is leveled out by centrally managed procurement that is not based on government budgets.

Result of operations EBIT was 28% higher than last year at EUR 6.0 million (1-3/2014: EUR 4.7 million). Although foreign exchange valuations as of the end of the quarter and expenses for the launch of new products and the Group's appearance at the world's largest trade fair caused other expenses to rise, EBIT improved thanks to higher earnings in North America as a result of optimized production.

However, the intra-year EBIT margin of 3.1% (1-3/2014: 3.1%) still fell short of the long-term target.

Owing to the remeasurement effects of forward transactions, net finance costs deteriorated year-on-year to EUR -3.3 million (1-3/2014: net finance costs of EUR -0.3 million); the gains by the companies in Russia and Spain that are accounted for using the equity method amounted to EUR 0.1 million in the first quarter of the current year (1-3/2014: EUR 0.6 million). Consolidated EBT for the reporting period amounted to EUR 2.9 million (1-3/2014: EUR 5.0 million).

Orders Even though the situation on the fire equipment markets is not the same all over the world and in some cases there are signs of restrained demand due to the leading trade fair in June 2015, a slight recovery in overall demand is nonetheless anticipated for the year as a whole. In the first three months, incoming orders of EUR 133.9 million were generated and were thus on a par with the previous year's level. The order backlog as of March 31, 2015 amounted to EUR 694.6 million, up 14% on the previous year's figure (March 31, 2014: EUR 607.5 million). This gives the Rosenbauer Group a good level of capacity utilization at all its production facilities and good visibility for the months ahead.

Outlook Based on the forecast market development and the solid development in incoming orders, the management is confirming a 10% increase in both revenues and EBIT in the 2015 financial year.

end of announcement euro adhoc

issuer: Rosenbauer International AG Paschingerstrasse 90 A-4060 Leonding phone: +43(0)732 6794 568 FAX: +43(0)732 6794 89 mail: ir@rosenbauer.com WWW: www.rosenbauer.com sector: Machine Manufacturing ISIN: AT0000922554 indexes: WBI, ATX Prime

stockmarkets: free trade: Berlin, Stuttgart, official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2916/aom

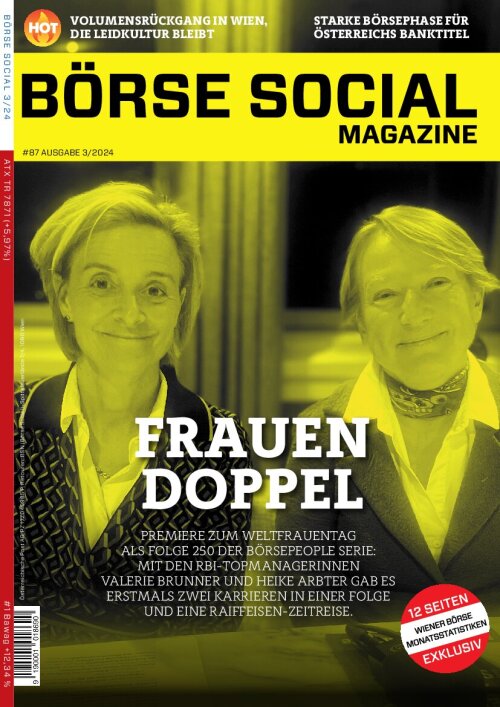

Wiener Börse Party #654: Christoph Boschan den Publikums-ATX Wiener Börse Party (Arbeitstitel) vorgestellt, ATX NTR All-time-High

Rosenbauer

Uhrzeit: 22:59:26

Veränderung zu letztem SK: 0.16%

Letzter SK: 31.20 ( -0.64%)

Bildnachweis

Aktien auf dem Radar:Rosenbauer, Österreichische Post, Palfinger, Flughafen Wien, Austriacard Holdings AG, Lenzing, Rosgix, Telekom Austria, voestalpine, SBO, ATX Prime, ATX TR, OMV, ATX, EVN, CA Immo, Wolford, Wiener Privatbank, Zumtobel, Agrana, Amag, Erste Group, Immofinanz, Kapsch TrafficCom, Uniqa, VIG, Wienerberger, Warimpex.

Random Partner

Immofinanz

Die Immofinanz ist ein börsenotierter gewerblicher Immobilienkonzern, der seine Aktivitäten auf die Segmente Einzelhandel und Büro in sieben Kernmärkten in Europa (Österreich, Deutschland, Tschechien, Slowakei, Ungarn, Rumänien und Polen) fokussiert. Zum Kerngeschäft zählen die Bewirtschaftung und die Entwicklung von Immobilien.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A3BQ27 | |

| AT0000A37NX2 | |

| AT0000A2QS86 |

- CA Immo legt Prioritäten-Liste vor - u.a. Rückfüh...

- Wiener Börse Party 2024 in the Making, 21. Mai (A...

- Wiener Börse Party 2024 in the Making, 20. Mai (z...

- Wiener Börse Party 2024 in the Making, 19. Mai (a...

- BSN Spitout Wiener Börse: Erste Group dreht nach ...

- Wiener Börse: ATX am Dienstag fester, ATX TR und ...

Featured Partner Video

Börsepeople im Podcast S12/15: Anneliese Proissl

Anneliese Proissl ist Finanz- und Wirtschaftsjournalistin, studierte Politikwissenschafterin mit Faible für Rechtsfragen, Skifahren und schnelle Autos.Wir sprechen über das "lokale Berühmtheit ...

Books josefchladek.com

A Way of Seeing

1965

The Viking Press

Driftwood 15 | New York

2023

Self published

Index Naturae

2023

Skinnerboox

Found Diary

2024

Self published

Liebe in Saint Germain des Pres

1956

Rowohlt

Sergio Castañeira

Sergio Castañeira Futures

Futures Andreas Gehrke

Andreas Gehrke