21st Austria weekly - Porr, Uniqa (21/11/2024)

24.11.2024, 1480 Zeichen

Porr: Construction group Porr increased its output by 4.6% to over EUR 5 bn in the first three quarters of 2024. Infrastructure construction is booming, especially on its home markets in CEE. In Poland, the order intake grew by over 50%. Further growth opportunities are currently seen in areas such as data centres and sustainable infrastructure. With a stable order backlog, PORR was able to significantly increase its EBIT by 17.8% to EUR 91.9m. The increase in output also boosted revenue by 3.3% to EUR 4,608.9m. In addition, PORR was able to significantly improve its EBIT by 17.8% to EUR 91.9m thanks to absolute savings in the cost of materials. The EBIT margin in relation to revenue rose to 2.0% (Q1-3/2023: 1.7%).

Porr: weekly performance:

Uniqa: UNIQA Insurance Group's premiums rose by 9.2 per cent to around €6.0 billion and earnings before taxes increased slightly by 1 per cent to €340 million. Premium revenues increased in all business lines: by +11.2 per cent in property and casualty insurance, +10.5 per cent in health insurance and +2.6 per cent in life insurance. The UNIQA Group’s earnings before taxes improved by 1.4 per cent to €340.3 million. Consolidated profit/(loss) (the proportion of net profit/(loss) for the period attributable to the shareholders of UNIQA Insurance Group AG) increased by 6.4 per cent to €264.0 million.

Uniqa: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (21/11/2024)

SportWoche Podcast #136: Formelaustria Young Driver Programme als Investment, Kart-Talente & Sim-Racer zu F4-Racern machen

Bildnachweis

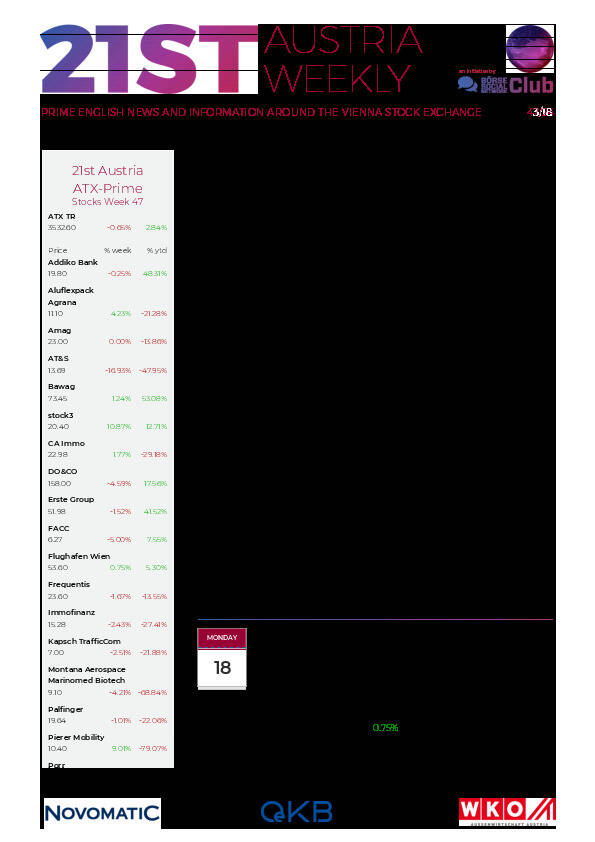

Aktien auf dem Radar:Pierer Mobility, Warimpex, Semperit, Austriacard Holdings AG, Addiko Bank, Immofinanz, Verbund, VIG, CA Immo, Flughafen Wien, Uniqa, AT&S, Cleen Energy, Kostad, Porr, Wolford, Oberbank AG Stamm, UBM, DO&CO, Agrana, Amag, Erste Group, EVN, OMV, Palfinger, Österreichische Post, S Immo, Telekom Austria, Wienerberger, Zalando, SAP.

Random Partner

Erste Asset Management

Die Erste Asset Management versteht sich als internationaler Vermögensverwalter und Asset Manager mit einer starken Position in Zentral- und Osteuropa. Hinter der Erste Asset Management steht die Finanzkraft der Erste Group Bank AG. Den Kunden wird ein breit gefächertes Spektrum an Investmentfonds und Vermögensverwaltungslösungen geboten.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten