voestalpine AG /Report of the Management Board of voestalpine AG(FN 66209 t)in accordance with § 171 (1) in conjunction with § 153 (4) Austrian Joint Stock Corporation Act [AktG]

06.03.2017, 8386 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

Company Information/Management Report concerning 0.8 % capital increase

1. General

In accordance with § 169 Austrian Joint Stock Corporation Act [AktG] the general meeting of shareholders of voestalpine AG held on July 2, 2014 authorized the Management Board to increase the company's capital up to EUR 31,330,923.02 on or before June 30, 2019, if necessary in several tranches, by issuing up to 17,244,916 bearer shares, in exchange for contributions in kind and/or cash contributions under exclusion of the subscription rights of shareholders to be made available to employees, executives and members of the Management Board of the company or a company affiliated with the company, under an employee shareholding scheme. The procedure, the issue price and the terms of the issue as well as any exclusion of the subscription rights are to be determined by the Management Board of voestalpine AG in agreement with the Supervisory Board. The Supervisory Board is authorized to make any changes to the Articles of Association of the Company resulting from the issue of shares from authorized capital (see § 4 (2b) of voestalpine AG's Articles of Association as in force on July 6, 2016). The Management Board has exercised this power so far once with resolution of the Management Board on the utilization of authorized capital as of March 9, 2015 as the company's capital was increased by EUR 4,542,052.14 to EUR 317,851,287.79 by issuing 2,500,000 new bearer shares.

2. Resolution of the Management Board

Pursuant to the authorization referred to in section 1 and subject to the agreement of the Supervisory Board, on March 6, 2017 voestalpine AG's Management Board resolved to increase the company's capital, currently totaling EUR 317,851,287.79, by EUR 2,543,549.20 to EUR 320,394,836.99, by issuing 1,400,00 new bearer shares entitled to participate in dividends as from April 1, 2016 ('Capital Increase'). This constitutes a 0.8% (rounded) increase in the Company's registered capital. The issue price was fixed at EUR 39.93 per share, to be fully paid in and in cash. The issue price for the shares corresponds to the voestalpine AG share's closing average market price over the 5 trading days prior to the resolution of Management Board taken on March 6, 2017. Shares from the capital increase may only be acquired by the shareholder voestalpine Mitarbeiterbeteiligung Privatstiftung, which is subject to the obligation to hold these shares in trust pursuant to the provisions of the voestalpine employee shareholding scheme for the employees and executives of voestalpine AG or any of its affiliated companies participating in the voestalpine employee shareholding scheme. The subscription rights of all other shareholders were excluded.

3. Exclusion of shareholder subscription rights

Employees are the most important assets of any company. Economic success cannot be achieved without their positive contribution. This is the reason why as early as 2000, voestalpine launched an employee shareholding scheme which has subsequently been expanded continually. Currently voestalpine Mitarbeiterbeteiligung Privatstiftung holds 12.92% of voestalpine AG's capital. Additionally, voestalpine Mitarbeiterbeteiligung Privatstiftung manages approximately 1.2% of private shares of present and former employees. Employee participation in voestalpine means that voestalpine AG has a stable shareholder. It also strengthens employee loyalty towards the company, and as shareholders employees profit from its success. Employee participation in voestalpine is essentially based on the utilization of portions of the wage and salary increases resulting from collective bargaining agreements to allocate shares in voestalpine AG. As a first step in this process, shares are acquired by voestalpine Mitarbeiterbeteiligung Privatstiftung, which holds them in its own account. The second stage is the annual allocation of shares to employees, taking account and making use of tax benefits as appropriate. The shares allocated to employees are held by voestalpine Mitarbeiterbeteiligung Privatstiftung for the employees in custodial accounts specifically opened for the employees. Voting rights for all shares held by voestalpine Mitarbeiterbeteiligung Privatstiftung (own account, custodial accounts) are exercised by voestalpine Mitarbeiterbeteiligung Privatstiftung, with employees being entitled to receive dividends from shares already allocated to them. If employees participating in the employee shareholding scheme leave the voestalpine Group for any reason (e.g. retirement), they will receive the shares that have been held for them in trust by voestalpine Mitarbeiterbeteiligung Privatstiftung, to do with as they wish. The number of voestalpine AG shares held by employees under the employee participation scheme is therefore not constant but decreases as a result of staff fluctuations, as happens in every company. The 0.8% (rounded) capital increase is being carried out in order to ensure that the level of employee participation in voestalpine AG capital is at least 10% - a basic objective pursued by both the Management Board and the company's employees. In addition, the capital increase will (initially) increase employee participation in voestalpine AG's capital to 13.61% (plus approximately 1.19% of private shares). This level of participation will decrease in the future, in line with staff fluctuations in the voestalpine Group, unless voestalpine Mitarbeiterbeteiligung Privatstiftung acquires additional voestalpine AG shares under the employee shareholding scheme. Under § 153 (5) of the Austrian Joint Stock Corporation Act [AktG], preferential issue of a company's shares to employees, executives and members of the Management Board of the company or any of its affiliated companies is sufficient grounds for excluding the subscription rights of shareholders. Furthermore, exclusion is justified on factual grounds, since

(i) for the reasons set forth above, both the employee shareholding scheme and measures to safeguard it are in the interests of voestalpine AG, (ii) exclusion of shareholder subscription rights in connection with the capital increase is likely to achieve the aim of safeguarding the voestalpine employee shareholding scheme and there is no other way to do so in a similarly efficient way without excluding these shareholder subscription rights, and (iii)exclusion of shareholder subscription rights is proportionate. As the increase of capital stock is relatively modest, the Management Board is of the opinion that the position of minority shareholders will be scarcely, or only slightly, affected and no new majority positions will arise. Shareholders will not incur any proprietary disadvantages, since the amount at which each share will be issued corresponds to the voestalpine AG share's closing average market price over the 5 trading days prior to the resolution of Management Board taken on March 6, 2017. Using this average market price will ensure that the amount at which each share is issued corresponds to the company's valuation on the stock exchange. In addition there is no substantial danger of diluting the shareholders' membership rights since the company's shares are highly liquid and shareholders are able to acquire the company's shares in the capital markets at any time in volumes that compensate for their diluted voting rights. Overall, exclusion of shareholder subscription rights is justified on factual grounds.

Linz, March 2017

The Management Board

This report of the Management Board is a translation of the German report called "Bericht des Vorstands der voestalpine AG gemäß § 171 Abs 1 iVm § 153 Abs 4 AktG". In any case the German report shall be binding. This translation is for information purposes only.

end of announcement euro adhoc

company: voestalpine AG voestalpine-Straße 1 A-4020 Linz phone: +43 50304/15-9949 FAX: +43 50304/55-5581 mail: IR@voestalpine.com WWW: www.voestalpine.com sector: Metal Goods & Engineering ISIN: AT0000937503 indexes: WBI, ATX Prime, ATX stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2054/aom

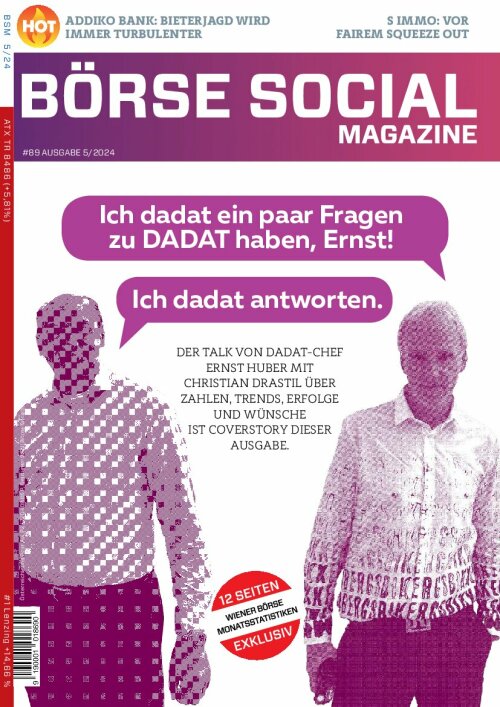

Börsenradio Live-Blick, Mo.15.7.24: DAX leicht schwächer in KW29, BayWa schockt in der 2. Reihe, ATX TR nach Rekord 10 leichter

voestalpine

Uhrzeit: 22:59:42

Veränderung zu letztem SK: 0.08%

Letzter SK: 25.02 ( -0.40%)

Bildnachweis

Aktien auf dem Radar:Amag, Zumtobel, Agrana, Addiko Bank, Flughafen Wien, Warimpex, Rosgix, Wienerberger, Palfinger, Austriacard Holdings AG, Josef Manner & Comp. AG, Pierer Mobility, Wiener Privatbank, Oberbank AG Stamm, Athos Immobilien, Marinomed Biotech, CA Immo, Erste Group, EVN, Immofinanz, Österreichische Post, S Immo, Telekom Austria, Uniqa, VIG.

Random Partner

Matejka & Partner

Die Matejka & Partner Asset Management GmbH ist eine auf Vermögensverwaltung konzentrierte Wertpapierfirma. Im Vordergrund der Dienstleistungen stehen maßgeschneiderte Konzepte und individuelle Lösungen. Für die Gesellschaft ist es geübte Praxis, neue Herausforderungen des Marktes frühzeitig zu erkennen und entsprechende Strategien zu entwickeln.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2SKM2 | |

| AT0000A3B0N3 | |

| AT0000A2UVV6 |

- Wiener Börse Nebenwerte-Blick: Manner gibt mehr a...

- Wiener Börse: ATX am Montag schwächer

- Wie Josef Manner & Comp. AG, Pierer Mobility, Aus...

- Wie Verbund, SBO, Andritz, Wienerberger, VIG und ...

- Dow Jones-Mover: Caterpillar, Travelers Companies...

- Analysten ad Flughafen Wien: "Sehen Kurspotenzial...

Featured Partner Video

SportWoche Podcast #114: Joel Schwärzler, Main Character im Fanboy-Buch, über Rafael Nadal, Nick Kyrgios und Sebastian Sorger

Joel Schwärzler ist der Grund, warum ich mich wieder viel mehr für Tennis, meinen Sport, interessiere. In meinem Fanboy-Buch gibt es zwei Tennis-Wetten: Jannik Sinner Nr. 1 (bereits erledigt) und d...

Books josefchladek.com

Here, In Absence

2024

IIKKI

27000 Kilometer im Auto durch die USA

1953

Conzett & Huber

India

2019

teNeues Verlag GmbH

Kurama

Kurama Shōji Ueda

Shōji Ueda Jerker Andersson

Jerker Andersson Gregor Radonjič

Gregor Radonjič Eron Rauch

Eron Rauch Eron Rauch

Eron Rauch Futures

Futures