Vienna Insurance Group with preliminary first half-year profit before taxes 2016 of about EUR 200mn and changed valuation approach and consolidation of non-profit housing societies

03.08.2016, 4009 Zeichen

Disclosed inside information pursuant to article 17 Market Abuse Regulation (MAR) transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is solely responsible for the content of this announcement.

Financial Figures/Balance Sheet 03.08.2016

VIG announces preliminary consolidated profit before taxes of about EUR 200mn for the first half-year 2016. Thus, the result is in line with the given earnings outlook for the financial year 2016. Consolidated shareholders' equity will be adjusted due to the change in the valuation method from the currently at-equity consolidated non-profit housing societies.

This amendment is based on the official notification of the Austrian Financial Market Authority (FMA) under Section 3 (1) 3 of the Accounting Control Act dated 2 August 2016. According to this notification, the method of inclusion of the non-profit housing societies is seen as non IFRS-compliant. The examination included the consolidated financial statements for FY 2014 and FY 2015 as well as the half-year reports as of 30 June 2014 and 30 June 2015. According to this notification, the regulatory restrictions applied for non-profit housing societies in terms of profit distribution and liquidation have not adequately been considered neither for calculation of fair value nor for including the profit share of these entities. According to the FMA notification, this implies after a first and preliminary review a reduction of the profit before taxes by about EUR 45mn and of shareholders' equity (own shares and non-controlling interests) by about EUR 550 - 580mn for the financial year 2015.

In the meantime, the Supervisory Boards agreed upon Vienna Insurance Groups' regaining of controlling influence over the non-profit housing societies. Most likely from August 2016, participations in the nine companies will be fully consolidated and relevant assets, amongst others real estate with a book value of roughly EUR 3.5bn, will be included in the balance sheet. Based on preliminary half-year 2016 data, the share of non-profit housing societies in shareholders' equity increases by about EUR 1bn when fully consolidated. Going forward, this increase will be separately shown under 'non-controlling interests' in the consolidated balance sheet.

These accounting changes have no impact on the Solvency II ratio. So far, the own funds calculation for regulatory solvency reason out of non-profit housing societies was already based on future dividend payouts, in which the specific distribution restrictions for non-profit housing societies are fully taken into account.

Moreover, management confirms the earnings outlook for 2016. The Group aims to at least double its profit before taxes up to EUR 400mn in 2016.

The following securities of VIG are admitted for trading on a regulated market:

Issue title ISIN Trading segment

Aktie AT0000908504 Vienna and Prague Stock Exchange, Official Market VIG nachrang. Anl. 15 AT0000A1D5E1 Luxembourg Stock Exchange, Second Regulated Market

VIG nachrang. Schuldv.13-43 AT0000A12GN0 Vienna Stock Exchange, Second Regulated Market Wr.Staedt. Hybridkap-Anl. 08 AT0000A09SA8 Vienna Stock Exchange, Second

Regulated Market Wr.Staedt.Vers. EK-Anl. 05-22 AT0000342696 Vienna Stock Exchange, Official

Market Wr.Staedt.Vers. var EK-Anl. 05 AT0000342704 Vienna Stock Exchange, Official Market

end of announcement euro adhoc

issuer: Vienna Insurance Group Wiener Versicherung Gruppe

Schottenring 30 A-1010 Wien phone: +43(0)50 390-21919 FAX: +43(0)50 390 99-23303 mail: investor.relations@vig.com WWW: www.vig.com sector: Insurance ISIN: AT0000908504 indexes: WBI, ATX Prime, ATX

stockmarkets: official market: Wien, stock market: Prague Stock Exchange language: English

Digital press kit: http://www.ots.at/pressemappe/7674/aom

BSN PodcastsChristian Drastil: Wiener Börse Plausch

Wiener Börse Party #701: ATX schwach, Tipp vom Addiko-Vorstand, Amag / Verbund matchen Erwartungen, Aufruf zu mehr Mut

VIGAkt. Indikation: 29.70 / 29.80

Uhrzeit: 22:59:29

Veränderung zu letztem SK: -0.34%

Letzter SK: 29.85 ( -0.33%)

Bildnachweis

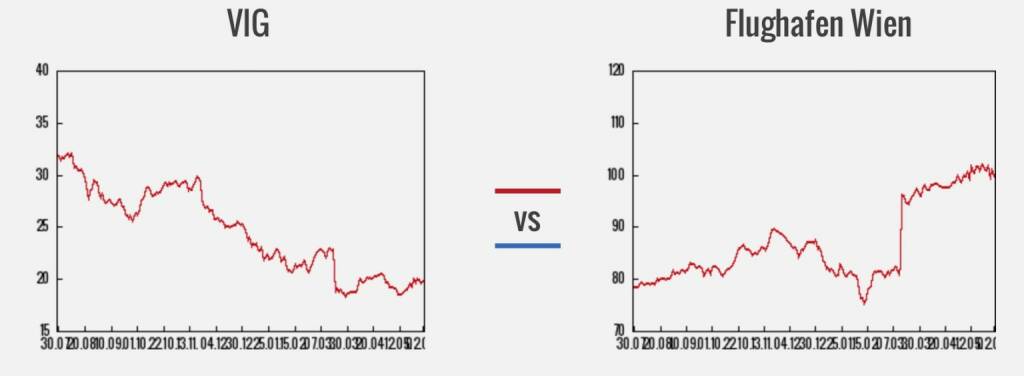

1. VIG vs. Flughafen >> Öffnen auf photaq.com

Aktien auf dem Radar:Warimpex, CA Immo, Wienerberger, Austriacard Holdings AG, Rosenbauer, UBM, EVN, Wiener Privatbank, VIG, Marinomed Biotech, Frequentis, ATX, ATX Prime, ATX TR, FACC, Agrana, AT&S, Mayr-Melnhof, Uniqa, Semperit, ams-Osram, Heid AG, Lenzing, Porr, S Immo, Addiko Bank, Oberbank AG Stamm, Amag, Erste Group, Flughafen Wien, Immofinanz.

Random Partner

Do&Co

Als Österreichisches, börsennotiertes Unternehmen mit den drei Geschäftsbereichen Airline Catering, internationales Event Catering und Restaurants, Lounges & Hotel bieten wir Gourmet Entertainment auf der ganzen Welt. Wir betreiben 32 Locations in 12 Ländern auf 3 Kontinenten, um die höchsten Standards im Produkt- sowie Service-Bereich umsetzen zu können.>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab. Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnierenRunplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A3C5D2 | |

| AT0000A3D5K6 | |

| AT0000A2VYE4 |

- Wie Heid AG, ams-Osram, Frequentis, Polytec Group...

- Wie AT&S, Lenzing, Verbund, Andritz, Erste Group ...

- Dow Jones-Mover: Honeywell Intern., Dow Inc., IBM...

- Österreich-Depots: Runter (Depot Kommentar)

- Analysten zu Verbund: "Abschreibung für GasConnec...

- Börsegeschichte 25.7.: Warimpex (Börse Geschichte...

Featured Partner Video

Wiener Börse Party #696: Auszeichungen für dad.at, Liane Hirner und die Bawag, Senat der Wirtschaft rügt die Grüne Planwirtschaft

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse. Inh...

Books josefchladek.com

Körpersplitter

1980

Veralg Droschl

Index Naturae

2023

Skinnerboox

Imperfections

2024

AnzenbergerEdition

De Muur

2002

Fotokabinetten Gemeentemuseum Den Haag

Ústí nad Labem

1965

Severočeské krajské nakladatelství

Sergio Castañeira

Sergio Castañeira Kjell-Ake Andersson & Mikael Wiström

Kjell-Ake Andersson & Mikael Wiström Max Zerrahn

Max Zerrahn Federico Renzaglia

Federico Renzaglia