Suche "esg" - 85 Treffer

Treffer CA Immo

... model Highlights Results Financing Property ESG Cap. Markets Entire value chain ... /virtuelle_messe/2021/cai

... cycle Highlights Results Financing Property ESG Cap. Markets Monetise future profit ... /virtuelle_messe/2021/cai

... / Earnings Highlights Results Financing Property ESG Cap. Markets Soild start into ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets 1Q 2021 Key ... /virtuelle_messe/2021/cai

... growth Highlights Results Financing Property ESG Cap. Markets Profit and loss ... /virtuelle_messe/2021/cai

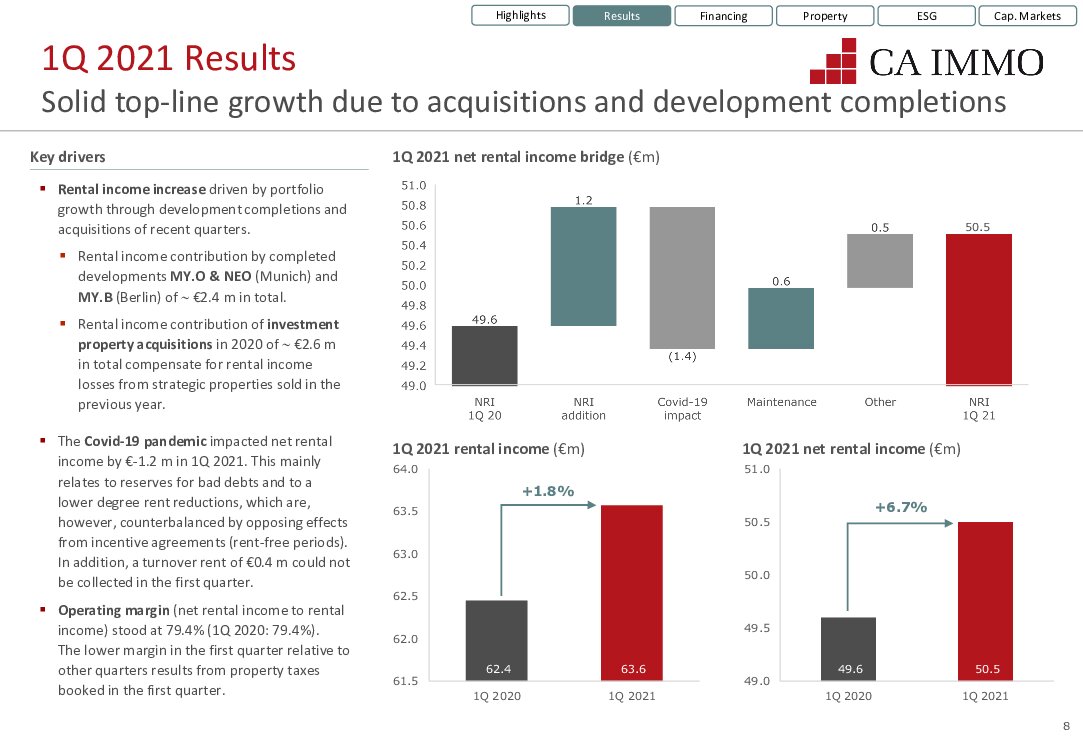

... completions Highlights Results Financing Property ESG Cap. Markets Key drivers 1Q ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets 1Q 2021 Results ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets 1Q 2021 Results FFO I at €31.4 m 4.5% up compared to previous year 1Q 2021 FFO I bridge (€m) 3 4 5 2 1 6 31.4 Key drivers 1 2 3 4 5 6 Decrease in rental income mainly due to lower rental income in Hungary. Positive contribution by acquisitions of investment properties in 2020: Am Karlsbad 11, Pohlstraße 20 (Berlin) and Postepu 14 (Warsaw). Positive contribution by recent development project completions, mainly MY.O (Munich) and MY.B. (Berlin). Decrease in rental income mainly due to sale of Zagrebtower (Zagreb) and Weblinger Gürtel (Graz) investment properties. Compared to the first quarter of the previous year the Covid-19 pandemic impacted the 1Q 2021 FFO I by €-1.4 m (primarily bad debt provisions). Mainly due to increase in interest expenses following bond issuances in 2020. 10 /virtuelle_messe/2021/cai

... , 2021 Highlights Results Financing Property ESG Cap. Markets Balance sheet (€m) Investment ... /virtuelle_messe/2021/cai

... , 2021 Highlights Results Financing Property ESG Cap. Markets Balance sheet (€m) Total ... /virtuelle_messe/2021/cai

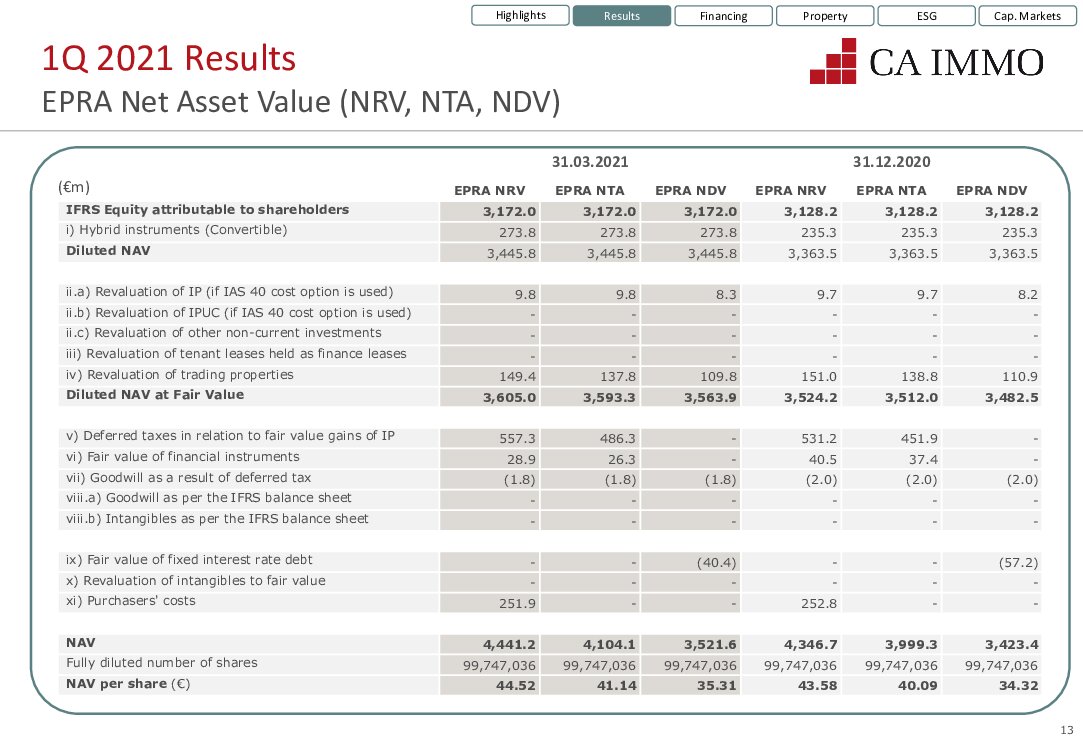

... , NDV) Highlights Results Financing Property ESG Cap. Markets (€m) IFRS Equity attributable ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets 1Q 2021 Results ... /virtuelle_messe/2021/cai

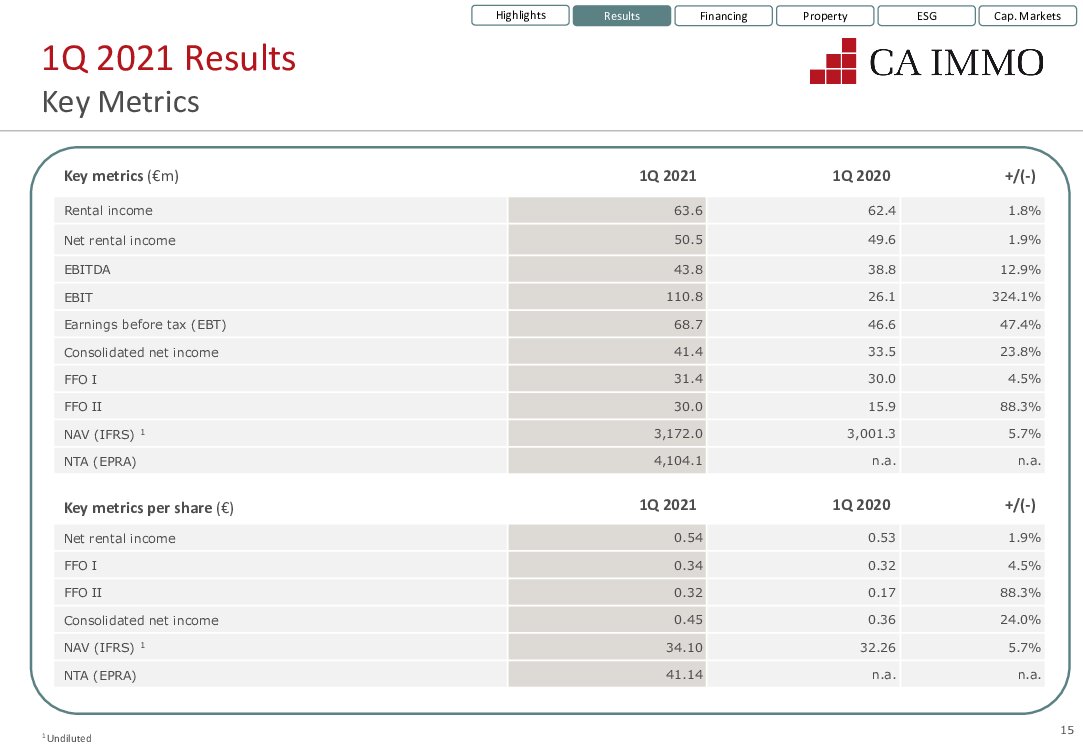

1Q 2021 Results Key Metrics Key metrics (€m) Rental income Net rental income EBITDA EBIT Earnings before tax (EBT) Consolidated net income FFO I FFO II NAV (IFRS) 1 NTA (EPRA) Key metrics per share (€) Net rental income FFO I FFO II Consolidated net income NAV (IFRS) 1 NTA (EPRA) Highlights Results Financing Property ESG Cap. Markets 1Q 2021 1Q 2020 63.6 50.5 43.8 110.8 68.7 41.4 31.4 30.0 3,172.0 4,104.1 62.4 49.6 38.8 26.1 46.6 33.5 30.0 15.9 3,001.3 n.a. 1Q 2021 1Q 2020 0.54 0.34 0.32 0.45 34.10 41.14 0.53 0.32 0.17 0.36 32.26 n.a. +/(-) 1.8% 1.9% 12.9% 324.1% 47.4% 23.8% 4.5% 88.3% 5.7% n.a. +/(-) 1.9% 4.5% 88.3% 24.0% 5.7% n.a. 1 Undiluted 15 /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Financing Well-balanced ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Financing Stable debt maturities and record low financing costs Key financing metrics 1 Average debt maturity (years) 1 Bond issuances in 2020 improved key financing metrics. Average financing costs incl. interest rate hedges at 1.5% (excl. 1.3%). Average debt maturity at 4.7 years. Interest rate hedging ratio stands at 92%. 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 5.8 4.7 4.0 1Q 2019 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Average debt maturity Secured debt maturity Unsecured debt maturity Hedging ratio (%) Average cost of debt (%) 1 8% 20% Hedging ratio 92% 2.0% 1.9% 1.8% 1.7% 1.6% 1.5% 1.4% 1.3% 1.2% 1.6% 1.5% 1.4% 73% 1Q 2019 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Floating Fixed Hedged Total all-in cost Secured all-in cost Unsecured all-in cost 1 Excl. contractually fixed credit lines for follow-up financings of development projects 18 /virtuelle_messe/2021/cai

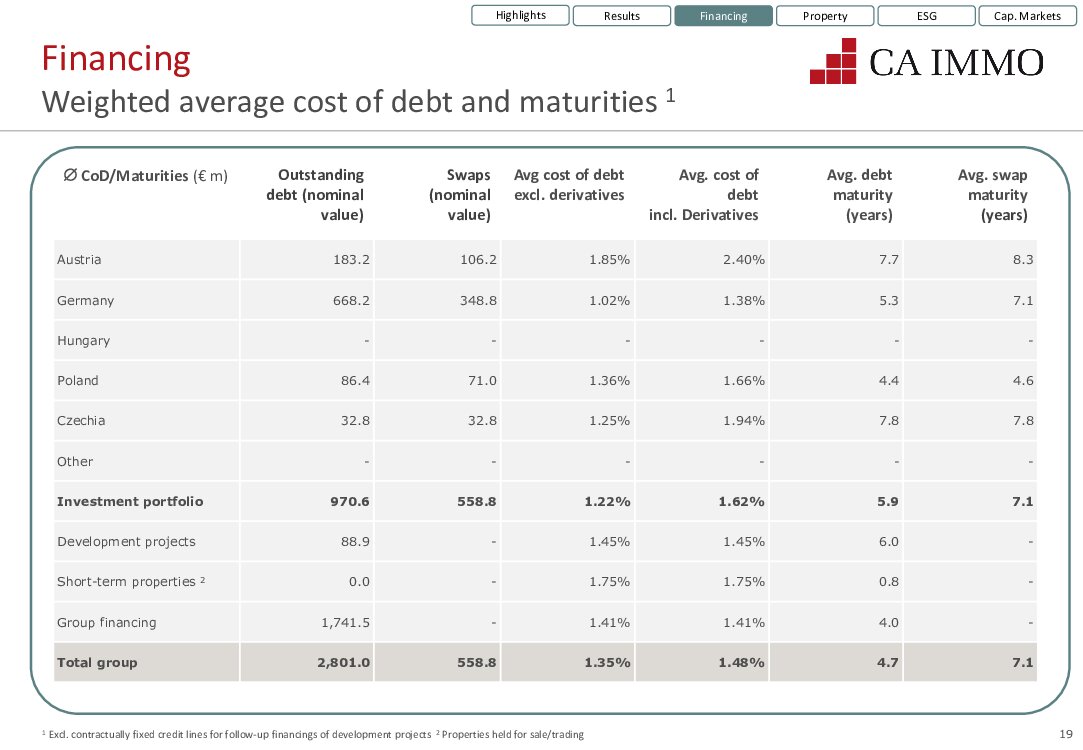

Financing Weighted average cost of debt and maturities 1 Highlights Results Financing Property ESG Cap. Markets CoD/Maturities (€ m) Outstanding debt (nominal value) Swaps (nominal value) Avg cost of debt excl. derivatives Avg. cost of debt incl. Derivatives Avg. debt maturity (years) Avg. swap maturity (years) Austria Germany Hungary Poland Czechia Other 183.2 668.2 - 86.4 32.8 - 106.2 348.8 - 71.0 32.8 - 1.85% 2.40% 1.02% 1.38% - - 1.36% 1.66% 1.25% 1.94% - - Investment portfolio 970.6 558.8 1.22% 1.62% Development projects Short-term properties 2 88.9 0.0 Group financing 1,741.5 - - - 1.45% 1.45% 1.75% 1.75% 1.41% 1.41% Total group 2,801.0 558.8 1.35% 1.48% 7.7 5.3 - 4.4 7.8 - 5.9 6.0 0.8 4.0 4.7 8.3 7.1 - 4.6 7.8 - 7.1 - - - 7.1 1 Excl. contractually fixed credit lines for follow-up financings of development projects 2 Properties held for sale/trading 19 /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Financing Robust financial profile with strong equity base Leverage Interest coverage 55% 50% 45% 40% 35% 30% 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x 49.6% 45.5% 30.9% 3.6x 3.5x 2016 2017 2018 2019 2020 Q1 2021 2016 2017 2018 2019 2020 Q1 2021 Equity ratio Loan-to-value Loan-to-value (net) FFO I interest cover FFO I net interest cover Unencumbered assets (€m, %) 3,000 2,500 2,000 1,500 1,000 500 - Capital structure 44.7% 60% 50% 40% 30% 20% 10% 0% 45% 40% 35% 30% 25% 20% 15% 40.4% 25.2% 15.1% 2016 2017 2018 2019 2020 Q1 2021 2016 2017 2018 2019 2020 Q1 2021 Unencumbered assets (lhs) Unencumbered assets / Property portfolio (rhs) Total debt / Total assets Secured debt / Total assets Net debt / Total assets 20 /virtuelle_messe/2021/cai

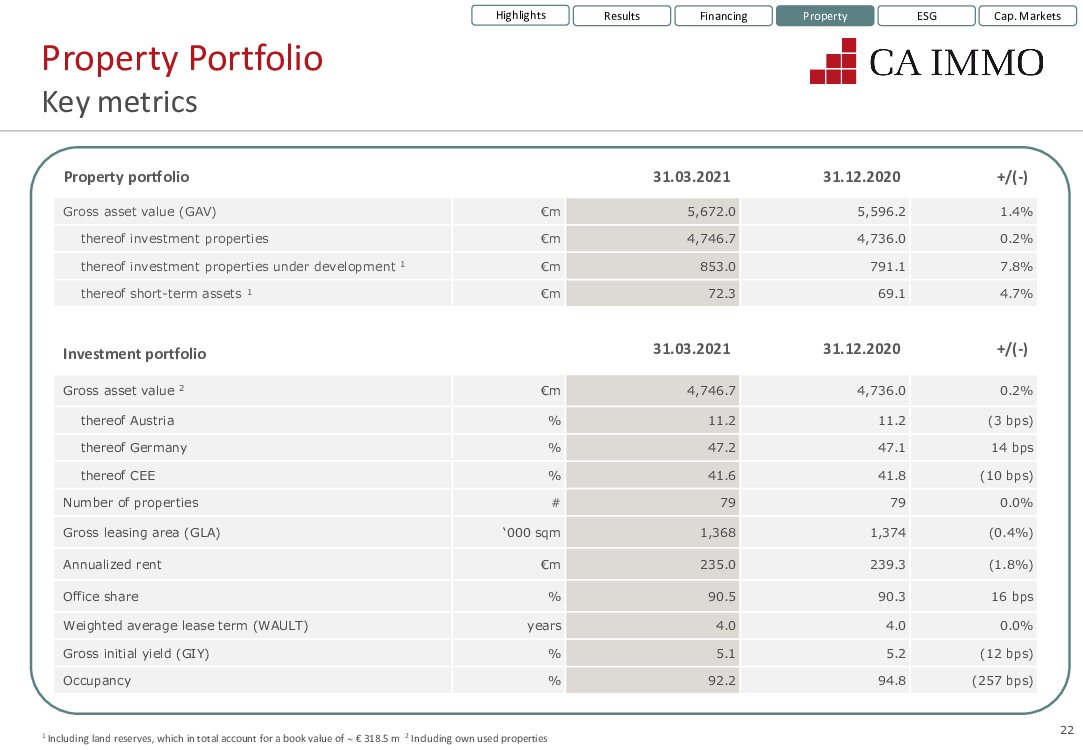

Property Portfolio Key metrics Property portfolio Gross asset value (GAV) thereof investment properties thereof investment properties under development 1 thereof short-term assets 1 Investment portfolio Gross asset value 2 thereof Austria thereof Germany thereof CEE Number of properties Gross leasing area (GLA) Annualized rent Office share Weighted average lease term (WAULT) Gross initial yield (GIY) Occupancy Highlights Results Financing Property ESG Cap. Markets €m €m €m €m €m % % % # ‘000 sqm €m % years % % 31.03.2021 31.12.2020 5,672.0 4,746.7 853.0 72.3 5,596.2 4,736.0 791.1 69.1 +/(-) 1.4% 0.2% 7.8% 4.7% 31.03.2021 31.12.2020 +/(-) 4,746.7 4,736.0 11.2 47.2 41.6 79 1,368 235.0 90.5 4.0 5.1 92.2 11.2 47.1 41.8 79 1,374 239.3 90.3 4.0 5.2 94.8 0.2% (3 bps) 14 bps (10 bps) 0.0% (0.4%) (1.8%) 16 bps 0.0% (12 bps) (257 bps) 1 Including land reserves, which in total account for a book value of € 318.5 m 2 Including own used properties 22 /virtuelle_messe/2021/cai

Property Portfolio Overview Highlights Results Financing Property ESG Cap. Markets Property portfolio by region (book value) Property portfolio by city (book value) Property portfolio by structure (book value) 9% 36% Total GAV: €5.7 bn 55% Germany CEE Austria 5% 7% 8% 26% 10% Total GAV: €5.7 bn 9% 17% 9% 9% Berlin Munich Vienna Frankfurt Budapest Warsaw Prague Bucharest Other 1% 10% 5% Total GAV: €5.7 bn 84% Investment properties Land reserves 2 Active development projects Short-term properties Investment portfolio by region (book value) 1 Investment portfolio by city (book value) Investment portfolio by asset class (book value) 11% Germany Total GAV: €4.7 bn 47% CEE 42% Austria 5%2% 8% 24% 8% 13% Total GAV: €4.7 bn 18% 11% 11% Berlin Munich Vienna Budapest Warsaw Bucharest Prague Other Frankfurt 4% 6% Total GAV: €4.7 bn 90% Office Hotel Other 1 Including own used properties 2 Partly held at amortised cost under current assets 23 /virtuelle_messe/2021/cai

... .2 years Highlights Results Financing Property ESG Cap. Markets Properties Total area ... /virtuelle_messe/2021/cai

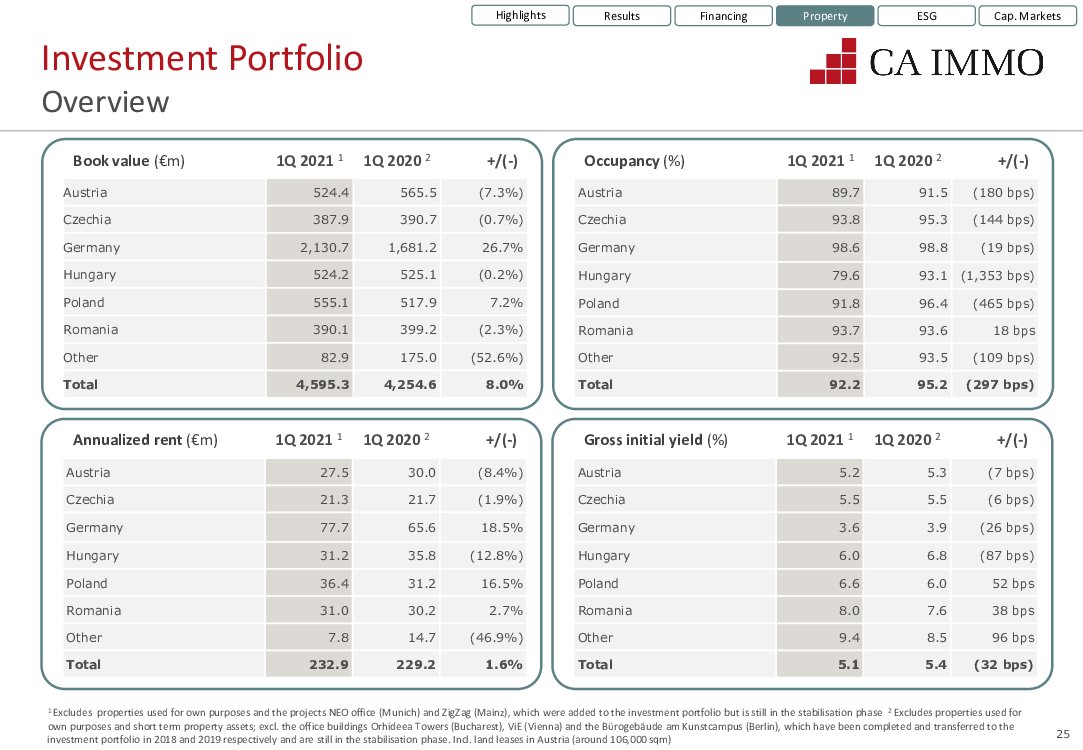

... Overview Highlights Results Financing Property ESG Cap. Markets Book value (€m) 1Q ... /virtuelle_messe/2021/cai

... WAULT Highlights Results Financing Property ESG Cap. Markets Well-staggered lease ... /virtuelle_messe/2021/cai

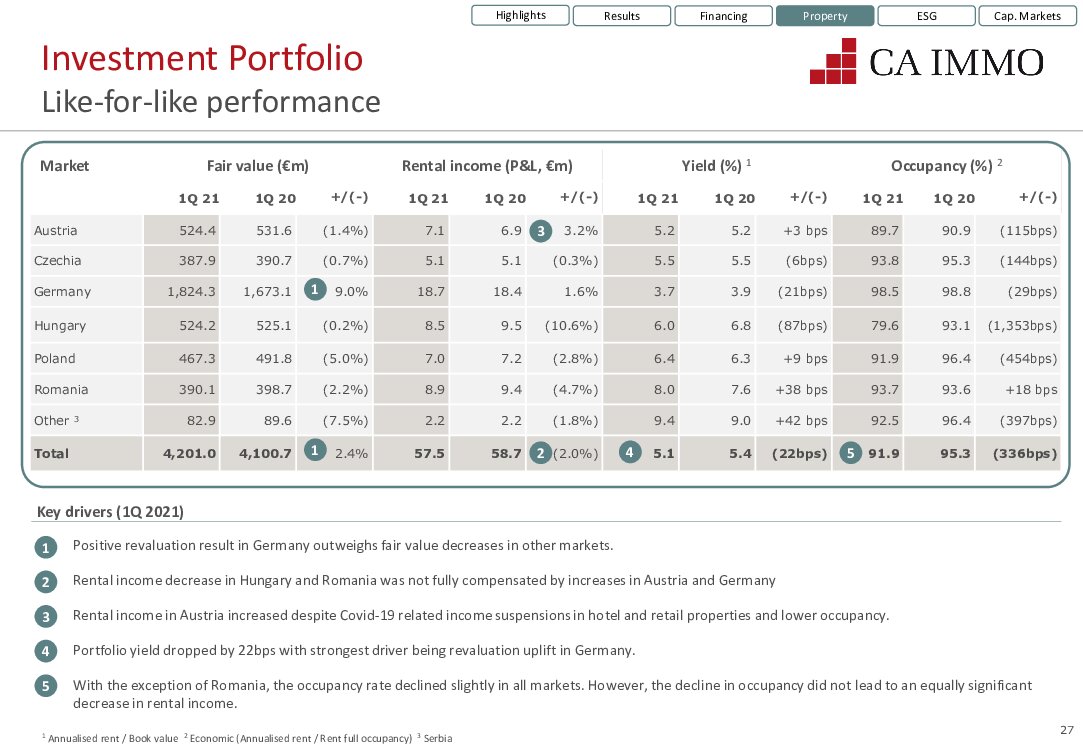

... performance Highlights Results Financing Property ESG Cap. Markets Market Fair value ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Property Portfolio Leasing ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Investment Portfolio Reversionary ... /virtuelle_messe/2021/cai

... structure Highlights Results Financing Property ESG Cap. Markets Tenant base Tenant ... /virtuelle_messe/2021/cai

... focus (I) Highlights Results Financing Property ESG Cap. Markets Top 40 tenants ... /virtuelle_messe/2021/cai

... (II) Highlights Results Financing Property ESG Cap. Markets Top 40 tenants ... /virtuelle_messe/2021/cai

Investment Portfolio Largest assets (I) Highlights Results Financing Property ESG Cap. Markets Skygarden, Munich Value Occupancy Tenants € 280 m 100% PwC Kontorhaus, Munich Value Occupancy Tenants € 224 m 98% Google, Salesforce Millennium Towers, Budapest Value Occupancy Tenants € 203 m 89% Morgan Stanley My.O, Munich Value Occupancy Tenants € 169 m 100% JetBrains JFK House, Berlin Value Occupancy Tenants € 141 m 96% White & Case, Airbus MY.B, Berlin Value Occupancy Tenants € 121 m 99% Hypoport Tour Total, Berlin Value Occupancy Tenants € 118 m 100% Total Warsaw Spire B, Warsaw Value Occupancy Tenants € 115 m 100% Frontex Riverplace, Bucharest Value Occupancy Tenants € 107 m 93% BAT Kavci Hory, Prague Value Occupancy Tenants € 105 m 98% ICZ, Wüstenrot 33 /virtuelle_messe/2021/cai

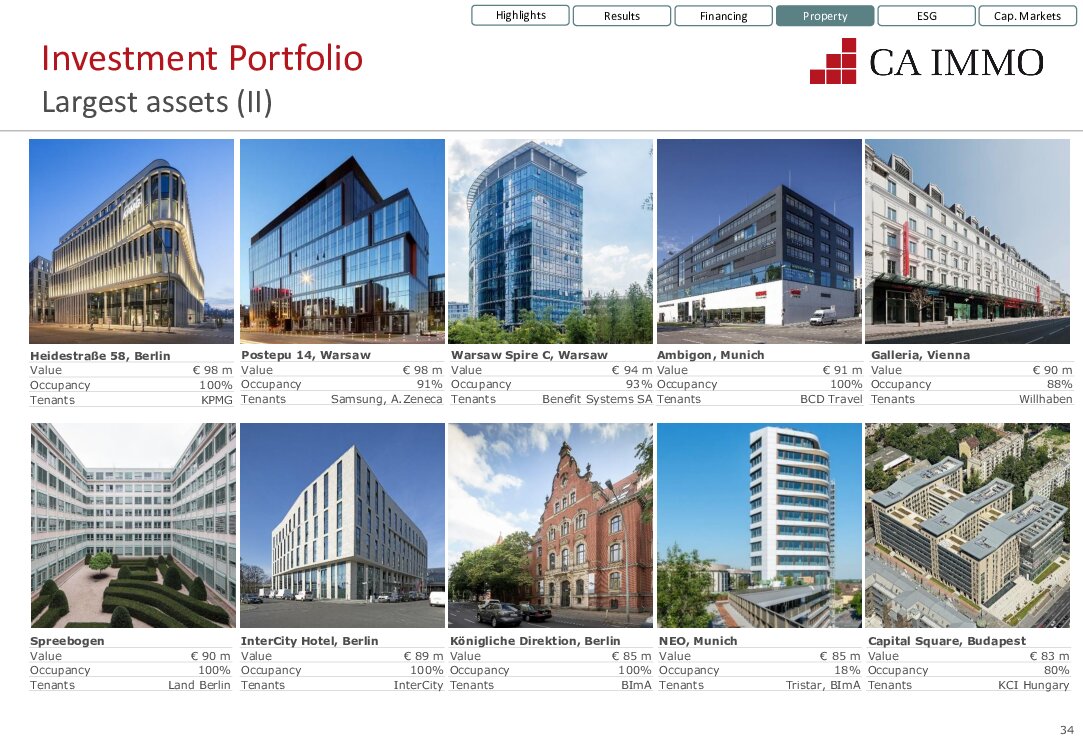

Investment Portfolio Largest assets (II) Highlights Results Financing Property ESG Cap. Markets Heidestraße 58, Berlin Value Occupancy Tenants € 98 m 100% KPMG Postepu 14, Warsaw Value Occupancy Tenants € 98 m 91% Samsung, A.Zeneca Warsaw Spire C, Warsaw Value Occupancy Tenants € 94 m 93% Benefit Systems SA Ambigon, Munich Value Occupancy Tenants € 91 m 100% BCD Travel Galleria, Vienna Value Occupancy Tenants € 90 m 88% Willhaben Spreebogen Value Occupancy Tenants € 90 m 100% Land Berlin InterCity Hotel, Berlin Value Occupancy Tenants € 89 m 100% InterCity Königliche Direktion, Berlin Value Occupancy Tenants € 85 m 100% BImA NEO, Munich Value Occupancy Tenants € 85 m 18% Tristar, BImA Capital Square, Budapest Value Occupancy Tenants € 83 m 80% KCI Hungary 34 /virtuelle_messe/2021/cai

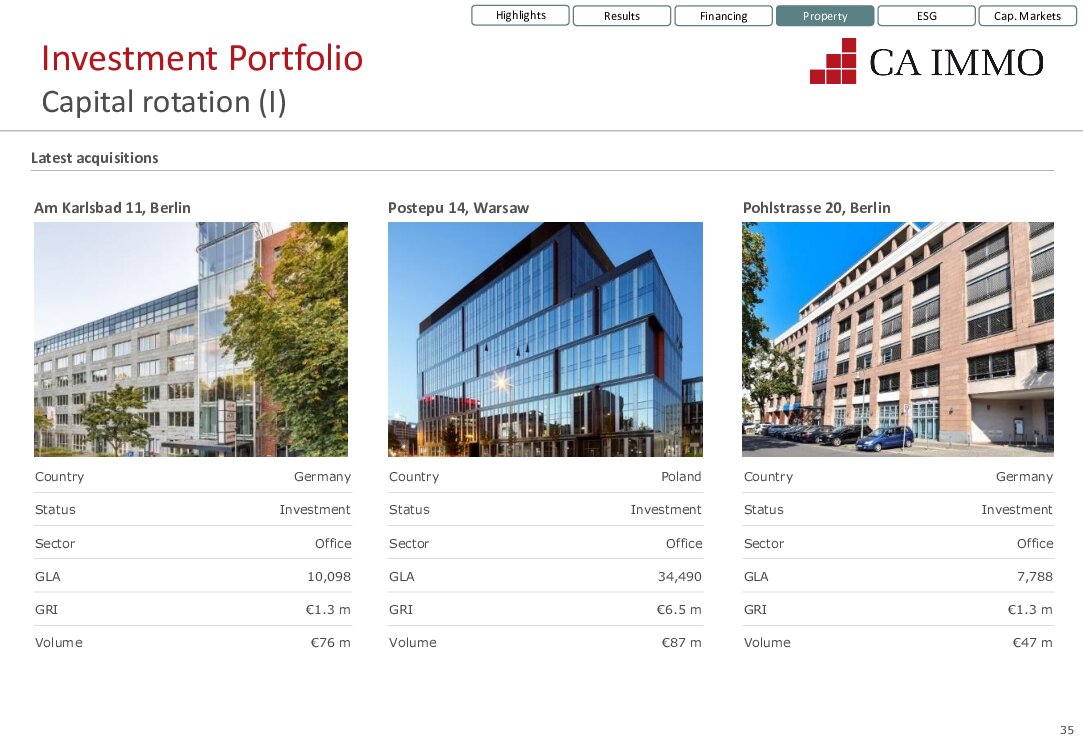

Highlights Results Financing Property ESG Cap. Markets Investment Portfolio Capital rotation (I) Latest acquisitions Am Karlsbad 11, Berlin Postepu 14, Warsaw Pohlstrasse 20, Berlin Country Status Sector GLA GRI Volume Germany Country Poland Country Investment Status Investment Status Office Sector Office Sector 10,098 GLA €1.3 m GRI €76 m Volume 34,490 GLA €6.5 m GRI €87 m Volume Germany Investment Office 7,788 €1.3 m €47 m 35 /virtuelle_messe/2021/cai

... (II) Highlights Results Financing Property ESG Cap. Markets Closed disposals 2021 ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Investment Portfolio Capital rotation (III) Selected planned disposals 2021 Meininger Hotel Rembrandstrasse, Vienna Canada Square, Budapest Wspólna, Warsaw Country Austria Country Hungary Status Investment Status Investment Country Poland Status Investment Sector Hotel Sector Office Sector Office GLA GRI 5,000 sqm €0.7 m GLA GRI 5,000 sqm €0.9 m GLA GRI 7,700 sqm €1.2 m Status Exclusivity Status Marketing Status Marketing Bodenseestrasse 225-229, Munich Rheinwiesen I, Mainz Kaufmannshof, Mainz Country Germany Country Germany Country Germany Status Investment Sector Hotel GLA GRI 5,000 sqm €0.4 m Status Sector GLA GRI Land Office 19,000 sqm - Status Development Sector Mixed use GLA GRI 6,900 sqm - Status Marketing Status Marketing Status Marketing 37 /virtuelle_messe/2021/cai

Property Portfolio Prime locations in all core markets Highlights Results Financing Property ESG Cap. Markets Property portfolio split by city (book value) 5% 7% 8% 26% 10% Total GAV €5.7 bn 9% 17% 9% 9% Berlin Munich Vienna Frankfurt Budapest Warsaw Prague Bucharest Other Key facts CA Immo‘s properties exclusively located in prime inner-city locations. Well-connected to transportation nodes with a large number of assets within walking distance to main stations. Access to high-quality land bank in sought-after locations will increase portfolio in core markets. Berlin Munich Frankfurt Vienna Standing assets Properties under construction Land reserves 38 /virtuelle_messe/2021/cai

Property Portfolio Prime locations in all core markets Highlights Results Financing Property ESG Cap. Markets Warsaw Bucharest Prague Budapest Property portfolio split by city (book value) 5% 7% 8% 26% 10% Total GAV €5.7 bn 9% 17% 9% 9% Berlin Munich Vienna Frankfurt Budapest Warsaw Prague Bucharest Other Key facts Portfolio focussed on eight core urban gateway cities that share favourable long term structural trends. Minimum portfolio value of € 300 m per city efficiently managed by local teams to allow for best management and high tenant retention. Standing assets Properties under construction Land reserves 39 /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Development Development start ... /virtuelle_messe/2021/cai

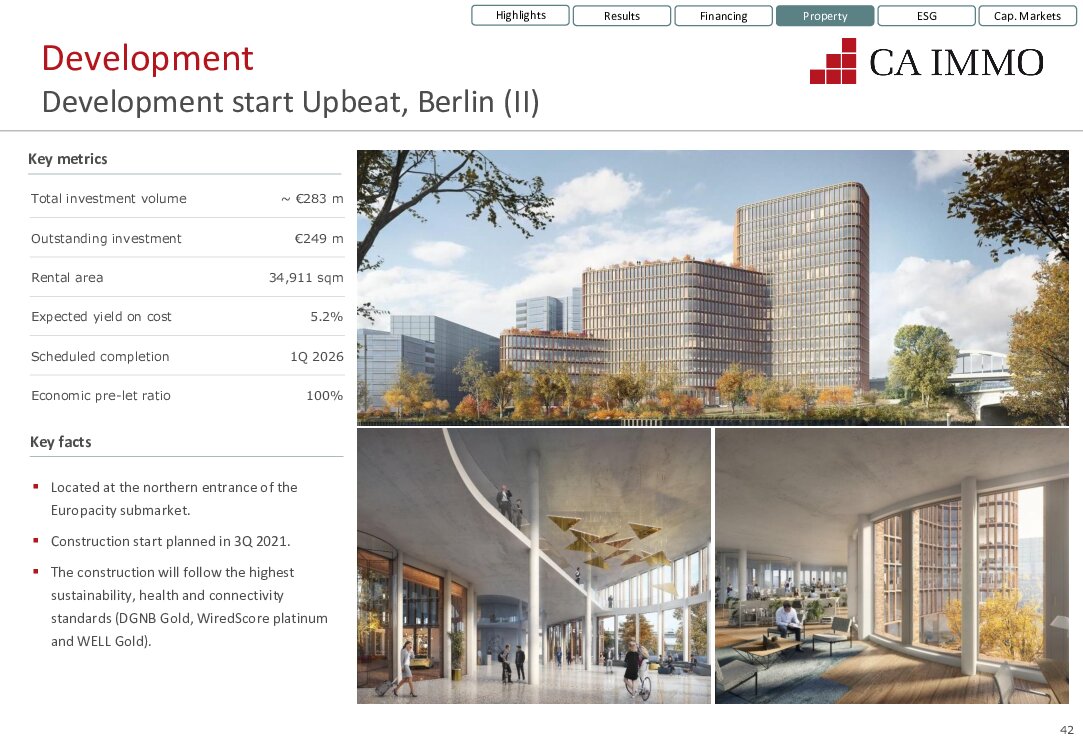

Development Development start Upbeat, Berlin (II) Highlights Results Financing Property ESG Cap. Markets Key metrics Total investment volume Outstanding investment ~ €283 m €249 m Rental area 34,911 sqm Expected yield on cost 5.2% Scheduled completion 1Q 2026 Economic pre-let ratio 100% Key facts Located at the northern entrance of the Europacity submarket. Construction start planned in 3Q 2021. The construction will follow the highest sustainability, health and connectivity standards (DGNB Gold, WiredScore platinum and WELL Gold). 42 /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Development Development start Upbeat, Berlin (III) Overview Europacity, Berlin 43 /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Development Commercial value ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Development Residential value ... /virtuelle_messe/2021/cai

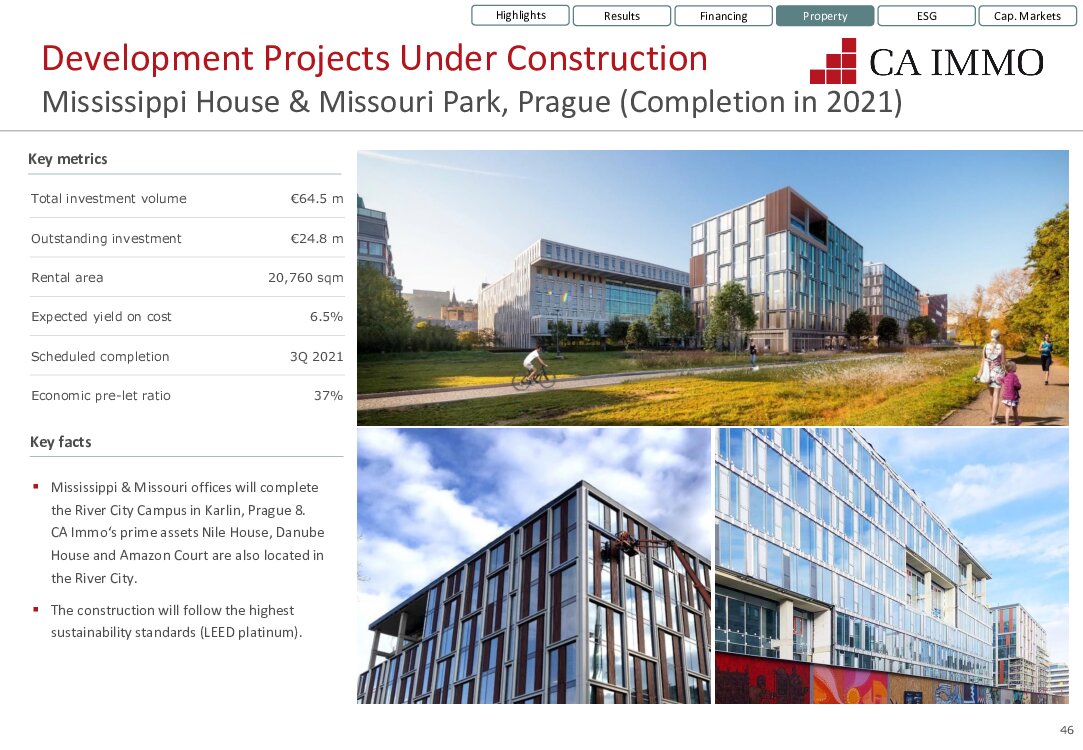

Development Projects Under Construction Mississippi House & Missouri Park, Prague (Completion in 2021) Highlights Results Financing Property ESG Cap. Markets Key metrics Total investment volume Outstanding investment €64.5 m €24.8 m Rental area 20,760 sqm Expected yield on cost 6.5% Scheduled completion 3Q 2021 Economic pre-let ratio 37% Key facts Mississippi & Missouri offices will complete the River City Campus in Karlin, Prague 8. CA Immo‘s prime assets Nile House, Danube House and Amazon Court are also located in the River City. The construction will follow the highest sustainability standards (LEED platinum). 46 /virtuelle_messe/2021/cai

Development Projects Under Construction ONE, Frankfurt (Completion in 2022) Highlights Results Financing Property ESG Cap. Markets Key metrics Total investment volume Outstanding investment €413.3 m €172.4 m Rental area 68,575 sqm Expected yield on cost 5.6% Scheduled completion 1Q 2022 Economic pre-let ratio 38% Key facts High rise hotel & office building with a flexible floor plan and a multi-storey car park and logistics building. High quality development offers all possibilities of smart, modern and technical infrastructure. More than 75% of construction works contracted. Pre-let ratio on the basis of rental area at 50%. 47 /virtuelle_messe/2021/cai

Development Projects Under Construction Grasblau, Berlin (Completion in 2023) Highlights Results Financing Property ESG Cap. Markets Key metrics Total investment volume Outstanding investment €67.0 m €39.9 m Rental area 13,383 sqm Expected yield on cost 8.3% Scheduled completion 2Q 2023 Economic pre-let ratio - Key facts Modern office building with a high degree of sustainability and a good connection to public and private transport. Utilization of building reserve on the plot of an existing investment property in the immediate vicinity of Potsdamer Platz. 48 /virtuelle_messe/2021/cai

Development Projects Under Construction Hochhaus am Europaplatz, Berlin (Completion in 2023) Highlights Results Financing Property ESG Cap. Markets Key metrics Total investment volume Outstanding investment €141.5 m €73.5 m Rental area 22,948 sqm Expected yield on cost 6.3% Scheduled completion 4Q 2023 Economic pre-let ratio 100% Key facts Development of a fully pre-leased modern Class-A high rise office building on the Baufeld 04 site in the heart of Berlin’s Europacity submarket. Construction of an 84 m high (21 storey) high rise office building. Pre-lease for 100% of the space of (KPMG also leases 100% of the space in the adjacent property Heidestraße 58 owned by CA Immo). 49 /virtuelle_messe/2021/cai

... overview Highlights Results Financing Property ESG Cap. Markets Investment portfolio Investment ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Sustainability Organizational structure ... activities by cross- departmental ESG committee. ESG focus implemented in compensation model ... -related Executive Board compensation includes ESG components and takes into account ... long-term stakeholder interests. ESG Management & Supervision, Reporting Executive Board ... ESG committee Corporate Communications & Sustainability, Corporate ... " for the 2019 Annual Report. ESG reporting was additionally expanded in ... /virtuelle_messe/2021/cai

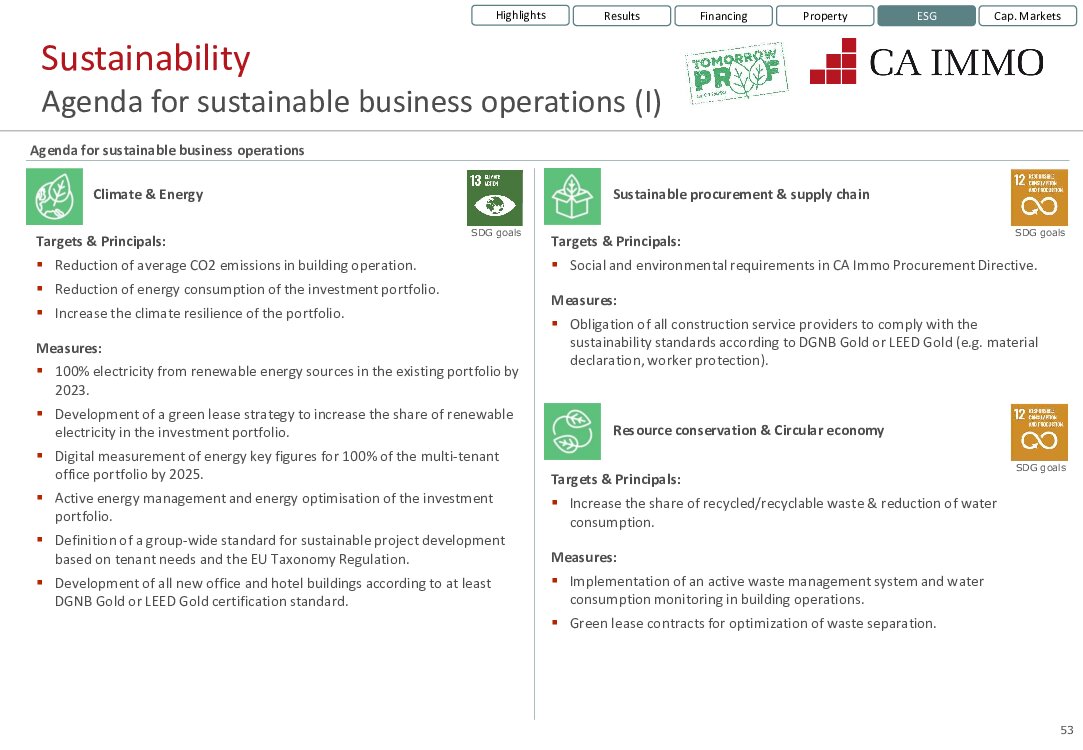

Highlights Results Financing Property ESG Cap. Markets Sustainability Agenda for ... /virtuelle_messe/2021/cai

... (II) Highlights Results Financing Property ESG Cap. Markets Agenda for sustainable ... /virtuelle_messe/2021/cai

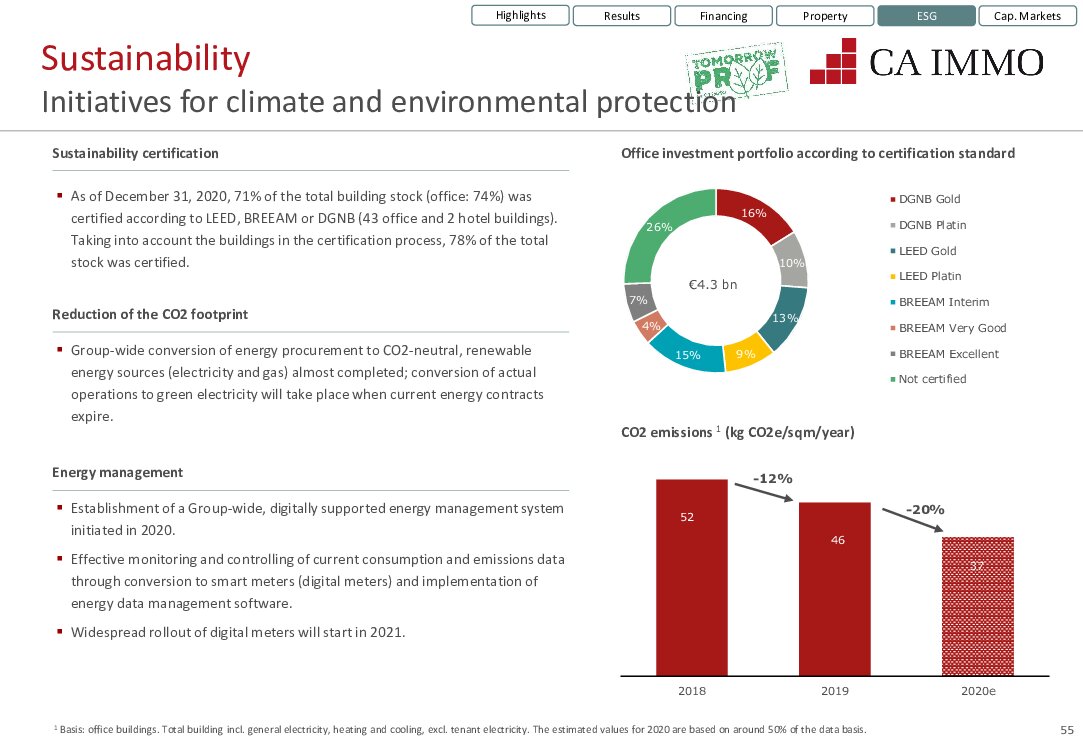

Highlights Results Financing Property ESG Cap. Markets Sustainability Initiatives for ... /virtuelle_messe/2021/cai

Highlights Results Financing Property ESG Cap. Markets Sustainability Health & safety, ... /virtuelle_messe/2021/cai

... Update Highlights Results Financing Property ESG Cap. Markets Starwood increases shareholding ... /virtuelle_messe/2021/cai

... Outlook Highlights Results Financing Property ESG Cap. Markets Further improving resilience ... /virtuelle_messe/2021/cai

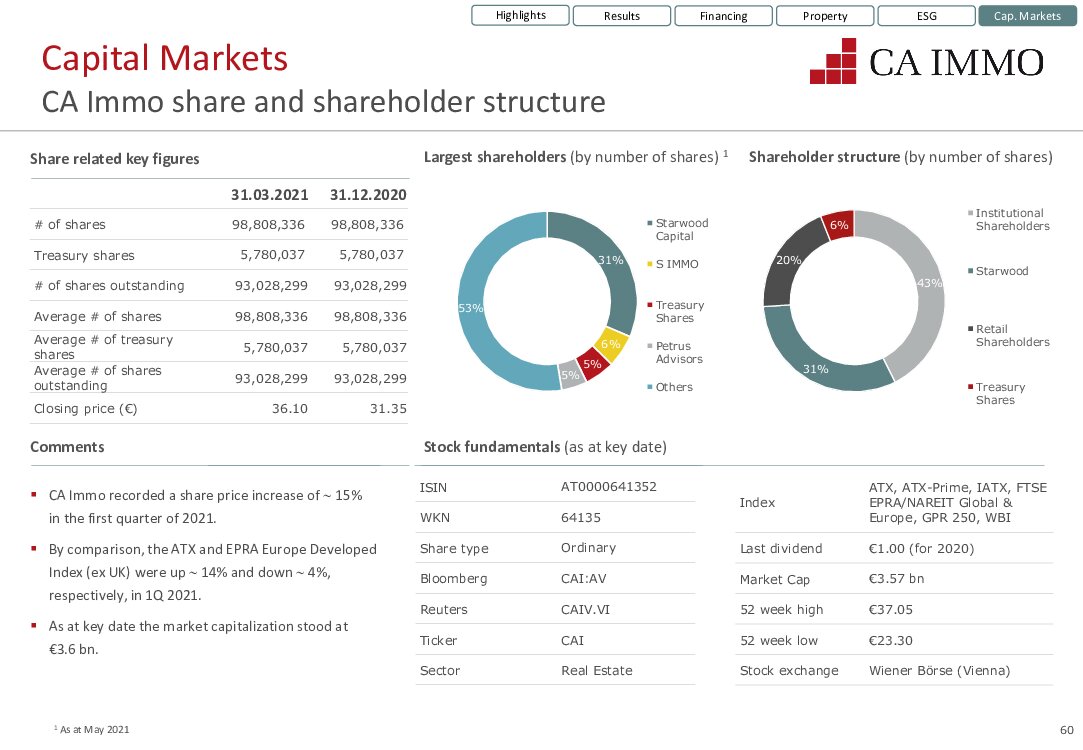

... structure Highlights Results Financing Property ESG Cap. Markets Share related key ... /virtuelle_messe/2021/cai

... attendance Highlights Results Financing Property ESG Cap. Markets Equity analyst coverage ... /virtuelle_messe/2021/cai

Treffer UBM

HIGHLIGHTS überblick. 1 2 3 4 5 6 rekord-dividende. € 2,20 dividende auf 2019 level. stärkste bilanz aller zeiten. erfolgreich durch die corona pandemie. green. smart. and more. fundament für die zukunft gelegt. esg rating. top 15% der branche. pipeline transformation. 80% in wohnen und büro. ausblick. zurück auf schiene nach einer corona “delle”. UBM Development AG – Investorenpräsentation 3 23.04.2021 /virtuelle_messe/2021/ubm

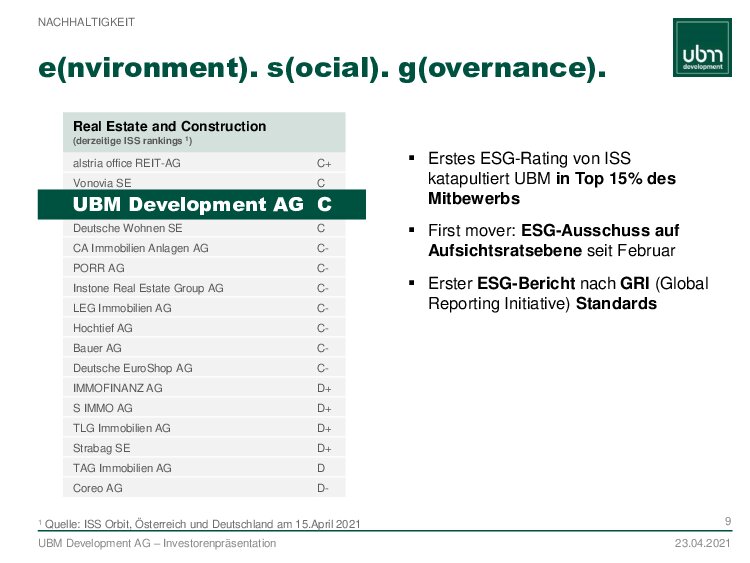

NACHHALTIGKEIT e(nvironment). s(ocial). g(overnance). ▪ Erstes ESG-Rating von ISS katapultiert UBM in Top 15% des Mitbewerbs ▪ First mover: ESG-Ausschuss auf Aufsichtsratsebene seit Februar ▪ Erster ESG-Bericht nach GRI (Global Reporting Initiative) Standards Real Estate and Construction (derzeitige ISS rankings 1) alstria office REIT-AG C+ C Vonovia SE UBM Development AG C UBM Development AG C C Deutsche Wohnen SE CA Immobilien Anlagen AG PORR AG Instone Real Estate Group AG LEG Immobilien AG Hochtief AG Bauer AG Deutsche EuroShop AG IMMOFINANZ AG S IMMO AG TLG Immobilien AG Strabag SE TAG Immobilien AG Coreo AG C- C- C- C- C- C- C- D+ D+ D+ D+ D D- 1 Quelle: ISS Orbit, Österreich und Deutschland am 15.April 2021 UBM Development AG – Investorenpräsentation 9 23.04.2021 /virtuelle_messe/2021/ubm

WOHNEN 5 wohnungs-boom. preise steigen. ▪ Wohnungsnachfrage von COVID-19 befeuert, attraktivste Asset-Klasse im Marktumfeld ▪ Niedrigzinspolitik wird für ▪ ungebremste Nachfrage sorgen green. smart. and more. Strategie trifft die ESG- Anforderungen der Investoren Wohnungs-Pipeline: Nordbahnviertel, Vienna 2020 1.000 Einheiten VERKAUFT Land Deutschland Österreich Tschechien Einheiten >1.100 >1.100 >600 UBM Development AG – Investorenpräsentation 11 23.04.2021 /virtuelle_messe/2021/ubm

BÜRO 5 green building. smart office. ▪ green. smart. and more. trifft den Zeitgeist der Ansprüchen der Post- Covid Zeit ▪ Mehr trophy assets nach dem F.A.Z. Tower (forward verkauft im Q4 2020) ▪ Weniger Bedarf und völlig veränderte Anforderungen Investor Intentions 2021 (CBRE)1 ubm Strategie Asset Klasse Bevorzugter Markt Sonstiges Sonstiges Core Development ✓ ✓ Büro Deutschland ✓ ESG Fähigkeit ✓ Zahlungsfähig keit der Mieter ✓ 12 23.04.2021 www.timber-pioneer.com www.nico-office.de 1 CBRE, EMEA Investor Intentions Survey 2021 UBM Development AG – Investorenpräsentation /virtuelle_messe/2021/ubm

AUSBLICK 6 2020. 2021. 2022 ausblick. besser als erwartet. corona „delle“. zurück auf Schiene. 2020 ▪ Corona Lockdowns ▪ keine Akquisitionen ▪ green. smart. and more. 2021 ▪ opportunity hunting ▪ ESG Finanzierungen ▪ Trading Portfolio 2022ff ▪ erste “New Projects” forward verkauft ▪ mehr strategische Partnerschaften ▪ hotel operations zurück zur Normalität UBM Development AG – Investorenpräsentation 13 23.04.2021 /virtuelle_messe/2021/ubm

Treffer Wienerberger

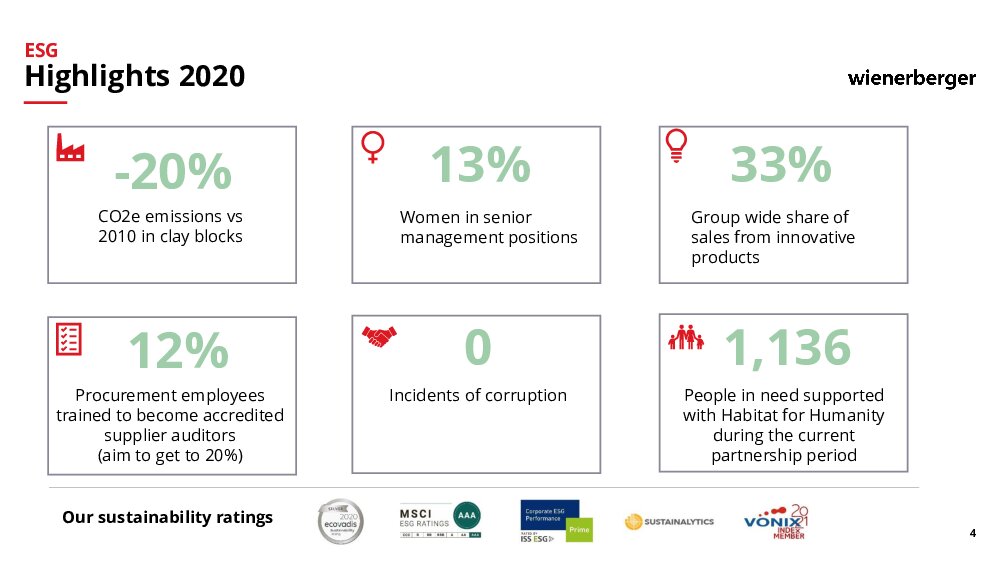

ESG Highlights 2020 -20% CO2e emissions vs 2010 in clay blocks 13% Women in senior management positions 0 Incidents of corruption 12% Procurement employees trained to become accredited supplier auditors (aim to get to 20%) Our sustainability ratings 33% Group wide share of sales from innovative products 1,136 People in need supported with Habitat for Humanity during the current partnership period 4 /virtuelle_messe/2021/wie

2021 Guidance GROWTH › In 2021 we foresee an EBITDA growth of 7 to 11% 1) driven by our self help program and a healthy market environment › Growth investment 2021: Special & ESG 140-160mn SELF HELP PROGRAM 2021-2023 › Continuous Operational Excellence measures › Special investments in recyclability, new product design, expanding solutions › ESG investments to reduce CO2 emissions, expand green energy & enhance biodiversity › Self help program leading to significant EBITDA enhancement 2021: 2021-2023: € 40 mn € 135 mn GUIDANCE 2021 1) 1) No contribution from Meridian considered 40 560 -20 +7 to +11% 20-40 600-620 Guidance 2021: EBITDA LFL 1) € 600 – 620 mn 30 /virtuelle_messe/2021/wie

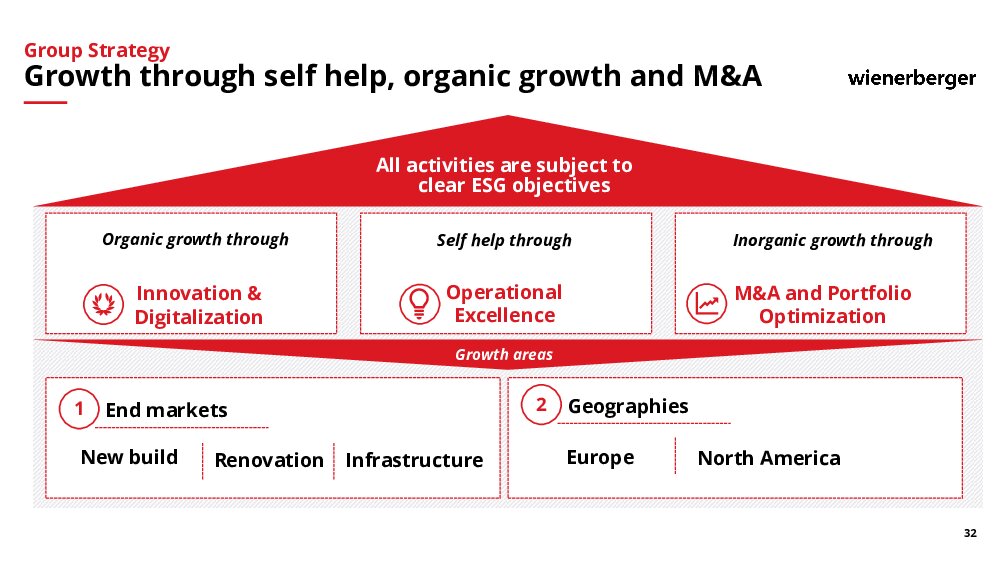

Group Strategy Growth through self help, organic growth and M&A All activities are subject to clear ESG objectives Organic growth through Self help through Inorganic growth through Innovation & Digitalization Operational Excellence Growth areas M&A and Portfolio Optimization 1 End markets 2 Geographies New build Renovation Infrastructure Europe North America 32 /virtuelle_messe/2021/wie

ESG All our activities need to be in line with our ambitious 2023 ESG targets ENVIRONMENT SOCIAL GOVERNANCE Climate Protection Diversity -15% CO2e 1) emissions vs. 2020 Circular Economy 100% Of new products will be designed in a way that they are recyclable or reusable Biodiversity Biodiversity program for all our sites in place >15% Female employees in senior management >30% Female employees in white collar positions Training and Development +10% More training hours per employee CSR Projects 200 Housing units built with our products per year for people in need in our local markets Committed to highest national and international governance standards and with focus on: › Business strategy › Board diversity and composition › Executive compensation › Succession management 1) “Carbon dioxide equivalents” or “CO2e” is a term used to describe the global warming potential (GWP) of various greenhouse gases in a single unit Note: All goals are set vs. the reference year 2020. 33 /virtuelle_messe/2021/wie

Group Strategy Strong foundations for sustainable growth 1 2 3 4 Clear commitment to ESG Maintain strong balance sheet Enhance organic growth through innovation and M&A Strong cash generation due to consistent execution of our growth strategy 34 /virtuelle_messe/2021/wie

Treffer Evotec

Agenda Unique business model Data-driven precision multi-modality platforms Co-owned pipeline building From BRIDGES to operational VC Financials, ESG & Outlook PAGE 2 /virtuelle_messe/2021/evotec

Financials, ESG & Outlook Sustainable growth business building massive upside PAGE 28 /virtuelle_messe/2021/evotec

Your contact: Volker Braun Global Head of Investor Relations & ESG +49.(0).40.560 81-775 +49.(0).151 1940 5058 (m) volker.braun@evotec.com /virtuelle_messe/2021/evotec

Treffer Porr

Why PORR Top tier in European construction • Market leader in Austria • Seven stable and growing home markets in Europe • High investment backlog as well as mega trends support ongoing demand in construction sector Focus on operational excellence • Enhancing value and focus on profitability • Reinforcement through transformation programme PORR 2025 • Expand technological leadership Investor Presentation ● April 2021 ● 18 150 years: core competency construction • Strong order book • Integrated approach – one-stop-shop • One of the few full-service providers for complex infrastructure The capital market matters • Stable, long-term oriented core shareholder • Continuity in the payout ratio (30–50%) post-pandemic • Strong focus on ESG and sustainability /virtuelle_messe/2021/porr

Top Awarded in Corporate Responsibility Economy Environment Social MSCI ESG Rating AA-Rating above industry average ISO 50001:2018 for Austrian PORR locations Workplace Health Promotion EcoVadis Gold among best 5% in construction Specific GHG emissions In thousand tons CO2 Women in management In % 162.9 -0.2% 162.5 150.3 +2.5PP 13.1 10.6 10.9 2018 2019 2020 2018 2019 2020 Investor Presentation ● April 2021 ● 25 /virtuelle_messe/2021/porr

Treffer S Immo

DAS VORSTANDSTEAM DER S IMMO AG Dr. Bruno Ettenauer, MRICS CEO Mag. Friedrich Wachernig, MBA COO • Seit März 2021 Vorstandsvorsitzender der S IMMO AG • 30 Jahre Erfahrung im Immobilienbereich, davon 7 Jahre als Vorstandsvorsitzender der CA Immobilien Anlagen AG • Finanzen, Investors Relations, Public Relations, Marketing, Recht, Compliance, Revision • Seit November 2007 Vorstand der S IMMO AG • Mehr als 27 Jahre Erfahrung im Management von Immobilien- Projektentwicklungen • Projektentwicklung, Asset Management, Personal, CEE DI Herwig Teufelsdorfer, MRICS CIO • Ab 12.04.2021 Vorstand der S IMMO AG • Spezialist in den Bereichen Digitalisierung und Innovation • An- und Verkauf, Risk Management, Organisation, IT, Digitalisierung, ESG, Deutschland und Österreich l e t i T O M M I S | 2 /virtuelle_messe/2021/spi

... werden in die Umweltaktivitäten einbezogen ESG Bewertung 21 Mittleres Risiko Unerheblich ... Hoch 30-40 Schwer 40+ ESG Ranking Immobilien Branche Globales Universum ... /virtuelle_messe/2021/spi

Treffer Immofinanz

Portfolio ESG – Highlights des Jahres (I) Environmental Steigerung der Energieeffizienz und Reduktion des CO2-Footprints Energieintensität um 9,4%¹ und Wasserintensität um 8,6%¹ reduziert Start des Roll-outs von Photovoltaik-Anlagen für unsere STOP SHOPs Langfristige Strategie zu Detailzielen und Zeitplan für die Klimaneutralität unseres Portfolios wird derzeit extern evaluiert und soll in den nächsten Monaten präsentiert werden Nachhaltigkeitszertifikate als Indikatoren für die Umweltauswirkungen von Gebäuden: ~40% des Portfolios bereits zertifiziert bzw. in Vorbereitung „STOP SHOP goes green“: Start des Zertifizierungsprozesses für unser Retail-Park-Portfolio mit dem ersten BREEAM-Zertifikat für den STOP SHOP Lazarevac Weitere Initiativen umfassen: Roll-out von Ladestationen für E-Fahrzeuge, Pilotprojekte für Brauchwassernutzung und Urban-Forest-Projekte ¹ je kWh/m² bzw. Liter/m² 23 /virtuelle_messe/2021/iia

Portfolio ESG – Highlights des Jahres (II) Social ... Unterziele in unsere ESG- Strategie Verbesserung des ESG-Ratings: ESG Risk Rating von ... /virtuelle_messe/2021/iia

Treffer Erste Group

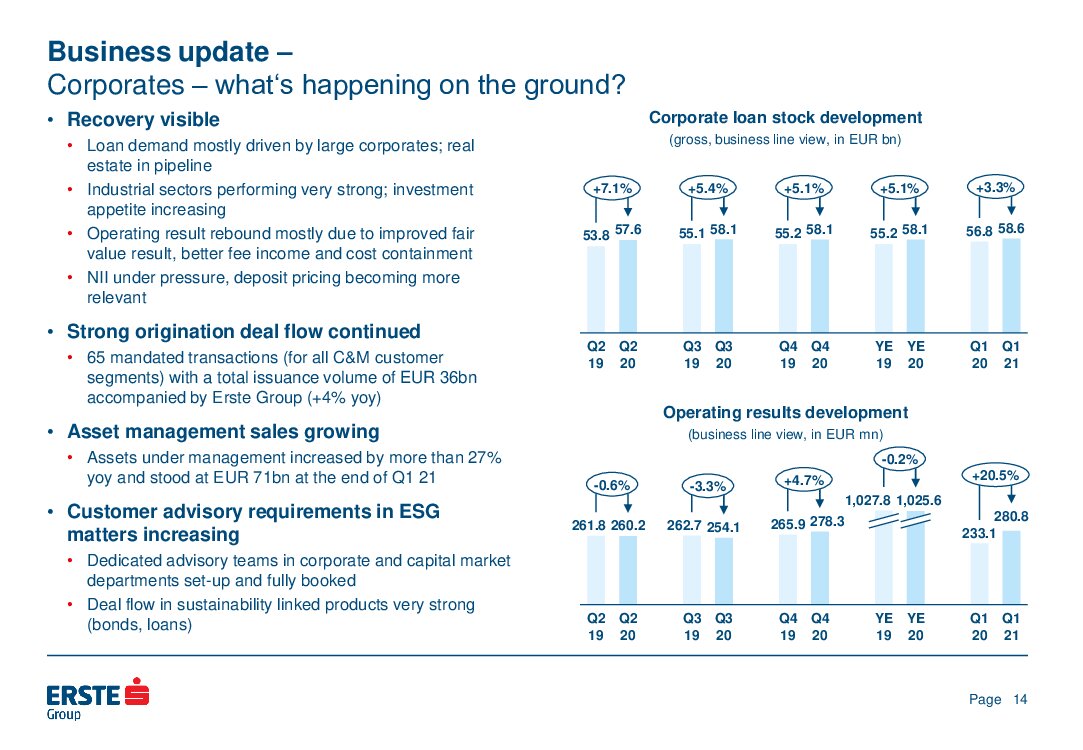

... 21 • Customer advisory requirements in ESG matters increasing • Dedicated advisory teams ... /virtuelle_messe/2021/ebs

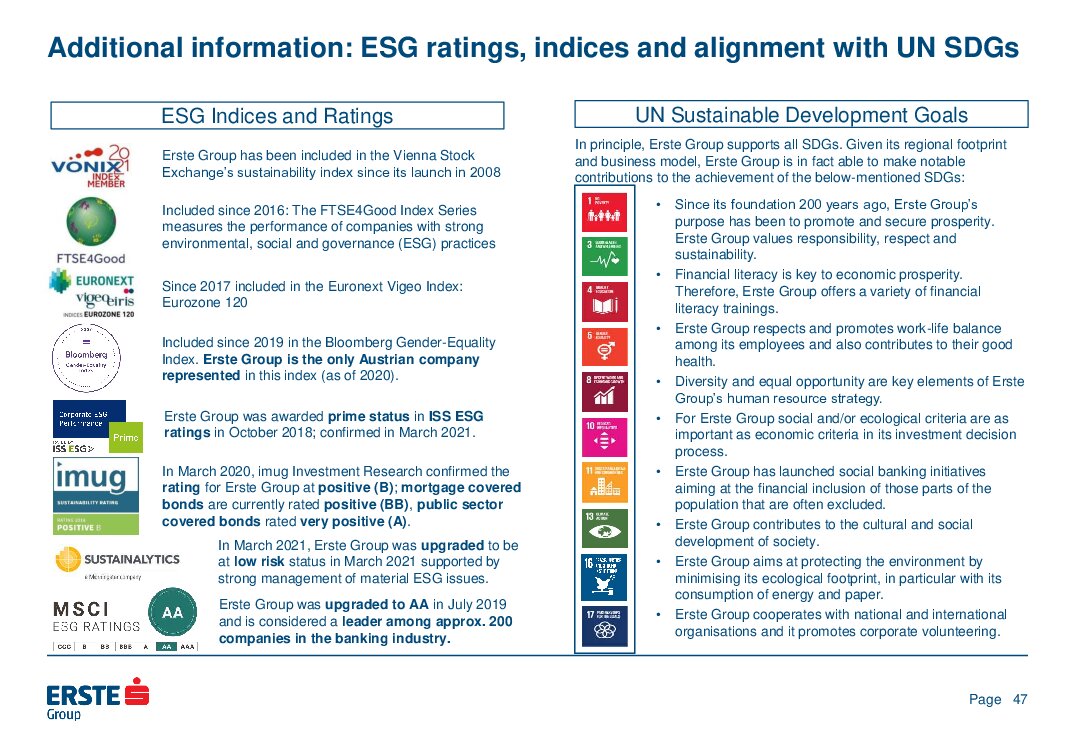

... and alignment with UN SDGs ESG Indices and Ratings UN Sustainable ... strong environmental, social and governance (ESG) practices Since 2017 included in ... awarded prime status in ISS ESG ratings in October 2018; confirmed ... by strong management of material ESG issues. Erste Group was upgraded ... /virtuelle_messe/2021/ebs

Treffer Pierer Mobility

... key measures Our six phase ESG framework Product quality and safety ... /virtuelle_messe/2021/pierer

... initiatives to protect the environment ESG SELECTION DEVELOPMENT & PRODUCTION ▪ 2% emissions caused ... /virtuelle_messe/2021/pierer

Treffer Österreichische Post

UNSERE ESG RATINGS UND REPORTING GUIDELINES Ratings Reporting Guidelines AAA (Range von AAA bis CCC) Prime-Status, Rating C+ (Range von A+ bis D-) A- (Range von A bis D-), Supplier Engagement Leader Silver (58 von 100 Punkten) Outperformer (68 von 100 Punkten) 64 von 100 Punkten Austrian Leading Companies (ALC) Award in der Kategorie Klimatransparenz Nachhaltigkeitsberichterstattung 2020 gemäß GRI-Standard Option Kern und NaDiVeG Klimaberichterstattung 2020 gemäß Vorgaben des TCFDs Nachhaltigkeitsberichterstattung 2021 gemäß SASB und EU Taxonomy in Vorbereitung Nachhaltigkeitsziele ermittelt gemäß Science Based Targets Ziele im Einklang mit den UN Sustainable Development Goals INVESTORENPRÄSENTATION Investor Relations Wien, 12. März 2021 43 /virtuelle_messe/2021/post

VERGÜTUNGSBERICHT Transparenz im Ausweis der Vergütung Vergütungsbestandteile werden klar und verständlich beschrieben Fokus liegt auf der variablen leistungsabhängigen Vergütungskomponente Langfristige Unternehmensstrategie und ESG Kriterien werden berücksichtigt Zielwerte und Zielerreichung sind nachvollziehbar dargestellt Vergleich mit der Geschäftsentwicklung des Unternehmens INVESTORENPRÄSENTATION Investor Relations Wien, 12. März 2021 75 /virtuelle_messe/2021/post

Treffer RBI

... Status" and Level “C+" by ISS-ESG (June 2020) ▪ Sustainalytics: “Low risk ... diversified banks (June 2021) ▪ MSCI ESG Rating: Level A (confirmed April 2021 ... is included in the STOXX ® ESG Leaders Indices, the FTSE4Good Index ... /virtuelle_messe/2021/rbi

Treffer Kontron

ESG IMPROVEMENTS & GOALS – 2020,2021 AND ... photovoltaic systems STEP-BY-STEP ESG PLAN 3 years plan to coordinate ... ESG topics on group level, clear ... target to improve ESG Ratings (MSCI to at least ... II Evaluation ESG-Goals Reporting expansion ESG-Goal extension ESG-Risk assessment Update ... Improved reporting according to recognised ESG standards Stakeholder Dialog Steps 2022 ... /virtuelle_messe/2021/snt

Treffer AT&S

ESG Highlights FY 20/21 45% renewable energy Start of life cycle assessment Rated by 20% women in management positions ISO 9001, 45001,14001 at all production sites ISO 50001 in Austria and India 16 Company Presentation I May, 2021 100% of the main suppliers confirm compliance with the Code of Conduct 100% RMI supply chain compliance /virtuelle_messe/2021/ats

Treffer Wolftank-Adisa

CERTIFICATES OF THE WOLFTANK-ADISA GROUP ESG Rating from ü Guaranteed compliance with the Italian Anti-Bribery and Anti- Corruption Law No. 231/2001 as a more specific approach to ISO 37001. ü Wolftank is an active member of several Technical Committees (TC's) and associated working groups for the maintenance of EN standards. 10 /virtuelle_messe/2021/wolftank