10.12.2019, 2685 Zeichen

Disclosed inside information pursuant to article 17 Market Abuse Regulation (MAR) transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

No Keyword 10.12.2019

Ternitz - The Austrian Enforcement Panel for Financial Reporting (OePR) has audited the consolidated financial statements of Schoeller-Bleckmann Oilfield Equipment AG (SBO) as of 31 December 2018 and the half-year financial statements as of 30 June 2019 in accordance with the Financial Reporting Enforcement Act (RL-KG). Based on today's preliminary notification by the Panel, there is a need for material restatement of the goodwill of the Cash Generating Unit (CGU) Resource Well Completion Technologies, Inc. (Resource) as of 31 December 2018. The goodwill of this CGU amounted to MEUR 23.7 as of 31 December 2018. The extent of the possible restatement could be in that same range. SBO expects the preliminary audit result to be confirmed in the coming weeks.

CGU Resource no longer exists in the form audited as of 31 December 2018. As of 1 October 2019, Resource and SBO's subsidiary Downhole Technology have been combined to form the new CGU "The WellBoss Company". The newly created company has high future potential and merges the high innovative capacity of Resource with the sales strength of Downhole Technology, which future potential was not taken into account in the restatement as of 31 December 2018.

Based on the final decision, SBO will make and publish the necessary corrections. Before restatement, the Group's equity amounted to MEUR 368.2 and the equity ratio to 40.9 % as of 31 December 2018. The corrections to the 2018 consolidated financial statements will reduce the Group's equity as of 31 December 2018 in the amount stated above and the equity ratio by up to 1.6 %. These corrections will also be included in the half-year financial statements as of 30 June 2019.

The non-cash goodwill restatement as of 31 December 2018 will have no impact on the 2019 result nor on the dividend proposal. It is planned to increase the dividend for the 2019 financial year compared with the previous year and it is expected to come to EUR 1.20 per share. The 2019 annual financial statements will be published on 18 March 2020.

end of announcement euro adhoc

issuer: Schoeller-Bleckmann Oilfield Equipment AG Hauptstrasse 2 A-2630 Ternitz phone: 02630/315110 FAX: 02630/315101 mail: sboe@sbo.co.at WWW: http://www.sbo.at ISIN: AT0000946652 indexes: ATX, WBI stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2917/aom

Wiener Börse Party #636: Marcel Hirscher läutet wieder die Opening Bell und ich denke dabei an Palfinger und Raiffeisen

Bildnachweis

1.

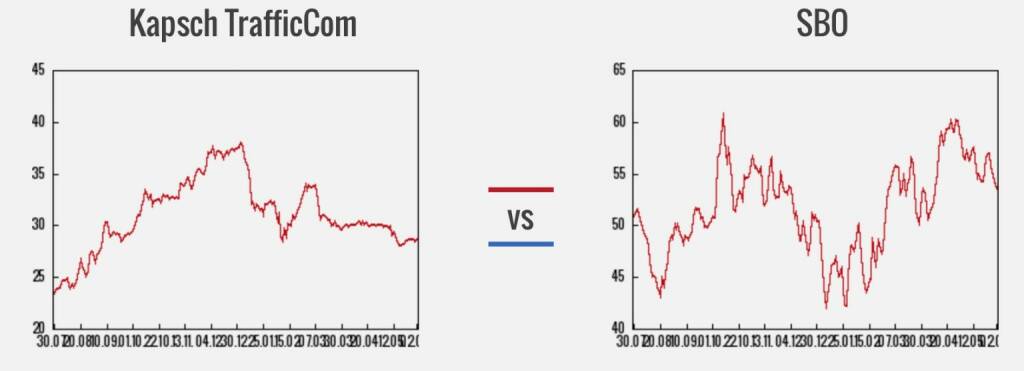

Kapsch vs. SBO

>> Öffnen auf photaq.com

Aktien auf dem Radar:Addiko Bank, Immofinanz, Marinomed Biotech, Flughafen Wien, Warimpex, EuroTeleSites AG, ATX Prime, ams-Osram, AT&S, Palfinger, RBI, Strabag, Pierer Mobility, UBM, CA Immo, Frequentis, Lenzing, SW Umwelttechnik, Oberbank AG Stamm, Wolford, Agrana, Amag, Erste Group, EVN, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

Kontron

Der Technologiekonzern Kontron AG – ehemals S&T AG – ist mit mehr als 6.000 Mitarbeitern und Niederlassungen in 32 Ländern weltweit präsent. Das im SDAX® an der Deutschen Börse gelistete Unternehmen ist einer der führenden Anbieter von IoT (Internet of Things) Technologien. In diesen Bereichen konzentriert sich Kontron auf die Entwicklung sicherer und vernetzter Lösungen durch ein kombiniertes Portfolio aus Hardware, Software und Services.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

-

20:36

-

20:06

-

19:19

-

23.04.

-

19:19

-

19:18

-

19:13

-

19:08

-

19:08

-

19:01

-

19:01

-

18:59

-

18:59

-

18:51

-

18:49

-

18:48

-

18:32

-

18:32

-

18:29

-

18:29

-

18:16

-

18:05

-

18:05

-

18:03

-

17:36

-

17:36

-

17:09

-

16:44

-

16:25

-

16:00

-

15:53

-

15:53

-

15:50

-

15:40

-

15:39

-

15:39

-

15:21

-

15:21

-

15:20

-

15:18

-

15:18

-

15:01

-

15:00

-

15:00

-

14:51

-

14:41

-

14:41

-

14:40

-

14:28

-

14:28

-

14:20