14.08.2018, 7077 Zeichen

- Romania: The National Bank of Romania has, surprisingly, signaled a near end to its rate hiking cycle in spite of inflation above target.

- Serbia: With economic growth accelerating and inflation contained, the National Bank of Serbia has no need to change its monetary policy stance.

Romania

In no other European Union member state, inflation is as high as in Romania. While for the whole European Union, Eurostat’s harmonized consumer price index (HICP) increased by 2.0 % in June, inflation was at 4.7 % in Romania. Using the domestic consumer price index, inflation was even higher at 5.4 %, although it decreased to 4.6 % in July. In spite of high inflation, the National Bank of Romania (NBR), has decided to keep monetary policy interest rates unchanged during the Board’s meeting on August 6. The monetary policy rate remains at 2.5 %, the deposit facility rate at 1.5 % and the lending facility rate at 3.5 %. Moreover, NBR Governor Mugur Isarescu indicating the country’s cycle of monetary tightening to be almost over, declaring victory over inflation. A rate hiking cycle has been initiated in early 2018 with rate hikes by 25 basis points in January, February and May. Additionally, the NBR has held its first repo auction of the year lending 10.5 billion Leu at an accepted interest rate of 2.5 %. Money market rates have, lately, signaled liquidity shortages with interbank interest rates being close to the NBR’s lending facility rate (Figure 1).

The NBR Board has mentioned three reasons for why an additional interest rate increase was not necessary. Firstly, it was highlighted that the inflation rate has stopped to increase in June, staying constant at 5.4 %. Secondly, the newly released quarterly inflation report, projects inflation to decrease to the upper band of the NBR’s inflation target at 3.5 % by year-end 2018. Thirdly, the medium-term inflation projection was revised downwards to 2.7 % by year-end 2019. Hence, over an 8-quarter projection horizon, the inflation lies within the NBR’s inflation target band of 1.5 % to 3.5 %.

The Romanian economy was expanding very rapidly in 2017 with GDP growth at 6.8 %. The first quarter of 2018 marked a slowdown of economic growth at 4.2 %, compared to the first quarter of 2017 (y/y, sa). The slowdown has mainly been driven by weaker growth of household consumption, partly compensated by slower import growth. The NBR expects a return to a more balanced growth structure between domestic demand and external demand, which is closer to the rate of potential growth. With slower economic growth the development of the output gap is assessed to be more stable which is associated with the NBR’s lower medium-term inflation projection. Besides the expected weakening of domestic inflationary pressures from excess demand, the transitory energy price effects should dampen inflation in the future. The energy price component of the HICP has increased by 17 % in June and higher base levels will lower the contribution of energy prices to inflation from the fourth quarter of 2018 onwards.

Hence, there are good reasons for why inflationary pressures should be weaker than previously expected. Nevertheless, the current inflation outlook shows inflationary risks. The ongoing labor market tightness with continued high growth rates of wages (figure 2), might fuel excess aggregate demand. Net wages continue to rise at double digit rates (June: 14.3 %, y/y) with no deceleration in sight, so far. In combination with monetary policy relevant core inflation at 3.3 % in June, which remains close to the upper band of the NBR’s inflation target band, it seems rather early to declare victory over inflation and announce the end of the monetary tightening cycle.

The real monetary policy rate has been at -2.1 % in July, being based on the nominal monetary policy rate of 2.5 % minus inflation at 4.6 %. The 3 months interbank real money market rate (ROBOR) was higher in July, though, also negative at -1.1 % (Figure 3). If the monetary policy rate would be left unchanged at the current level of 2.5 % and inflation develops as outlined in the latest NBR’s inflation report, the real monetary policy rate will be -1.0 % by the end of 2018 and -0.2 % by the end of 2019. Assuming a positive natural rate of interest for Romania, which is even true for the Euro Area (0.07 % in Q1 2018, Holston-Laubach-Williams), monetary policy would remain accommodative for the whole projection period given the interest rate hiking cycle is over. Hence, it seems rather unlikely that victory over inflation can be declared at the current monetary policy rate. The current environment might require the NBR to be patient, prudent and persistent, rather than changing course too quickly.

Serbia

The National Bank of Serbia (NBS) left the key policy rate on hold at 3.0 % last week. The NBS had lowered the key rate both in March and April by 25 basis points from 3.5 % and stopped afterwards. The long interest rate cutting cycle had started in 2012 when the key policy rate was 11.75 %. Recently, the frequency of interest rate cuts was low with 2 steps each year between 2016 and 2018.

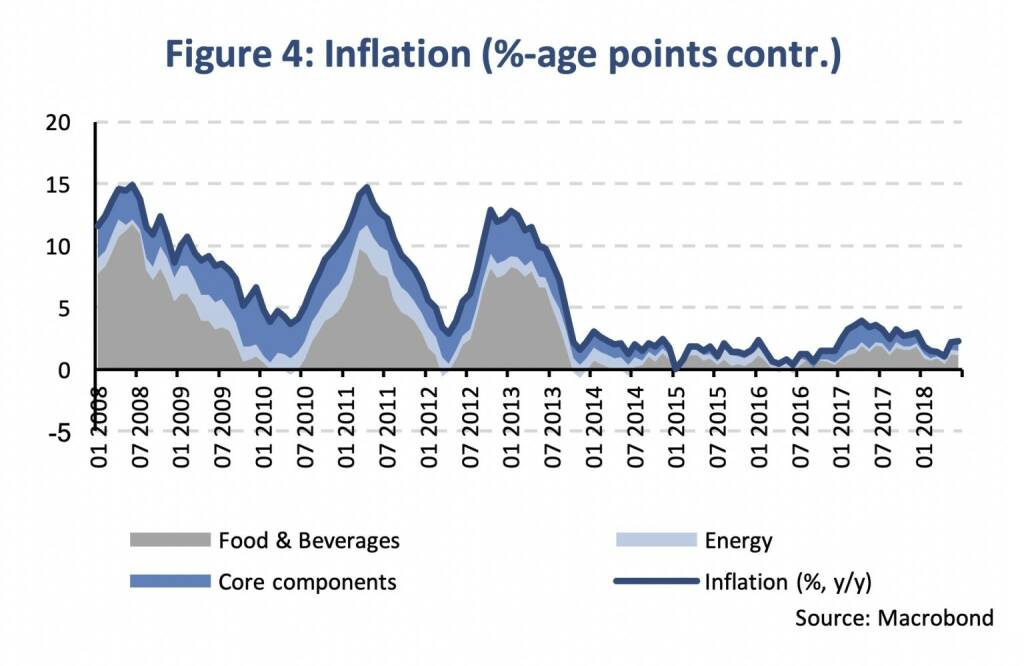

The inflation rate reached a low in April 1.0 % and increased subsequently until June (2.3 % y/y). The recent rise was largely driven by volatile components, although rising prices of core goods (1.7 % y/y in June) also contributed to the increase (Figure 4). Hence, the inflation rate has moved into the target band of +/- 1.5 percentage points around the inflation target of 3 %. According to the NBS projections from August, inflation is expected to continue to move within the target tolerance band in the next two years. By the end of 2019, inflation will most probably be below the target midpoint, while gradually approaching the midpoint in the first months of 2019.

Economic growth accelerated during the first half of the year. According to the 1st estimate, real GDP expanded by 4.4 % (y/y) in Q2 following GDP growth of 2.2 % in 2017. The H1 growth acceleration came as a surprise, which poses upside risks to our previous GDP forecast of 3.5 % for the total of 2018. In Q1, fixed investments had accelerated (+14.9 % y/y). Households consumption posted also a sound increase (+3.0 %), while net exports were a drag on growth. Construction activity accelerated during H1 2018 (+27.3 % y/y in Q2) likely being a main driver of the current bounce in economic activities. In Q1, gross valued added in construction increased by 26.4 % (y/y).

In its statement of past week, the NBS called for a cautious monetary policy stance in light of international uncertainties. A further loosening of monetary policy is not warranted given that both growth and inflation have been accelerating, in our view. According to surveys, inflation expectations (households, firms and unions) have been converging steadily (3.4 % in June) into the inflation tolerance band of the NBS. Hence, neither a tightening in monetary conditions is necessary.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #633: Heute April Verfall, Ex-Marinomed-Investor in Troubles und die Radio-Studios A, B, C und vielleicht D

Bildnachweis

1.

NBR and interbank rates

2.

Net wage growth

3.

Real short-term interest rates

4.

Inflation (%-age points contr.)

Random Partner

Strabag

Strabag SE ist ein europäischer Technologiekonzern für Baudienstleistungen. Das Angebot umfasst sämtliche Bereiche der Bauindustrie und deckt die gesamte Bauwertschöpfungskette ab. Durch das Engagement der knapp 72.000 MitarbeiterInnen erwirtschaftet das Unternehmen jährlich eine Leistung von rund 14 Mrd. Euro (Stand 06/17).

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» BSN Spitout Wiener Börse: Erste Group übernimmt year-to-date-Führung von...

» Österreich-Depots: Weekend-Bilanz (Depot Kommentar)

» Börsegeschichte 19.4.: Rosenbauer (Börse Geschichte) (BörseGeschichte)

» Aktienkäufe bei Porr und UBM, News von VIG-Tochter, Research zu Verbund,...

» Nachlese: Warum CA Immo, Immofinanz und RBI positiv bzw. voestalpine neg...

» Wiener Börse Party #633: Heute April Verfall, Ex-Marinomed-Investor in ...

» Wiener Börse zu Mittag schwächer: Frequentis, Immofinanz, Palfinger gesu...

» Börsenradio Live-Blick 19/4: DAX eröffnet zum April-Verfall deutlich sch...

» SportWoche Party 2024 in the Making, 19. April (Augarten-Zombie)

» Börse-Inputs auf Spotify zu u.a. Sartorius, Munich Re, VIG, Immofinanz, ...

-

22:54

-

22:05

-

22:05

-

18.04.

-

18:36

-

18:36

-

18:24

-

18:23

-

18:22

-

18:05

-

18:05

-

17:27

-

17:00

-

16:43

-

16:43

-

16:34

-

15:44

-

15:37

-

15:31

-

15:31

-

15:20

-

15:00

-

14:53

-

14:53

-

14:40

-

14:20

-

14:00

-

13:45

-

13:07

-

13:07

-

13:04

-

13:01

-

13:01

-

13:01

-

12:51

-

12:42

-

12:41

-

12:41

-

12:28

-

12:28

-

12:21

-

12:21

-

11:58

-

11:46

-

11:46

-

11:29

-

11:29

-

11:22

-

11:01

-

11:01

-

10:29