16.07.2019, 10244 Zeichen

- Prolonged uncertainty is enough to justify monetary policy easing

- The Euro Area outlook is split between mounting uncertainty about business and investors’ sentiment – implying a continuing slowdown – and a profound labor market picture.

- CEE outstrips growth in advanced economies substantially. Eastern European EU member states remain the growth leaders among EU countries. Low inflation and interest rates as well as multi-year lows in unemployment underpin a favorable business environment.

- Monetary policy easing is back on the table

Major developments

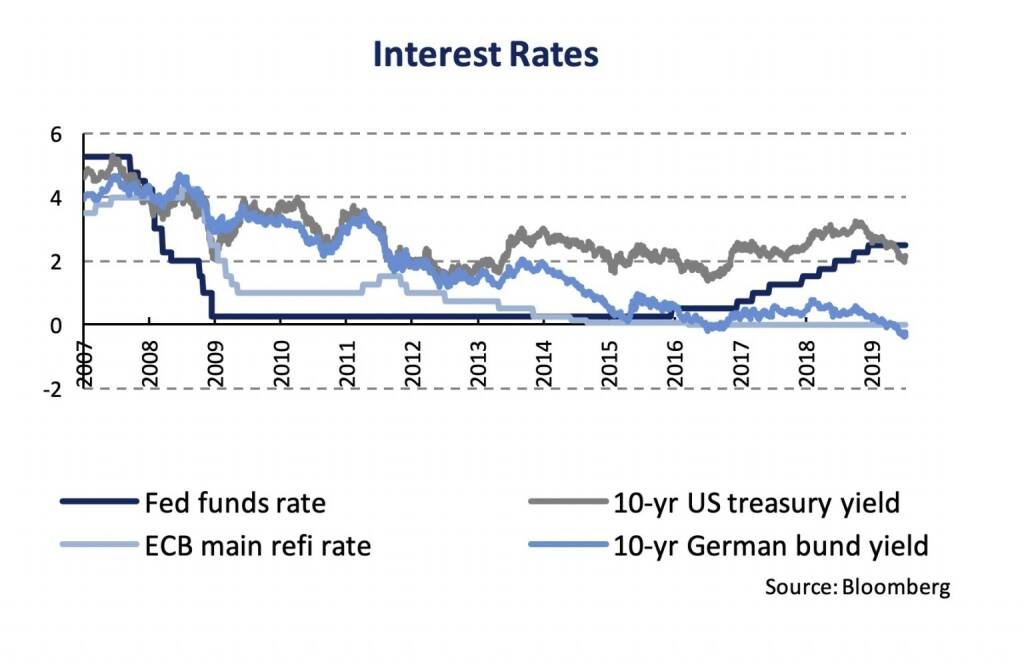

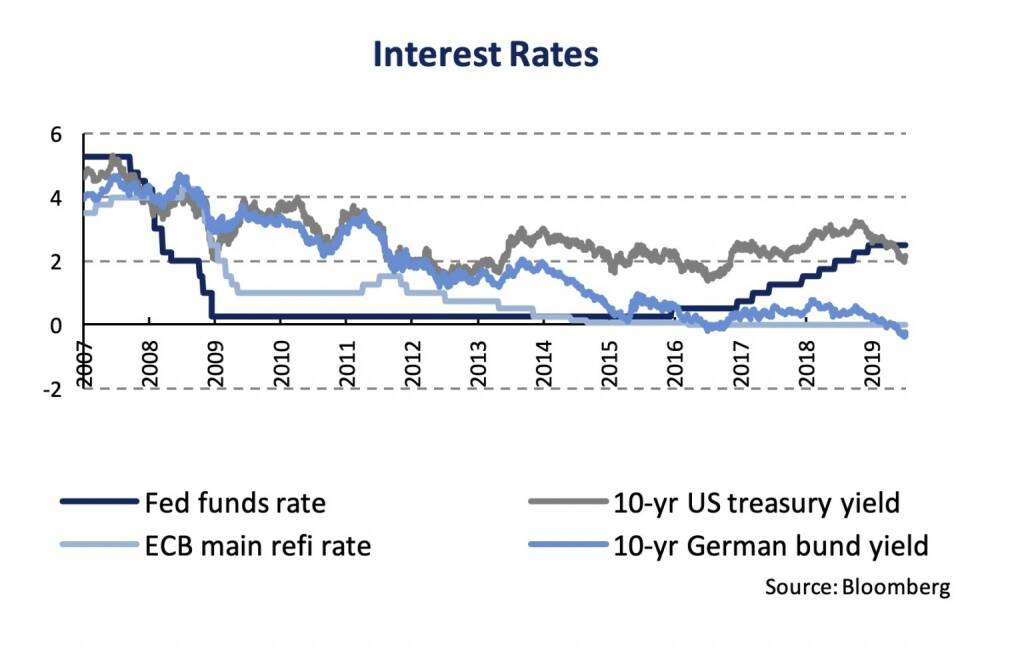

Prolonged uncertainty seems to justify monetary policy easing. Financial investors express their fears about a nasty response of the global economy to the trade war with lower and lower yields and, following their heavy front-running, major central banks now threaten us with another loosening of monetary policy. Inflation runs below the European Central Bank’s and the US Fed’s target and central bankers restart talking about lower policy rates, negative yields, QE and other ammunition; as ever.

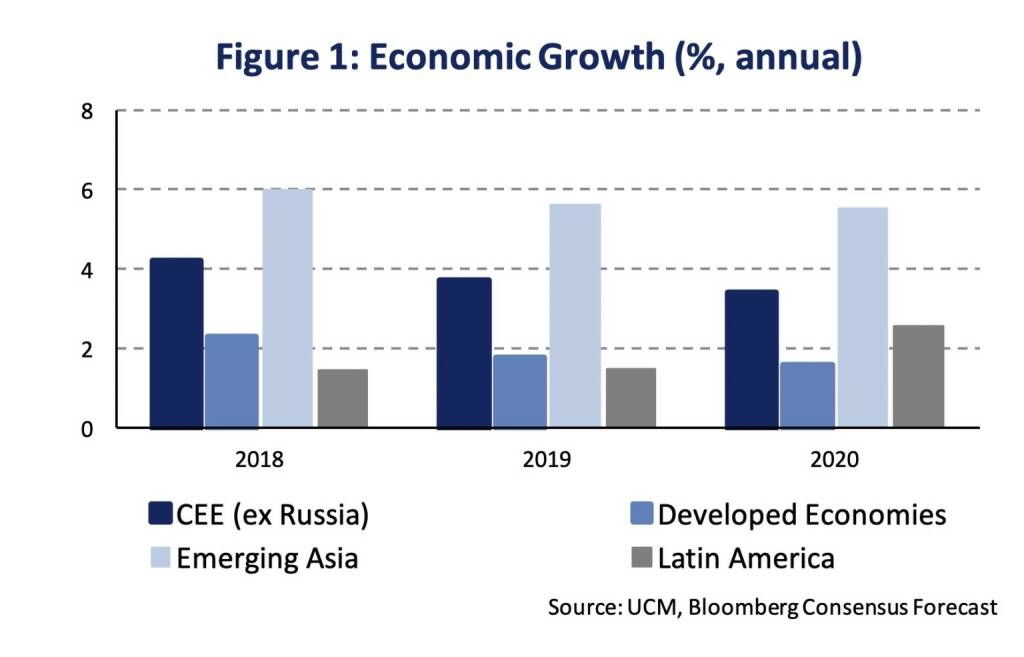

Meanwhile, the global economy continues to expand (Figure 1), yet, growth prospects have been lowered considerably over past quarters, predominantly based on weak global trade and deteriorating sentiment. Most recent projections for global growth in 2019/20 are between 2.6/2.7 % (World Bank) and 3.3/3.6 % (IMF).

The threat of protectionism remains to be the main source of prolonged economic uncertainty. The G20 agreement between Trump and Xi to restart US-China trade talks has prevented a further escalation, though it is far from certain that a successful deal can be reached any time soon.

Major central banks are citing heightened and prolonged uncertainty and signal the possibility of easing monetary policy. Yet, the economic outlook has recently not deteriorated any further. In fact, GDP growth has surprised to the upside both in the Euro Area and the United States during the first quarter. Labor markets remain tight and unemployment rates are setting new all-time lows (US: 3.6 %, EA: 7.5 %). The probability of an imminent recession is low. In Austria, business conditions remain solid in spite of a gradual cooling. Germany’s industry rings the alarm bell as it is in contraction.

Inflation, though, runs below the central banks‘ targets. US core inflation (PCE) has fallen to 1.6 % in May from 2.0 % at the end of 2018. In the Euro Area core inflation fails to gain momentum, fluctuating around 1 % for the past years (June: 1.1 %). A notable deterioration was visible in market-based inflation expectations (US: 1.8 %, EA: 1.2 %), while long-term survey-based inflation expectations remain well anchored near the inflation target.

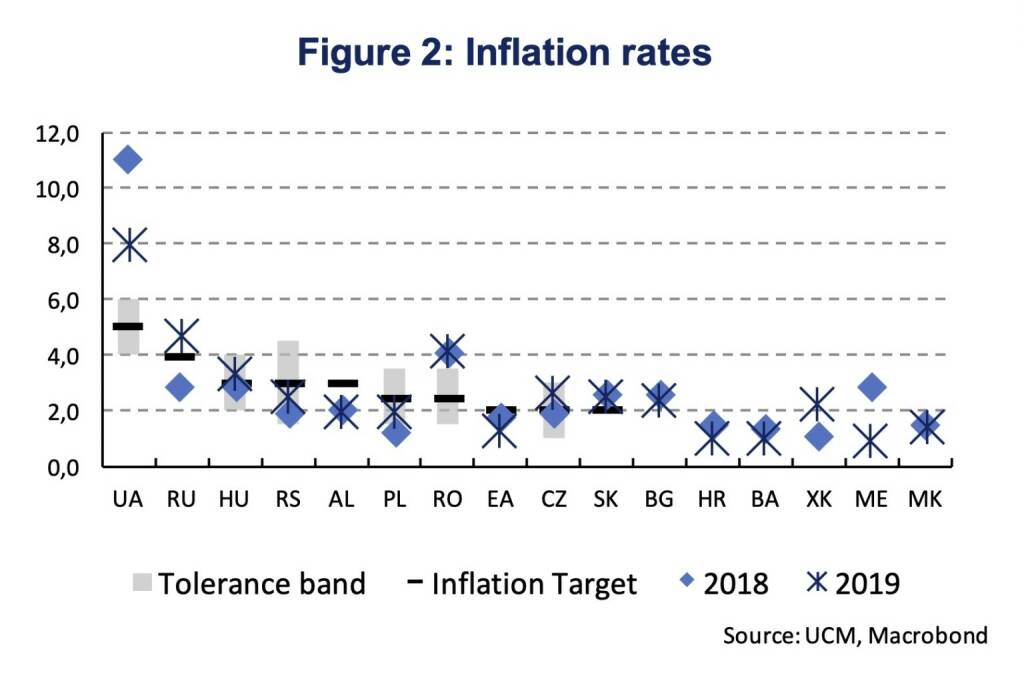

For the time being, spillovers to Central and Eastern Europe are disguised. The region decouples and growth prospects outstrip advanced economies substantially. Inflation rates remain benign in most countries (Figure 2). Recently, monthly inflation passed the respective inflation targets in Central Europe (PL, HU, CZ). Nevertheless, CEE central banks remain cautious regarding monetary policy tightening within a weak external macroeconomic environment and high uncertainty.

Eurozone: Split

- The Euro Area outlook is split between mounting uncertainty about business and investors’ sentiment – implying a continuing slowdown – and a profound labor market picture.

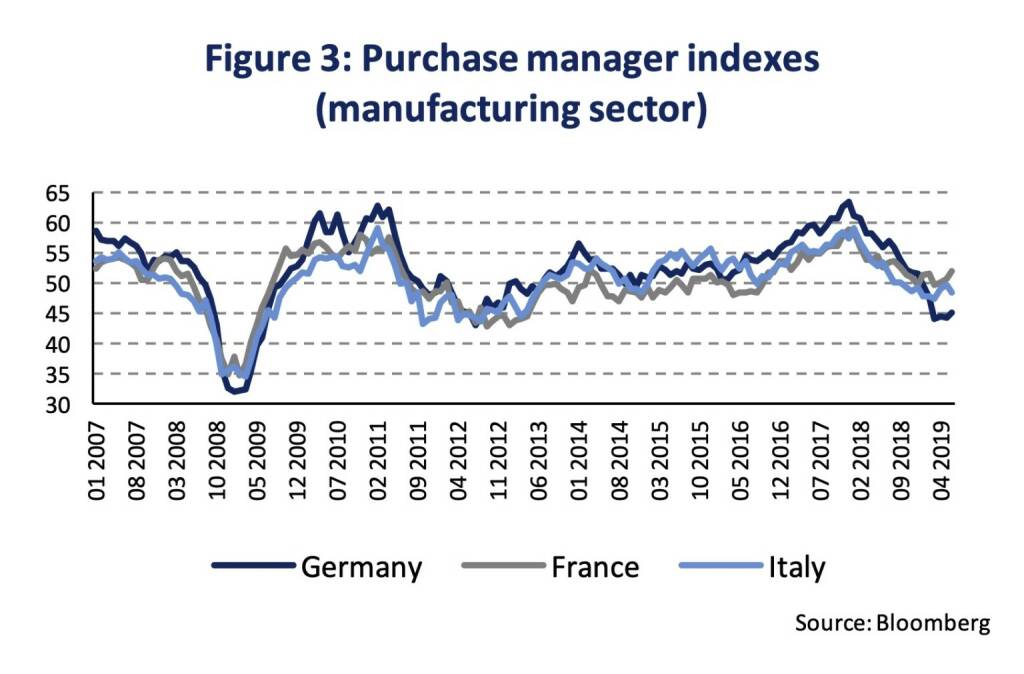

Uncertainty about near-term Euro Area business cycle prospects mounts, as business surveys slide (Figure 3), investors express their fears with ultra-low, even negative yields and central bankers anticipate the downside risks. Businesses and investors seem to attach both a high chance and a high impact of an upcoming trade shock. Yet, growth data rather surprised on the upside during the first months of the year, while we do not know how far or even if the economy will fall from the cliff during the coming months.

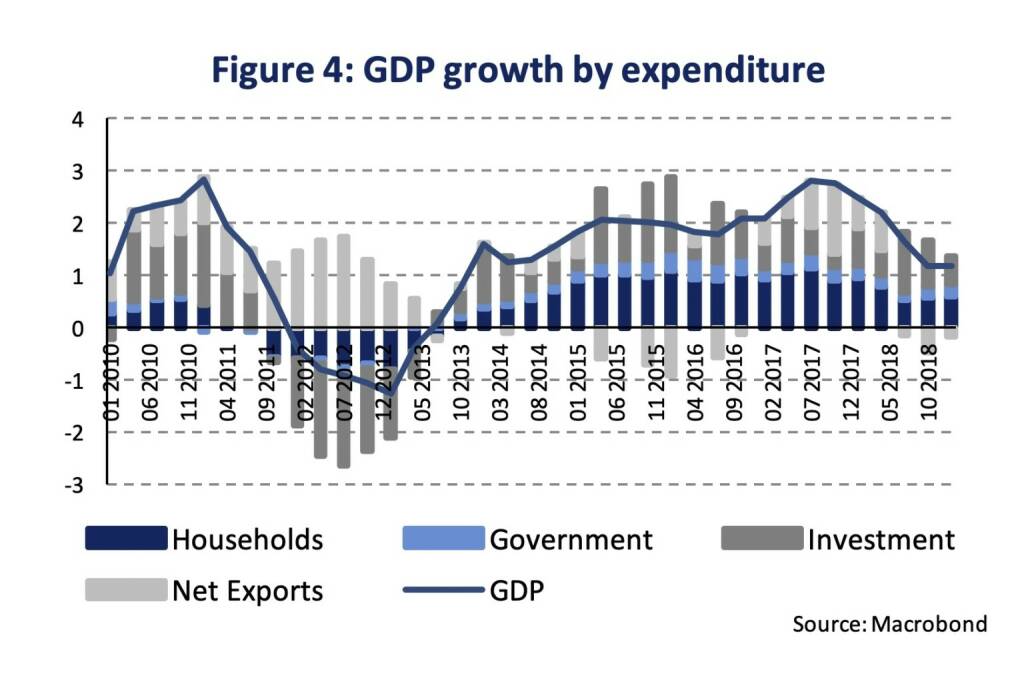

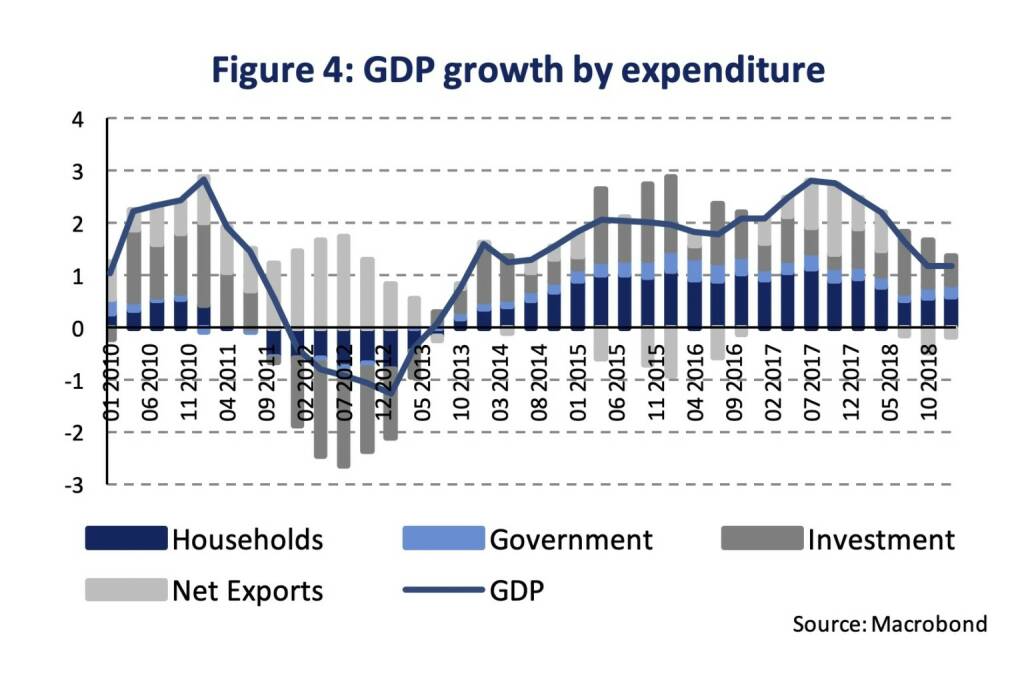

In Q1, real GDP surprisingly rose by 0.4 % after a weak H2 2018 (0.2 % q/q) indicating solid economic activities (Figure 4), however, there are some indicators signaling a further softening in Q2. Domestic demand has been supporting growth, while net external trade subtracts from GDP. Private consumption expands moderately (0.5 % q/q and 1.1 % y/y) and fixed investment made the largest growth contribution (1.1 % q/q and 4.8 % y/y) in spite of slowing business sentiment. Signs for capacity constraints already emerge invoking our expectation that growth will eventually converge towards a sustainable, long-run level (~1.5 % p. a.) or, otherwise, investment might have to accelerate. Latest data suggest weak short-term dynamics (including our Q2 nowcast signaling 0.1 % q/q GDP growth), i. e. a continued slowdown.

A main driver of a slowdown is the industry which is contracting given slower international demand (-0.5 % y/y in May) and after it had reached a trough in December (-4.2 % y/y). The German industrial production had a low last year (-3.9 % in November), and dropped again sharply in May (-3.7 %). On the other side, there are quite solid developments in construction (+3.9 %) and retail (+1.8 % in April). Consumer demand remains very well support by the labor market conditions. The unemployment rate has been declining (7.5 % in May), what is already a relatively low level for the Eurozone. Wage growth likely peaked in H2 2018 (+2.4 %) though continued to expand (2.2 % in Q1). The same might be true for job growth, which continued in Q1 (1.3 % y/y/).

Central and Eastern Europe[1]: Decoupled

- CEE outstrips growth in advanced economies substantially. Eastern European EU member states remain the growth leaders among EU countries. Moderate inflation and interest rates as well as multi-year lows in unemployment underpin a favorable business environment.

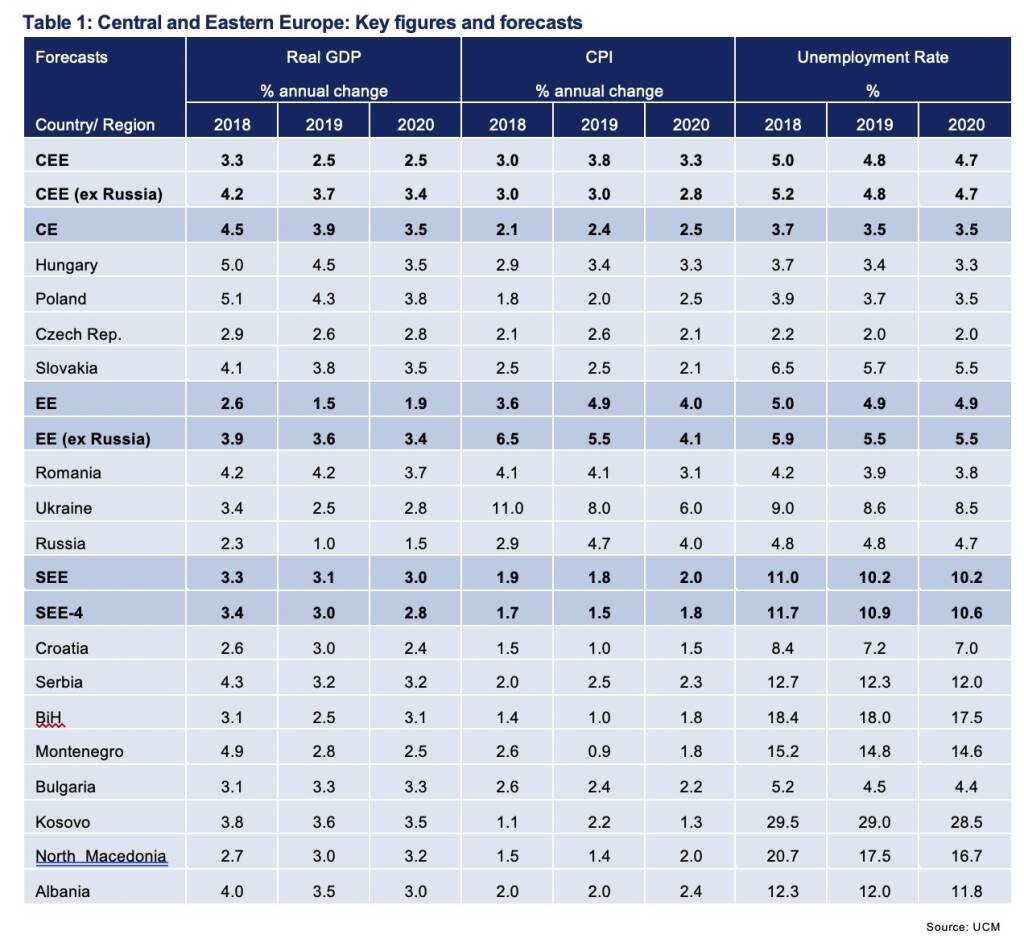

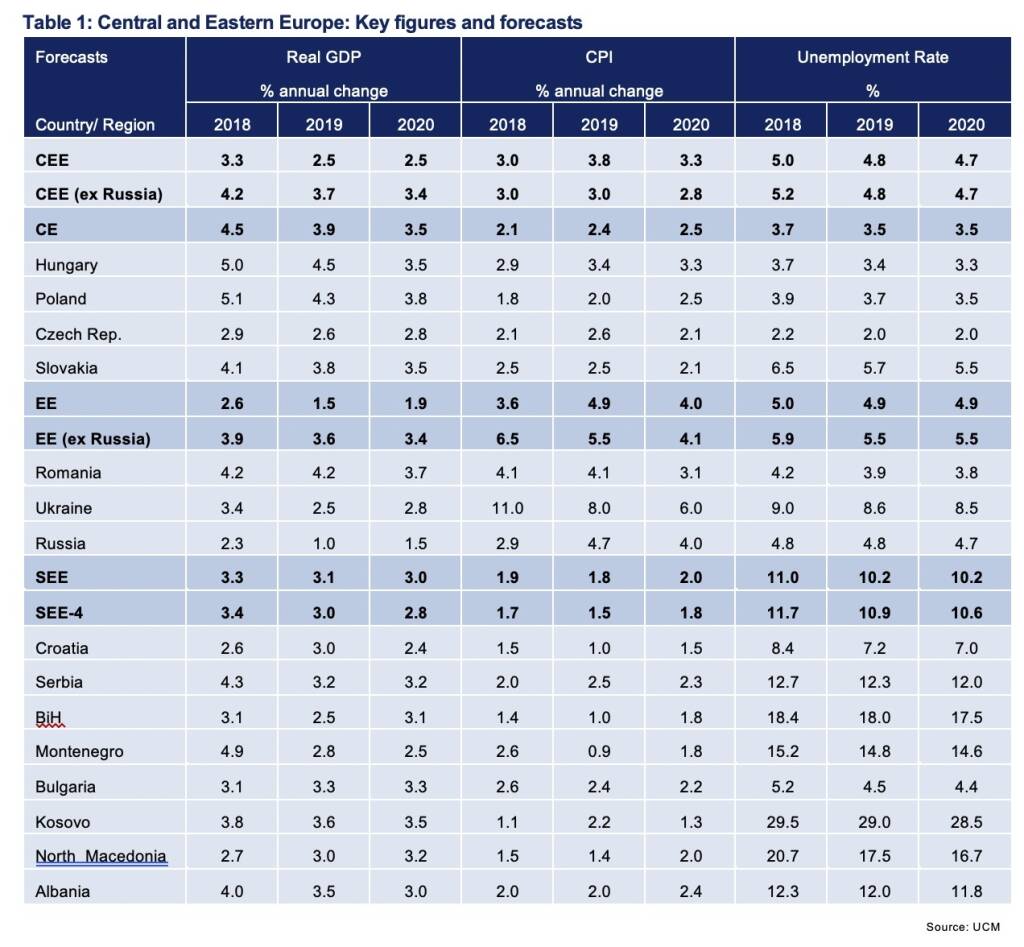

In spite of mounting slowdown fears in a lot of advanced economies, the CEE region is projected to expand solidly by 2.5 % in 2019 and 2020 (3.7 % and 3.4 % ex Russia). In a way, the region decouples from advanced economies for longer than expected (Table 1).

A solid expansion is set to continue in Central Europe (CE). Economic growth surprised to the upside in Poland (1.5 %, q/q) and Hungary (1.5 %), kept its solid pace in Slovakia (0.9 %) and was only marginally weaker in the Czech Republic (0.6 %). Inflation has passed the respective inflation targets in all CE economies now, also driven by rising food prices which might prove to be transitory. Inflation is highest in Hungary (3.9 %, May), has picked up in the Czech Republic (2.9 %), Slovakia (2.7 %) and Poland (2.6 %, June). Nevertheless, central banks refrain from any aggressive tightening of monetary conditions amid moderate inflation in the Euro Area and global business cycle uncertainties.

Russia maintains macroeconomic stability but remains in a low growth equilibrium. In addition, slowing inflation paves way for lower interest rates. Ukraine continues its economic recovery, yet the consumer price inflation is still elevated. The Romanian economy continues to be driven by domestic demand, based on rising wages and consumption, at the same time Romania’s external position (current account) weakens.

Croatia and Serbia keep a solid business cycle. Both countries see solid domestic demand; particularly a pick-up in fixed investment. An economic cooling of Montenegro could reveal financial imbalances, which have been masked by high growth previously. So far 2019 has seen robust growth in Bulgaria and North Macedonia, while the business cycle has become somewhat less balanced in Bosnia & Herzegovina (BiH). Labor markets continue to gradually improve, yet in the case of BiH, North Macedonia and Kosovo from very high levels. In BiH the labor market remains structurally weak and skilled labor is scarce, a problem which is amplified by high emigration rate (brain drain).

Financial Markets: Monetary policy easing is back on the table

- ECB monetary policy normalization is over and out amid prolonged uncertainty to the Euro Area’s economic outlook. Mario Draghi has even paved the way for further easing measures in the absence of improvement.

- The Fed signals to be less patient regarding future adjustments to the federal funds rate. The US economy continues to expand solidly, yet uncertainties to the outlook have increased, particularly with respect to inflation.

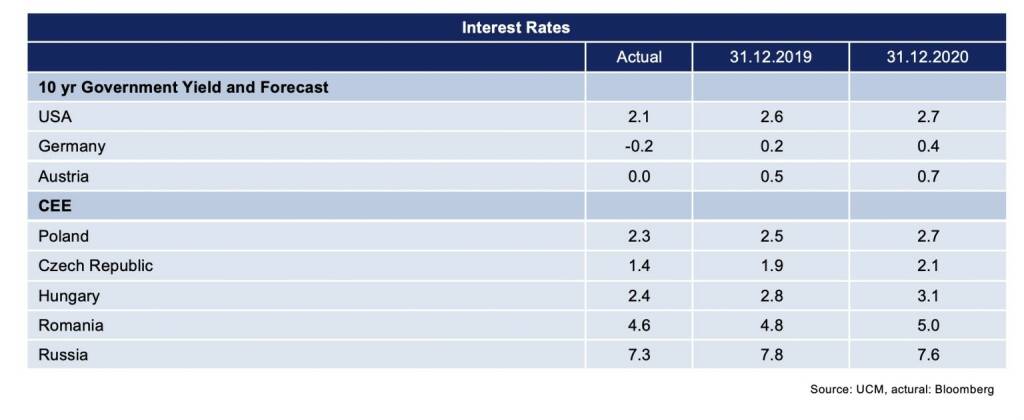

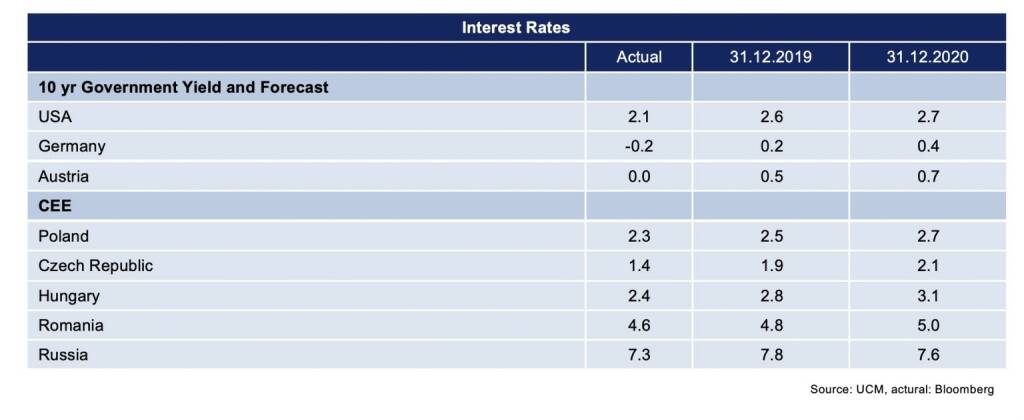

The Euro Area’s economic outlook, as presented by the ECB’s quarterly macroeconomic projections, has not changed materially since March. As before, the risks surrounding the growth outlook remain titled to the downside as global trade disputes remain unsolved. In reaction to the prolongation of uncertainty, the ECB’s Governing Council decided to extend the forward guidance on interest rates, which are now expected to remain unchanged at least through the first half of 2020 (previously: end of 2019). Financial markets expect interest rates to be cut, the deposit facility rate is currently set at -40 bp. Further easing of monetary policy (lower deposit facility rate, restarting the asset purchase program) is not off the table and has been discussed by the Governing Council in the case of adverse contingencies. Mario Draghi has even further fueled expectations stating that additional stimulus will be required in the absence of improvement.

The US Federal Reserve has completed its interest rate hiking cycle with the target range of the federal funds rate at 2.25 to 2.5 %. Future adjustments in the federal funds rate depend on incoming business cycle indicators. The patience of determining future adjustments has, however, been removed from the Fed’s monetary policy statement in June. Moreover, uncertainties regarding the outlook of a sustained expansion in economic activity, strong labor market conditions and inflation near the 2 % objective have increased. Projections of the federal funds rate by members of the Federal Open Market Committee shifted lower, the median assessment indicating no change in 2019 and 1-2 cuts in 2020. Financial markets are currently pricing a 50 bp decrease in the federal funds rate as early as July.

[1] CEE is including only countries where UNIQA Insurance Group is active.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #632: Warum CA Immo, Immofinanz und RBI positiv bzw. voestalpine negativ auffallen, morgen April-Verfall

Bildnachweis

1.

Economic Growth

2.

Inflation rates

3.

Purchase manager indexes

4.

GDP growth by expenditure

5.

Interest Rates

6.

Central and Eastern Europe: Key figures and forecasts

7.

Interest Rates

Aktien auf dem Radar:Amag, Palfinger, SBO, Addiko Bank, Flughafen Wien, Austriacard Holdings AG, EVN, EuroTeleSites AG, Pierer Mobility, Semperit, Bawag, Kostad, Wolford, Oberbank AG Stamm, Polytec Group, ams-Osram, Agrana, CA Immo, Erste Group, Immofinanz, Kapsch TrafficCom, Mayr-Melnhof, OMV, Österreichische Post, Strabag, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

Porr

Die Porr ist eines der größten Bauunternehmen in Österreich und gehört zu den führenden Anbietern in Europa. Als Full-Service-Provider bietet das Unternehmen alle Leistungen im Hoch-, Tief- und Infrastrukturbau entlang der gesamten Wertschöpfungskette Bau.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» BSN Spitout Wiener Börse: Wienerberger zurück in den Top5 year-to-date

» SportWoche Party 2024 in the Making, 14. April (2nd Screens)

» SportWoche Party 2024 in the Making, 15. April (SportWoche-Riegel)

» Österreich-Depots unveändert (Depot Kommentar)

» Börsegeschichte 18.4.: Mayr-Melnhof (Börse Geschichte) (BörseGeschichte)

» SportWoche Party 2024 in the Making, 18. April (ein Freund, ein guter Fr...

» Reingehört bei A1 Telekom Austria (boersen radio.at)

» News von Verbund und VIG, Research zu Palfinger, A1 Telekom Austria, Ers...

» Nachlese: Matejka Poetry Slam, B&C, 10% auf Wienerberger (Christian Dras...

» Wiener Börse Party #631: XXS-Folge mit einer Facette, in der CA Immo, Im...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2U2W8 | |

| AT0000A39UT1 | |

| AT0000A2SUY6 |

- BSN Spitout Wiener Börse: Wienerberger zurück in ...

- Wiener Börse: ATX am Donnerstag fester, Bawag mit...

- Wiener Börse Nebenwerte-Blick: Kostad mit Kursver...

- Wie Kostad, Wolford, ams-Osram, BTV AG, Addiko Ba...

- Wie Bawag, Lenzing, EVN, SBO, Immofinanz und OMV ...

- Österreich-Depots unveändert (Depot Kommentar)

Featured Partner Video

Wiener Börse Party #621: Voll Komplexes bei der RBI, ziemlich Komplexes bei der Addiko Bank und Verbund unter Druck

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse....

Books josefchladek.com

Berlin. Symphonie einer Weltstadt

1959

Ernst Staneck Verlag

I’ll Bet the Devil My Head

2023

Void

Flughafen Berlin-Tegel

2023

Drittel Books

Christian Reister

Christian Reister Sebastián Bruno

Sebastián Bruno Andreas H. Bitesnich

Andreas H. Bitesnich Vladyslav Krasnoshchok

Vladyslav Krasnoshchok Jerker Andersson

Jerker Andersson