Vienna Insurance Group increases premiums and profits in the 1st quarter of 2019 / Double-digit growth rate in health insurance

22.05.2019, 3808 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Financial Figures/Balance Sheet

-\nPremiums rise to EUR 2.9 billion (+3%)\nProfit (before taxes) increases to EUR 127.5 million (+9%)\nCombined ratio of 96.8% (+0.6 percentage points)\nVienna Insurance Group continued to grow in the first quarter of 2019. A solid increase in premiums and profit (before taxes) shows that performance is on schedule to meet the goals set for 2019. The combined ratio recorded a small weather-related increase. "We can look back on a successful first quarter of 2019, with results that are clearly in line with our expectations. Therefore, we maintain our targets to achieve a premium volume of EUR 9.9 billion and profit (before taxes) of EUR 500 to 520 million in 2019", explained Elisabeth Stadler, CEO of Vienna Insurance Group.

Double-digit premium growth in health insurance Total premium volume has reached EUR 2.9 billion in the first three months of 2019. This implies a 2.9% year-on-year increase. Health insurance recorded the largest premium growth of around 10%. Single-premium life insurance, which only reported a small quarter-on-quarter decrease of around 2% in the first quarter, now shows the improvement that was expected after the large decreases that were intentionally recorded in the past. The markets in Bulgaria, the Baltic states, Hungary and Poland contributed exceptional premium increases in the 1st quarter of 2019.

Profit (before taxes) improved by 9% Profit (before taxes) amounts to EUR 127.5 million. This implies an 8.7% year- on-year increase. The Austria, Slovakia and Poland segments made particularly large contributions to the increase in profit.

Profit (after taxes and non-controlling interests) rose by 10.5% to EUR 83.5 million.

Combined ratio records a small weather-related increase As expected, the winter storms that occurred in Austria and the Czech Republic at the beginning of 2019 increased claims expenses compared to the previous year. The combined ratio rose marginally by 0.6 percentage points to 96.8%. The Slovakia (-4.0 percentage points) and Bulgaria (- 3.1 percentage points) segments achieved very positive developments in their respective combined ratios.

The financial result amounted to EUR 186.6 million in the first quarter of 2019. This implies a 21.7% year-on-year decrease that was due mainly to a reduction in profits on the disposal of investments.

Group investments including cash and cash equivalents amounted to EUR 38.7 billion (+2.8% compared to 31 December 2018) as of 31 March 2019.

Other VIG has adjusted its reporting in line with a change in the rules for the prime market segment of the Vienna Stock Exchange. In this respect, no changes apply to the annual and half-year financial reports. However, starting in 2019, interim reports in accordance with IAS 34 will no longer be prepared for the 1st and 3rd quarters. The quarterly figures for net assets, financial position and results of operations for the 1st and 3rd quarters are prepared in accordance with the International Financial Reporting Standards (IFRS).

end of announcement euro adhoc

Attachments with Announcement: ---------------------------------------------- http://resources.euroadhoc.com/documents/59/5/10310132/1/190522_-_IR_News_VIG_Results_3M_2019__IR_.pdf

issuer: Vienna Insurance Group AG Wiener Versicherung Gruppe Schottenring 30 A-1010 Wien phone: +43(0)50 390-22000 FAX: +43(0)50 390 99-22000 mail: investor.relations@vig.com WWW: www.vig.com ISIN: AT0000908504 indexes: ATX, VÖNIX, WBI stockmarkets: Prague Stock Exchange, Wien language: English

Digital press kit: http://www.ots.at/pressemappe/7674/aom

Wiener Börse Party #632: Warum CA Immo, Immofinanz und RBI positiv bzw. voestalpine negativ auffallen, morgen April-Verfall

VIG

Uhrzeit: 13:35:10

Veränderung zu letztem SK: 0.43%

Letzter SK: 29.00 ( 1.05%)

Bildnachweis

1.

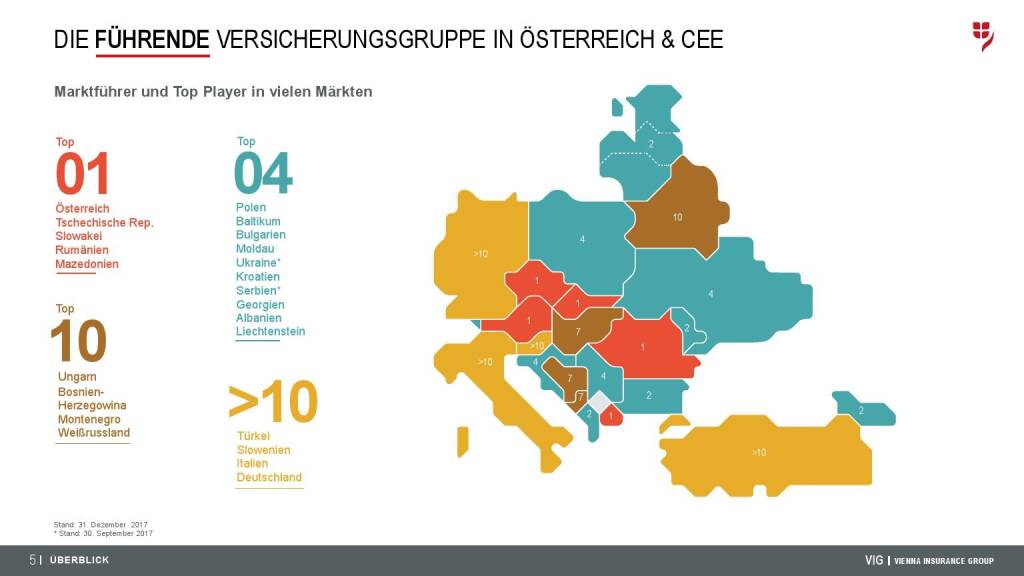

VIG Unternehmenspräsentation - Führende Versicherungsgruppe

>> Öffnen auf photaq.com

Aktien auf dem Radar:Rosenbauer, SBO, Palfinger, Addiko Bank, Austriacard Holdings AG, Flughafen Wien, EVN, Immofinanz, AT&S, ams-Osram, Marinomed Biotech, Porr, Warimpex, SW Umwelttechnik, Oberbank AG Stamm, Pierer Mobility, Agrana, Amag, CA Immo, Erste Group, Kapsch TrafficCom, Österreichische Post, Strabag, Telekom Austria, Uniqa, VIG, Wienerberger, Continental, adidas, Travelers Companies, Fresenius.

Random Partner

CA Immo

CA Immo ist der Spezialist für Büroimmobilien in zentraleuropäischen Hauptstädten. Das Unternehmen deckt die gesamte Wertschöpfungskette im gewerblichen Immobilienbereich ab: Vermietung und Management sowie Projektentwicklung mit hoher in-house-Baukompetenz. Das 1987 gegründete Unternehmen notiert im ATX der Wiener Börse.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2SUY6 | |

| AT0000A39UT1 | |

| AT0000A2C5J0 |

- EZB fordert auf: RBI soll Reduzierung der Geschäf...

- Wiener Börse Party #631: XXS-Folge mit einer Face...

- Wiener Börse zu Mittag stärker: Strabag, Bawag, V...

- Unser Robot findet: Continental, adidas, Traveler...

- Börsenradio Live-Blick 18/4: DAX okay, Sartorius-...

- Bestätigtes Buy für Palfinger

Featured Partner Video

Die Deutschen wieder im Glück

Das Sporttagebuch mit Michael Knöppel - 5. April 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel - 5. A...

Books josefchladek.com

Berlin. Symphonie einer Weltstadt

1959

Ernst Staneck Verlag

I’ll Bet the Devil My Head

2023

Void

Bonifica

2024

Self published

Valie Export

Valie Export Tommaso Protti

Tommaso Protti Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.) Naotaka Hirota

Naotaka Hirota Igor Chekachkov

Igor Chekachkov Futures

Futures