16.04.2018, 5146 Zeichen

- While the recovery has been weak, we have been arguing that Russia gained in macroeconomic stability in recent years.

- Financial shock-absorbing factors include low inflation and the transition to a new monetary policy framework, rebuilt FX reserves, a prudent fiscal rule and a consumption-driven recovery.

In a surprise action, on Friday 6th April, the US Office of Foreign Assets Control (OFAC) designated Rusal, a Russian corporate issuing foreign currency denominated bonds, as a specially designated national (SDN). US persons holding debt and equity in the company must sell its holdings until 7th May 2018. How resilient is the macroeconomy to financial shocks such as the tightening in foreign currency financing conditions? Higher firm borrowing cost lower investment and employment. Currency depreciation induces higher domestic inflation and a tightening response by the central bank raising domestic borrowing cost for companies and households. Households react with lower consumption and the economy enters a recession. The US announcement was a surprise and further steps are unknown. However, what we can evaluate is how resilient the Russian economy would be to absorb such shocks.

The recovery has been weak and – in absence of a positive impulse from higher oil prices – the Russian economy is hardly able to generate growth above its potential (1.5 %). In Q4 2017, real GDP growth slowed (0.8 % y/y) compared to the preceding three quarters in 2017 (avg. 1.6 %). Economic growth has predominately been driven by the recovery in private consumption (+4.3 % y/y in Q4), while net exports subtracted from GDP growth in Q4 (~1.7 %-age points) and during the whole last year (Figure 1).

The recovery in fixed investment has been subdued since the recession in 2015. Gross fixed capital formation rose by 3.4 % in Q4 and, hence, slower than in the two previous quarters (7.0 % and 4.0 %). Investment might have even contracted versus the previous quarter (-1.3 %) according to our own seasonally-adjusted calculation. This all mirrors a very adverse investment environment. Total annual 2017 growth is estimated at 1.5 %. Economic growth is likely to remain near potential growth in 2018 and 2019.

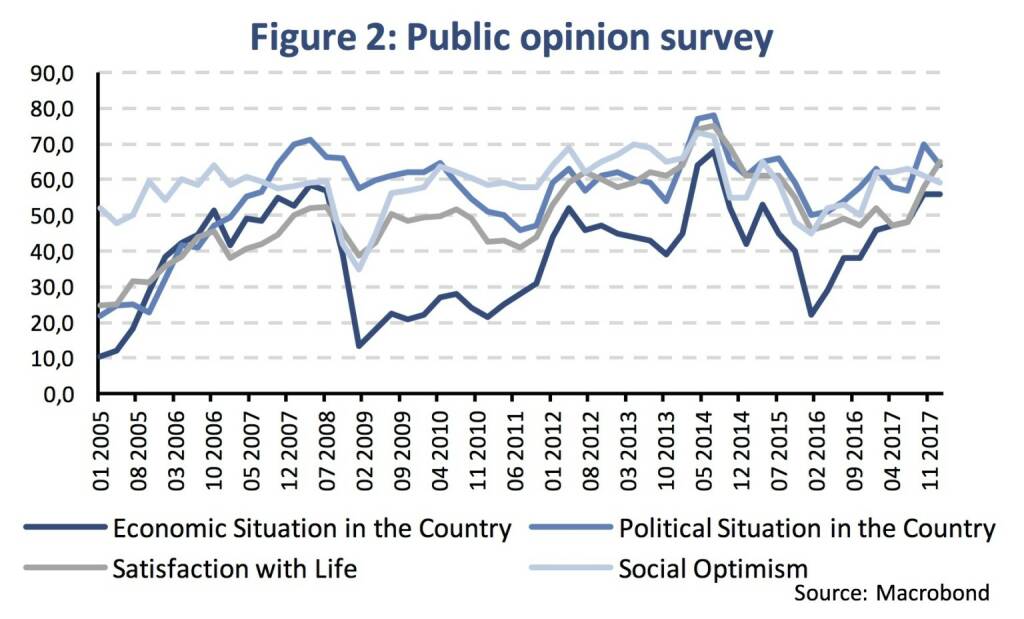

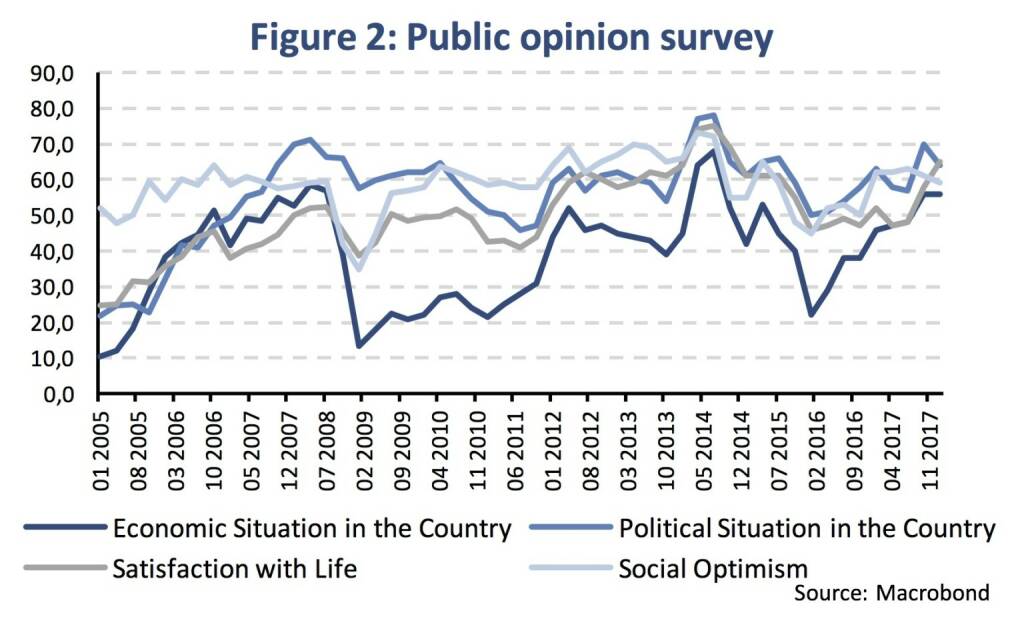

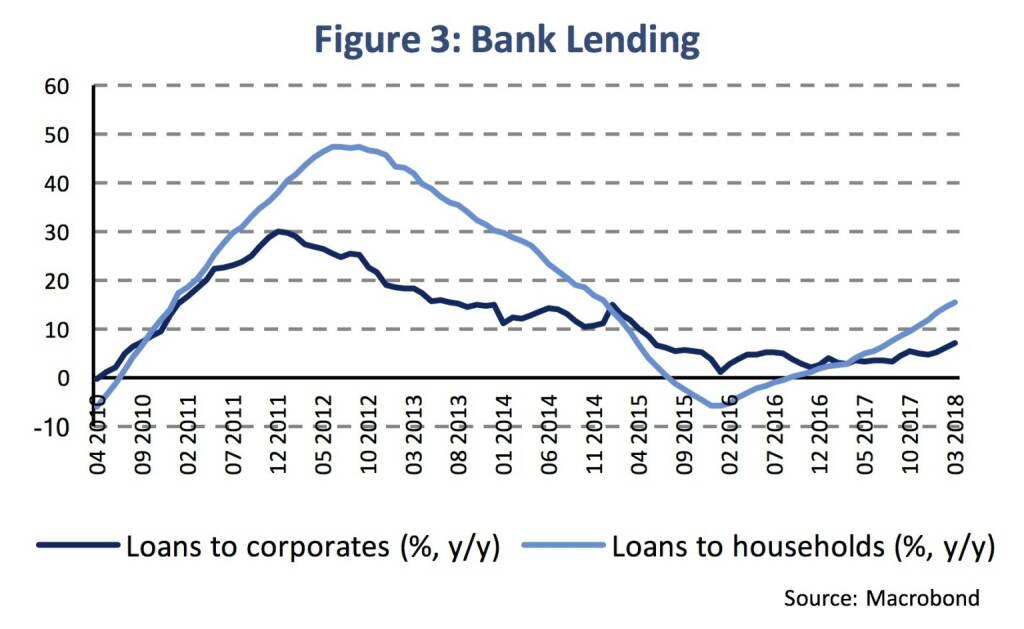

Consumer indicators kept improving during the first months in 2018. In February, real wage growth accelerated to 9.1 % (3-months average) amid higher nominal wages (+11.6 %) and low consumer price inflation. Retail and car sales rose by 2.6 % and 23.3 % (y/y) in February (3-months average). With regards to household surveys (Public Opinion Research Center), social mood improved with respect to the economic situation of the country since 2015/16 (Figure 2). In addition, consumers’ balance sheets gained from the recovery in household lending (+15.5 % y/y in December) and lower credit costs (Figure 3). The unemployment rate has been rather stable around 5 % for some time.

The recovery has so far been driven by household expenditure and the above factors suggest that the economic situation of the consumer keeps improving. Moreover, consumers are less directly concerned by foreign financial sanctions.

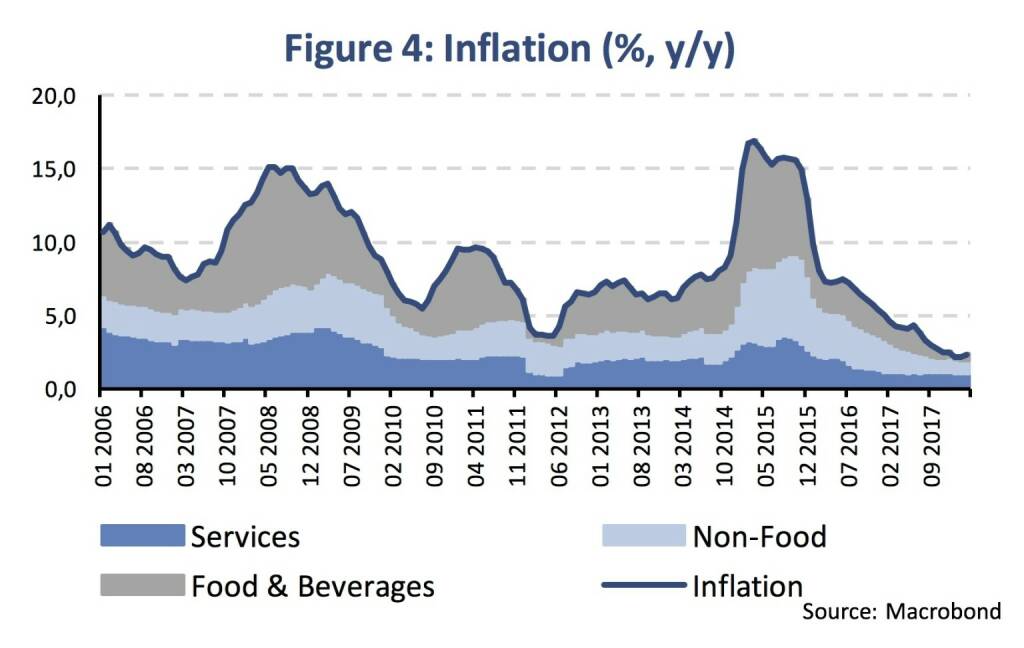

In addition, the inflation rate has rapidly been decelerating to a multi-year low (2.4 % y/y in March) helped by a transitory drop in food prices (Figure 4). Against this background, the Central Bank of Russia (CBR) was able to decrease the main policy rate to 7.25 % until March (from 10 % in early 2017) to support growth in the economy. With the central bank inflation target at 4 %, inflation expectations in the private sector have been adopting to a lower level accordingly. The ruble lost less than 10 % versus the USD last week and we would roughly estimate the inflation pass-through of a 10 % shock to the exchange rate to around 1-2 %-age points. Hence, given that inflation has fallen to a historic low, the CBR will likely judge the impact to be minor and temporary and would not see enough reason to tighten the domestic economic conditions. In addition, total foreign exchange reserves were rebuilt to 457 bn USD in December (Figure 5). Central bank reserves had slid in 2015 before the CBR had to abandon the ruble exchange rate band and switched to an inflation-targeting regime. In an emergency case of drying-up liquidity, the CBR could provide FX liquidity to the banking sector and directly to corporates.

Finally, fiscal policy is set to remain prudent. In November, the 12-months average of the federal budget deficit decreased to 1.3 % after a peak above 3 % in 2016. The new fiscal rule regards any oil & gas income in excess of the one corresponding to a price of oil at 40 USD/bl as unsustainable. Excess oil income is transferred to the National Wellbeing Fund that amounted to 65.9 bn USD in December 2017.

To some extent, improving economic conditions of Russian households that have been driving the weak recovery, lower inflation, higher currency reserves and monetary policy room to maneuver as well as a prudent fiscal stance support the Russian economy against further financial shocks.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #636: Marcel Hirscher läutet wieder die Opening Bell und ich denke dabei an Palfinger und Raiffeisen

Bildnachweis

1.

Contribution to GDP growth

2.

Public opinion survey

3.

Bank lending

4.

Inflation

5.

FX Reserves

6.

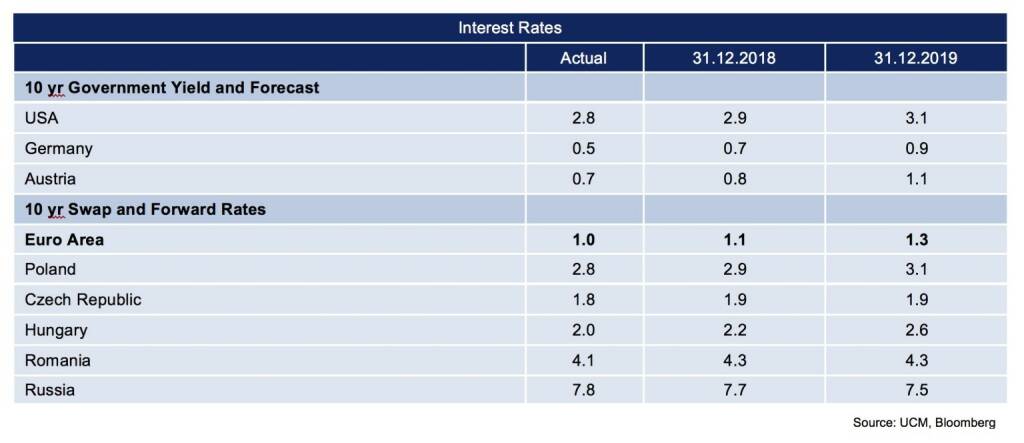

Interest Rates

Aktien auf dem Radar:Addiko Bank, Immofinanz, Marinomed Biotech, Flughafen Wien, Warimpex, EuroTeleSites AG, ATX Prime, ams-Osram, AT&S, Palfinger, RBI, Strabag, Pierer Mobility, UBM, CA Immo, Frequentis, Lenzing, SW Umwelttechnik, Oberbank AG Stamm, Wolford, Agrana, Amag, Erste Group, EVN, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

Agrana

Die Agrana Beteiligungs-AG ist ein Nahrungsmittel-Konzern mit Sitz in Wien. Agrana erzeugt Zucker, Stärke, sogenannte Fruchtzubereitungen und Fruchtsaftkonzentrate sowie Bioethanol. Das Unternehmen veredelt landwirtschaftliche Rohstoffe zu vielseitigen industriellen Produkten und beliefert sowohl lokale Produzenten als auch internationale Konzerne, speziell die Nahrungsmittelindustrie.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Wiener Börse Party 2024 in the Making, 23. April (#iFG)

» Wiener Börse Party 2024 in the Making, 22. April (#glaubandi)

» BSN Spitout Wiener Börse: Strabag geht über den MA200

» Börse Social Depot Trading Kommentar (Depot Kommentar)

» Börsegeschichte 24.4.: Rosenbauer, CA, Universale, Veitscher & Co. (Bör...

» Einschätzungen zu den AMAG-Zahlen, neuer CTO bei Frequentis, Research zu...

» Nachlese: Peter Heinrich, Didi Hallervorden und Robert Halver (Christian...

» Wiener Börse Party #636: Marcel Hirscher läutet wieder die Opening Bell ...

» Wiener Börse zu Mittag stärker: Bawag, AT&S, Palfinger gesucht, DAX-Blic...

» SportWoche Party 2024 in the Making, 24. April (Marcel und Mama)

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A39G83 | |

| AT0000A347X9 | |

| AT0000A39UT1 |

- Wiener Börse Party 2024 in the Making, 23. April ...

- Wiener Börse Party 2024 in the Making, 22. April ...

- BSN Spitout Wiener Börse: Strabag geht über den M...

- Wiener Börse: ATX am Mittwoch minimal schwächer, ...

- Wiener Börse Nebenwerte-Blick: ams Osram zurück ü...

- Wie ams-Osram, RHI Magnesita, Addiko Bank, Freque...

Featured Partner Video

D-Roadshow Österreich: FACC als Star der Schlusswoche Q1, Auftakt Q2 mit dem ersten Live-Blick nach einer Stunde

Seit Jänner gibt es einen täglichen Live-Blick in den aktuellen Handelstag der Börsen Frankfurt und Wien, dies von Audio-CD-Macher Christian Drastil im deutschen Börsenradio 2 Go Podcast des deuts...

Books josefchladek.com

erotiCANA

2023

in)(between gallery

India

2019

teNeues Verlag GmbH

Flughafen Berlin-Tegel

2023

Drittel Books

Duelos y Quebrantos

2018

ediciones anómalas

Bolnichka (Владислава Краснощока

2023

Moksop

Christian Reister

Christian Reister Horst Pannwitz

Horst Pannwitz Federico Renzaglia

Federico Renzaglia Carlos Alba

Carlos Alba