Schoeller-Bleckmann Oilfield Equipment AG / Positive operating result in challenging market environment - Very sound balance sheet structure with liquid means of MEUR 165 - cashflow increased to MEUR 57

20.08.2015, 6952 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

6-month report

Ternitz/Vienna, 20 August 2015. In the first half of 2015, the oilfield service industry was hit by the expected collapse of drilling activity, and so was Schoeller-Bleckmann Oilfield Equipment AG (SBO). Nevertheless, SBO was able to generate positive operating income in this extremely difficult market environment.

Sales fell by 18.9 %, to MEUR 186.9 (1-6/2014: MEUR 230.3). Here, SBO still profited from the strong bookings in the fourth quarter of 2014. Earnings before interest, taxes, depreciation, and amortisation (EBITDA) fell by 31.5 %, to MEUR 45.1 (1-6/2014: MEUR 65.9). Earnings before interest and taxes (EBIT) shrank by 57.6 %, to MEUR 19.3 (1-6/2014: MEUR 45.7). Half-year profit before tax arrived at MEUR 4.8, down 88.5 % from last year's reading (1-6/2014: MEUR 41.4). Half-year profit after tax arrived at MEUR 0.0 (1-6/2014: MEUR 30.3). Half-year earnings per share were EUR 0.0 (1-6/2014: EUR 1.90). Cashflow from operating activities increased from MEUR 28.4 by 101.5 % to MEUR 57.1.

An effect created by the quarterly valuation of option commitments was reflected in the financial result, concerning essentially the option for acquiring 33 % of the shares in Resource Well Completion Inc. (Resource): According to IFRS 13, an additional non-cash-effective expenditure of MEUR 12.1 had to be included. While business prospects for Resource remain unchanged and thus had no influence on this adjustment, modification of the quarterly multiple used - which had no effect on the actual value of the option - was relevant to increasing the option commitment.

Gerald Grohmann, CEO of SBO: "We delivered a positive operating income in the first half of 2015, despite the continued extremely difficult market environment. Cashflow from operating activities even doubled from last year's reading. As we expected, 2015 is going to be a challenging year for the entire oilfield service industry. We are preparing for the current downturn to last longer than previous ones. But we know our industry and have learnt how to deal with its cycles. This is why we initiated a set of measures at a very early point and will consistently pursue this course."

The EBITDA margin came to 24.1 % (1-6/2014: 28.6 %), the EBIT margin was 10.4 % (1-6/2014: 19.8 %), and the pre-tax margin arrived at 2.6 % (1-6/2014: 18.0 %). Compared to year-end 2014, net debt as at 30 June 2015 fell by 69.4 %, to MEUR 10.9 (31 December 2014: MEUR 35.6). Liquid means went up by 27.3 %, to MEUR 165.7 (31 December 2014: MEUR 130.2). This rise was mainly attributable to a decrease of the net working capital of MEUR 38.6.

With its equity ratio of 57 % SBO has a very sound balance sheet structure and therefore was able, despite the current downturn, to distribute to shareholders an unchanged high dividend of EUR 1.50 per share for the year 2014 (MEUR 24).

Bookings dropped by 54.1 %, to MEUR 104.8 (1-6/2014: MEUR 228.5). The order backlog at the end of the first half of the year arrived at MEUR 60.9, down 43.7 % from last year's reading (30 June 2014: MEUR 108.1).

Outlook

In its most recent report the International Monetary Fund (IMF) reviewed its forecast for global economic growth in full 2015 slightly downwards, from 3.5 % to 3.3 % (2014: 3.4 %). For 2016, the IMF currently projects growth to arrive at 3.8 %. According to the International Energy Agency (IEA), oil consumption is set to go up in the third and fourth quarter (94.5 mb/d and 95.2 mb/d, following 93.5 mb/d in the second quarter). Calculated for full 2015, this should bring average growth up by 1.6 mb/d to 94.2 mb/d. For 2016, IEA anticipates growth to come to 1.4 mb/d (IEA Oil Market Report August 2015). Barclays, one of Britain's major banks, projects growth levels of 1.7 mb/d in 2016 (Barclays' Oil Market Outlook August 2015).

SBO continues to expect global E&P spending to contract by 20 % to 30 % in full 2015. Consequently, the company braces for a continuation of the very difficult development in fiscal 2015. SBO will consistently continue implementing the countermeasures initiated in 2014 throughout the second half of 2015. However, those measures can compensate for only part of the fierce decline in demand in the established core markets. Our operating cashflow remains positive, debt is low and liquid means are sufficiently high to provide SBO with a stable basis to overcome the current cyclical downturn. As a result, SBO is in a position to continue its search for strategically fitting acquisition targets, even in the present challenging environment.

The current situation has demonstrated once again how fast the business cycle in the oil and gas industry can turn around. While full attention is now focused on managing the downturn, it is clear that the medium to long-term growth perspectives for the oilfield service industry remain absolutely intact. Growing demand for oil and gas, in addition to increasing decline rates from existing fields, will call for new spending and usher in the next upswing for which SBO, as technology and market leader, is well prepared.

Comparison of key financial figures

1-6/2015 1-6/2014 Change Sales in MEUR 186.9 230.3 -18.9 % EBITDA in MEUR 45.1 65.9 -31.5 % EBITDA margin in % 24.1 28.6 - EBIT in MEUR 19.3 45.7 -57.6 % EBIT margin in % 10.4 19.8 - Profit before tax in MEUR 4.8 41.4 -88.5 % Profit after tax in MEUR 0.0 30.3 -99.9 % EPS* in EUR 0.0 1.90 -99.9 % Headcount** in numbers 1,279 1,640 -22.0 %

* based on average number of shares outstanding ** reporting date 30 June

Schoeller-Bleckmann Oilfield Equipment AG is the global market leader in high-precision components and a leading supplier of oilfield equipment for the oilfield service industry. The business focus is on non-magnetic drillstring components and high-tech downhole tools for drilling and completing directional and horizontal wells. As of 30 June 2015, SBO has employed a workforce of 1,279 worldwide (30 June 2014: 1,640), thereof 408 in Ternitz/Austria and 486 in North America (including Mexico).

end of announcement euro adhoc

company: Schoeller-Bleckmann Oilfield Equipment AG Hauptstrasse 2 A-2630 Ternitz phone: 02630/315110 FAX: 02630/315101 mail: sboe@sbo.co.at WWW: http://www.sbo.at sector: Oil & Gas - Upstream activities ISIN: AT0000946652 indexes: WBI, ATX Prime, ATX stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2917/aom

Wiener Börse Party #637: Egalite Addiko und Marinomed, AT&S nach 2 Monaten zurück, 19 Jahre RBI an der Börse, Strabag top

SBO

Uhrzeit: 14:36:16

Veränderung zu letztem SK: -0.43%

Letzter SK: 46.25 ( -1.28%)

Bildnachweis

1.

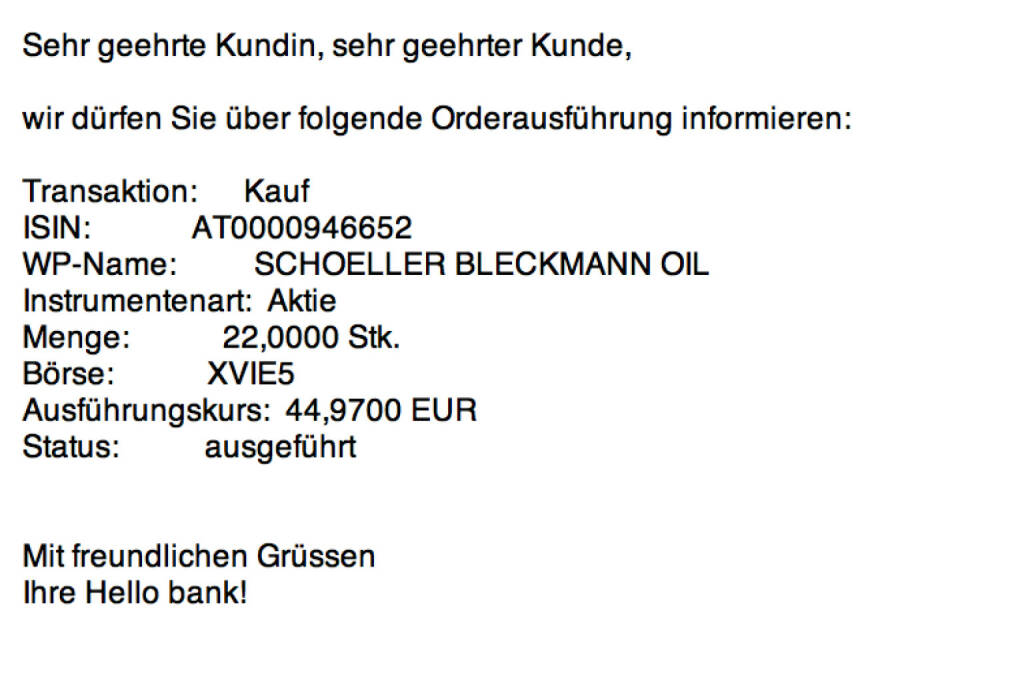

Tag 30: Kauf 22 SBO zu 44,97

>> Öffnen auf photaq.com

Aktien auf dem Radar:Addiko Bank, Immofinanz, Marinomed Biotech, Flughafen Wien, Warimpex, EuroTeleSites AG, ATX Prime, ams-Osram, AT&S, Palfinger, RBI, Strabag, Pierer Mobility, UBM, CA Immo, Frequentis, Lenzing, SW Umwelttechnik, Oberbank AG Stamm, Wolford, Agrana, Amag, Erste Group, EVN, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

stock3

Der Münchner FinTech-Vorreiter wurde im Jahr 2000 gegründet und bietet Privat- und Geschäftskunden IT-Lösungen und redaktionelle Inhalte. Bekannt ist die BörseGo AG für GodmodeTrader und Guidants. Das Portal GodmodeTrader bietet Web-Lösungen für Trading, Technische Analyse und Anlagestrategien. Guidants ist eine Finanzmarktanalyse- und Multi-Brokerage-Plattform.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A38NH3 | |

| AT0000A2QS86 | |

| AT0000A2U2W8 |

- Zahlen von Strabag, News von Marinomed, S Immo, R...

- Wiener Börse Party #637: Egalite Addiko Bank / Ma...

- Nachlese: Marcel Hirscher, Hannes Roither, Raiffe...

- Strabag-CEO: "Wohnbaupaket muss schnell und ohne ...

- S Immo kauft weiteres Portfolio von CPI Property

- Wiener Börse zu Mittag schwächer: Frequentis, AT&...

Featured Partner Video

Wiener Börse Party #631: XXL-Folge mit ATX in Zürs, Thieme-Einschätzung zum ATX, Missverständnis Matejka und Poetry Slam

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse....

Books josefchladek.com

Gentlemen's Club

2023

This Book is True

Liebe in Saint Germain des Pres

1956

Rowohlt

Kurama

Kurama Adrianna Ault

Adrianna Ault Federico Renzaglia

Federico Renzaglia Igor Chekachkov

Igor Chekachkov Sebastián Bruno

Sebastián Bruno Helen Levitt

Helen Levitt Futures

Futures